In any sort of retail business there is, what in many ways resembles, a gamble at the core. Can you sell the stock you buy at a price, and in sufficient quantities, without having too much leftover, and still turn a profit? You’ll become more expert at this as time goes by, but it must be said that even the most expert sellers get it wrong sometimes. The briefest stroll around the High Street sales this January is stark testament to that.

Being as efficient possible with stock levels and shifting those slow lines is a key part of your profitability. Here are some thoughts:

Keeping Stock Costs Money

For any retailer, keeping the stock itself is part of the cost of doing business. Of course, it might not be a pressing cost if you have ample cheap premises or operate from home. But even then remember that slow moving stock might be preventing you from stocking new goods. Have you got a batch of stuff that been lingering? If so, it’s efficient to try and get rid of it.

Something is Better than Nothing

You might have a price in mind for the stock that’s not moving that you need to achieve to make a profit or break even. If you’ve been failing to get that, it’s possibly worth considering whether your price is unrealistic. You can leave that stock safely stowed because you don’t want to make a loss or sell it (and make only a hopefully small loss) and then at least it’s putting something back into the business. If it’s gathering dust it’s a dead loss.

Hold a Sale

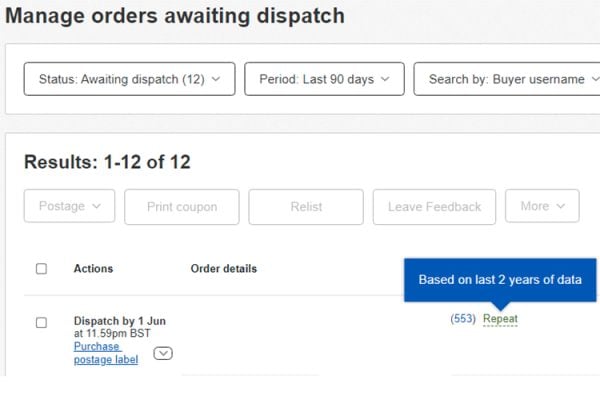

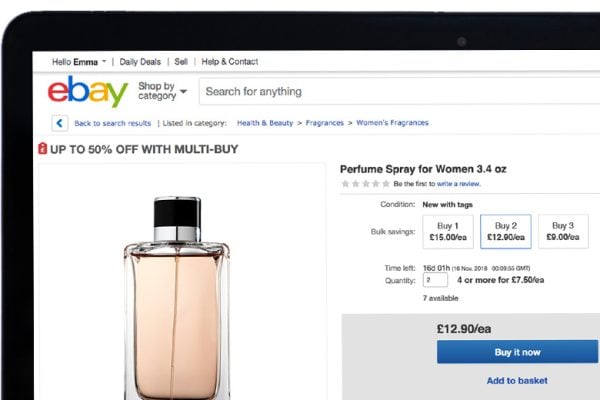

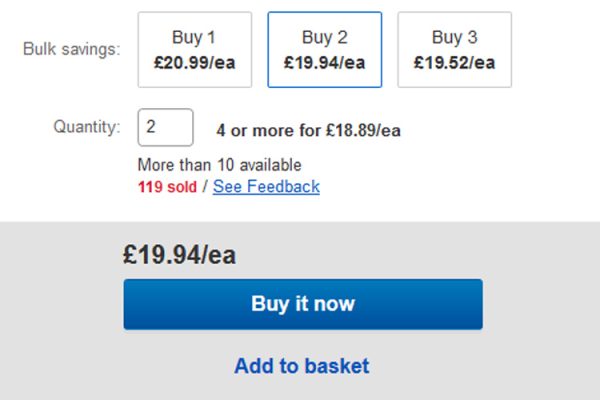

It’s that time of year and a sale of some sort is a good way of shifting stock. On eBay you have 3 options. In your Shop you can fire up Markdown Manager. There may be some requirements but at least buyers will know they’re getting a reduction. Secondly, just go for the cheap and cheerful 1-99p start price auction. Or finally, rather than sell individual items, sell batches wholesale. This cuts costs and hassle.

Every cloud…

… has a silver lining. Use your sell-off as a marketing event. Be sure to cross-promote and signpost and see if you can attract to your regular items using your cut-price items.

21 Responses

Personally, I’d say that MM is *such* a powerful marketing tool that if you are using SIF for a significant percentage of your listings, you should put your normal prices *up* to cover the ability to discount them again. My experimentation suggests that the actual price matters much less than the big orange “25% off” sticker.

STOCK buy it low ,sell it high

sell it quickly… 🙂

Sell what people want to buy….

Sue: I’ve heard very mixed things about Markdown Manager not least because many sellers are dubious about discounting. But your idea is a smart one. ;O)

Norf: I agree with the theory, but practice can be a bit more tricky.

Lynne: absolutely!

Keeping stock definately isn’t a good idea. Think of it as how many times your cash works for you. If you have £100 of stock and sell it all in a week you can spend £400 on stock per month and get 4x profit. If however it takes two months to shift £100 of stock you’re only getting 1/2x profit in a month! 😯

Having said that I have a rule that if stock is available at a ridiculously cheap price I bulk buy as much inventory as possible. So long as I can get the entire stock cost back in a week the rest is effectively free stock and some that I’ve bought I’ve dribbled out in sales over as long as two years. If it’s paid for in the first few sales and you have enough storage space it can be a smart way to work, but make sure you get your money back in the first few sales so that you can turn and churn your cash many times over.

