I’ve been asked by a number of sellers why they should continue to list high Average Selling Price (ASP) items on their eBay Business account, instead of using a Private seller account, once the fee changes come into effect in May this year.

On eBay UK, final value fees will be a flat percentage of the sale price from May (which will for most categories be 10%). However private sellers will continue to pay according to two different fee schedules – one for auctions and the other for fixed price items.

, when selling on a fixed price format, are 9.9% of the final selling price up to £49.99 plus 5.9% of the portion of the final selling price between £50.00 and £599.99 plus 1.9% of the final selling price in excess of £600.00.

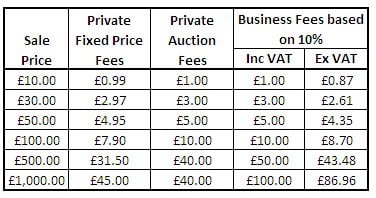

This means for a high value sale of say £1000.00 a Business seller will pay final value fees of £100.00 whereas a Private seller will pay fees of just £45.00. For auctions Private sellers pay final value fees at the rate of 10%, however that’s capped at £40.00 so on auction the £1000.00 sale would attract a charge from eBay of just £40.00.

Why you shouldn’t sell on a Private Account

There are a number of reasons why you shouldn’t transfer some of your high ASP stock to a private eBay account.

Firstly it’s against the law for a Business to masquerade as a Private Seller. The Unfair Commercial Practices Directive (opens in .pdf) makes it an offence in the UK for a business to falsely represent itself as a private individual. You have a responsibility as a Business seller to provide certain information to buyers who have more rights when purchasing from you as a business than they would when buying from a private individual.

eBay have trading limits for Private accounts and the likelihood is, unless you used multiple accounts, that with high ASP items you would hit trading restrictions very quickly. There is also the trust issue – buyers may be more likely to buy from an established Business Seller account with a trading history than from a low feedback Private Seller account.

Whilst it may still be tempting for Business sellers to consider using a Private account to save fees, the financial savings of a Business account may wipe out any savings from the deception. VAT registered sellers able to reclaim VAT on eBay fees will save 15% on their business account compared to a private account.

Whilst it may still be tempting for Business sellers to consider using a Private account to save fees, the financial savings of a Business account may wipe out any savings from the deception. VAT registered sellers able to reclaim VAT on eBay fees will save 15% on their business account compared to a private account.

For a £100.00 sale on your Business account, whilst you’d pay £10.00 in final value fees, with % deducted this would reduce to £8.70. Selling on a Private seller account as an auction would attract £10.00 fees as they is no VAT deduction. Private seller fees for a fixed price sale would be £7.90 but even then with the higher insertion fee of 40p it probably makes any savings negligible everything you list sells first time. For lower value sales a VAT registered seller would actually lose out financially by selling on a private account.

In summary unless your ASP is relatively high you there is probably little or no great financial saving in listing on a Private eBay.co.uk account instead of your Business account. Plus it’s against the law.

For sellers of very high ASP items there will be a big temptation to list their items on private accounts. When final value fee savings start to be measured in hundreds of pounds eBay sellers have a long and colourful history of embracing fee avoidance. It will be interesting to see how eBay police Business sellers masquerading as Private sellers once the fee changes come into effect.

23 Responses

“It will be interesting to see how eBay police Business sellers masquerading as Private sellers once the fee changes come into effect.”

with a potential difference of 60%

no doubt ebay will police it with vigour

“

I no longer sell as a business on eBay – have moved to Amazon and own website. I do still occassionally (ie free listing weekends) sell my personal stuff on eBay – and if I did still sell my business stuff on eBay, as I am not VAT registered I would probably take my chances and sell under a new private seller ID.

A simple question.

Why have eBay done this?

Could it be that top TRS will be in line for some future (larger) discounts?

Or will that just be for ‘outlets’?

It is obvious the many will use this loophole…

The simple fact of the matter is that business sellers are being taken for a ride, generally people within a trade get a discount when selling at auction for example, not on Ebay, those in the trade pay considerably more, it both baffles and annoys me.

I am prepared to pay Ebay £5 on a £50 sale however I am not prepared to pay them £100 on a £1000 sale, that is just not good value – simple.

A business seller could use an ebay private account to list but still inform their customers that they are a buisiness and offer all the services which they are obliged to by law eg DSR.

A business can still account for these sales for VAT and for income tax as usual.

The tax man does not care if ebay get less income.

It is open to conjecture if it is against the law to use a private ebay account for business. The fact that it is against ebay rules is not in my opinion a matter for moral uneasiness.

I doubt very much that there could be a case against a business trading in this way as long as they make it clear in their advertising (ie listing) that they are in fact a business.

The fact is, there are plenty of people already doing this and most of them do not even admit they are businesses and they do not get prosecuted or even thrown off ebay.

As long as a business continues to treat a customer in the correct way and deal with returns, refunds etc according to (and perhaps beyond) reulations, then I would say good luck to them. It is Ebay’s look out if they wish to treat their business customers in this way.

What are the selling thresholds for private accounts?

Chris Dawson,

500 sellers doing the same equates to 18 million pounds a year, I think they would notice that.

avoiding ebay fees is a a bit like avoiding vat

if your frightend by them its not such a good business

Selling on eBay is just not going to be worth it once the new fee structure comes in for me, I’ll probably scale back to a handful of items.