Making your cash work harder is one of the fundamentals to profitability, the more times you spend it on new stock (for which recouping it from sales is a pre-requisite) the more profit you can ultimately make.

Even if this means lowering your price slightly (or having a Markdown Manager sale) to shift it more speedily churning your investment starts to pay dividends. 😀

AND While we’re talking stock this is the BIGGEST reason I hate non-paying bidders (NPBs).

You list on maybe a 10 day auction and some one wins. You wait a week before you can open a UPI. You wait a further week before you can close the UPI and then relist on another 10 day auction. Your stock has now been sitting on the shelf for 34 days minimum assuming you listed it the day it arrived.

If the NPB had paid the day the auction ended you’d have shipped maybe on the 11th day and could have reinvested the money. That means every NPB costs you at least two rounds of churning your money, that’s two lots of profit lost because of a time waster.

Forget about not getting paid and the nuisance value, think of the churn and turn costs. Or maybe don’t or you’ll detest NPBs as much as I do 😐

🙄

Ups at Chris, hate is a strong word! But I must admit I agree. NPB’s are a drain, they are time consuing and a nusiance – and if it is the last one of something then you cant relist it – just incase tney finally get round to bidding – enough to make you scream

Worse are those peeps who say, can I give you X for an item, you put it on a one day listing on a buy it now – and then they dont click on it

Sometimes, I think eBay shoots itself in the foot, – as sellers we cannot sell outside of the eBay arena, but if we are made an offer, and abide by the rules, and the peep doesnt buy – we pay.

Maybe there could be something like second chance bidder, – but called one chance offer – which just the one person who has made you the offer ,who you have revised the listing for could bid

But there again – tis open to abuse by fee dodging sellers

shrugs

Crawls back under rock

Suz x

@ Dan: other sellers are welcome to be dubious about discounting; more power to my elbow 😆 I’ve used it a few times on eBay.fr recently, and gotten SO many emails from other sellers going “how do you get those orange stickers” though.

I think the reason most sellers are dubious about it is because they don’t understand how the law works wrt “sales” – and because eBay’s system makes them adhere to the 28 day rule but doesn’t tell them what it’s doing, it looks like it doesn’t work correctly.

Stock turn is one of the factors venture capitalists use to gauge the viability of a company, and is recommended as being a Buy/Sell indicator for the stock market. Interesting question asked here at UK Business Forums –

Quote:

” As a rule of thumb, most retail business’ would be happy with a turn of four which in effect means that your stock is turned every ninety days.

The holy grail for all retailers is a turn of twelve, which means that by the time the invoice (assuming terms of thirty days) is due, the stock has been sold and the next thirty day cycle has begun.”

Gosh, wouldn’t that be something! (she says with some things still in boxes from the middle of last year….. 😳 )

That reminds me, I need to do a sale…

Oh and get your stock listed is good advice 🙂

ohhh – very interesting Lynne, thanks for that 🙂

ha Mark!!

What is the oldest bit of stock you are sitting on then??

Looking at my stock take sheet, I have a small piece of Troika that I bought in February 2004… I paid too much for it, so I am waiting for the price to go back up again…

Perhaps I might be able to list it in 2014…. 🙄

I’ll confess that today I found an nice lot of purple lampwork sets I’ve had for 18 months and not listed yet coz the colour’s difficult to photograph 😆

Have just been having a look at Markdown manager (Sue made me curious) and it seems to be a bit of a swizz. You can only discount sif items that have been active and not price adjusted for at least 28 days. So if you use 30 day sifs you have to be pretty on the ball to create your markdown sale at just the right time before the listing expires AND later than 28 days. Seeing as sales cannot run for less than 1 day the window of opportunity is miniscule. It’s a good job sellers have the opportunity to schedule these sales otherwise I would say it’s impossible to set up. The other option you have for a larger window to create a sale is to opt for 90 day listing (where you loose out on google picking up your listing or being able to upload it via googlebase store connector as 90 day listings are 60 days too long to qualify). It seems only idea to be used in conjunction with GTC listings. Am I missing something?

Lynne: I don’t suppose one bit of Troika is much of a problem. 😆

Louise, that’s the law, not eBay. You can’t call something a sale unless it’s been on sale at a higher price for 28 days or more.

Admittedly eBay have chosen a simple implementation which uses the eBay item number as the identifier rather than the actual item, but then I tend to think if sellers could fiddle this one, they probably would.

Ah Dan, but it is the principle isn’t it?

Well we did get rid of all of our wooden onions.

Mind you, compo/marketing/give away was the preferred disposal choice…

We do try to make sure EVERYTHING is listed within 2 weeks of purchase. Otherwise money is sitting there doing nothing 🙂

Philomena is very good on cash flow.

Mark

You know what, Mark, I just caught the end of Richard and Judy while I was waiting for the Simpsons this afternoon, and you know what they had in the foreground of the set? A wooden onion 😯 😯 😯