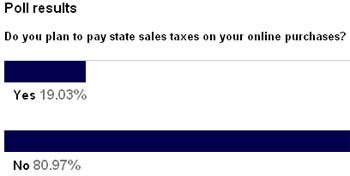

It’s that time of year that if you haven’t already your income tax bill is due to be paid. I’m sure not many of us like paying tax. I suspect that quite a few of us would avoid paying tax if we could. Now a survey of South Carolina residents in the US has confirmed this with almost 81% saying that they plan to fiddle their tax forms.

When selling on eBay it’s pretty much impossible to fiddle your figures. Your eBay account records every sale and your PayPal account and bank account record the payments. If the tax man wants to check you’ve paid what’s due it’s pretty easy for him. The same goes for VAT for those of us that are registered – everything leaves an electronic record which is easy to follow.

It’s different in the US though, there they have sales tax and local taxes instead of VAT. What makes US sales tax incredibly complicated is that the rate varies from area to area and state to state. Up until now in most of the US it was up to the consumer to declare their purchases on the Internet which are sold without tax being collected and pay the tax on their tax return.

It’s different in the US though, there they have sales tax and local taxes instead of VAT. What makes US sales tax incredibly complicated is that the rate varies from area to area and state to state. Up until now in most of the US it was up to the consumer to declare their purchases on the Internet which are sold without tax being collected and pay the tax on their tax return.

Many companies such as Amazon are busily opposing the requirement to collect sales tax (and for smaller sellers understandably you don’t want to be figuring out tax rates across 51 states!). Amazon have recently negotiated a 5 year deal not to collect sales tax in South Carolina on condition they merely email their customers and let them know what tax is due. That doesn’t appear to make much difference though – consumers are happily buying on the Internet tax free and costing the State some $110 million annually in unpaid tax.

No one wants to pay tax, but you have to wonder why the US never implemented Sales Tax in the way we do in the UK. When you sell regardless of which state you sell to you collect sales tax for your local state. That’s what happens with VAT in the EU, you generally charge VAT at the rate in your local country regardless of the VAT rate in the consumers country.

I can understand the opposition to charging sales tax in the US. It’s too complicated for merchants to economically process and consumers enjoy sales tax free purchases. For the US tax office it’s a bizarre situation that they’ve allowed it to continue for so long though.

If you’re in the US do you declare your Internet purchases on your tax return and pay your tax (feel free to comment anonymously).

14 Responses

VAT is generally a simple tax. The rate is 20%(currently) in the UK on most items but there are a few exceptions such as Newspapers and Magazines and of course Books. But we do have a few complications such as Calendars where some have VAT on them and some do not.

But I am of an age that I can remember before VAT. We had Purchase Tax That was a glorious mess with differant rates on all sorts of items and it often depended of if the item was considered “essential” or a “luxury”.

When VAT was introduced. It was generally an Accountants Dream. One of my responsibilities at the time was to go round the group I worked for and make certain that everybody understood the change.

There was one small branch and its Office Manager(too small for an Accountant) and she just could not understand VAT. She had been brought up on the complications of Purchase Tax and could not understand VAT. So I had to go back and go through it with her on three of four occassions. Finally she understood the change(before anybody asks I have often wondered if it was my lousy education that was at fault).

Anyway a little time later I was heavily critisised in the Group. Several General Managers jumped to my defence. My Boss(The Group Chief Accountant) called me in the next morning.

It was totally unheard of for General Managers to jump to the Group Internal Auditors(my job description) defence and he demanded to know what I was doing wrong!!!

I thought for a moment and suggested a few GM’s names. My Boss confirmed that they were all amongst those defending me. One was the GM of this branch where I had to go back several times.

Anyway the result was that I was not shot at dawn but I was told that I should spend my time Auditing rather than sorting out GM’s problems(I must admit after I continued to try to do both).

Anyway my Boss recently died. He was the only boss I ever had That I truly liked and respected and long after I left that company I am proud to say that I always considered him a friend(even if he did on occassions call me in for a bo*****ing-usually well deserved)

But the change from Purchase Tax to VAT was a great improvement and I for one would never want to go back to Purchase Tax. I am not an expert on US Sales Tax but from my understanding it is more like our old Purchase Tax than our present VAT. So that could go some way to explaining the problems with it.

In the US you don’t declare and pay tax on purchases. The seller collects any sales tax due at the time of purchase, and makes payment to the appropriate tax authority, generally quarterly. You must have a sales tax authorization to collect tax on behalf of the state/local government, and if you just sell your own personal belongings there is no tax due. (The exception is selling something like a car, where in order to get it registered the buyer must pay sales tax.)

The reason we don’t have a national sales tax is that the right to levy taxes resides primarily with the states, and the federal government doesn’t have the constitutional right to just make that change.

It isn’t actually Sales tax that US consumers are supposed to be paying. Sales tax is what is charged when you purchase in-state. Use tax is what it is called when you purchase from another state. That is what consumers are responsible for reporting to their state and pay.

Use tax is completely separate from income tax so you don’t pay it when you are submitting your forms to the IRS. If you are running a business then there is a line in your Sales & Use tax for your state (at least this is the case in Texas) where you declare your taxable purchases and Use tax owed. If you are running a business and collecting Sales and Use tax you are open to audit by the state so you better declare your taxable purchases. But unless you are running a business I have no idea where you are supposed to even go to declare Use tax owed and I doubt many do.

51 stages?

..or even States…

Sales Tax is a State’s issue, not one for the Federal Government.

Currently, there are 45 States that collect Sales Tax and among them, there are over 10000 tax districts, each with it’s own tax rate and definitions as to what should be taxed (Peanut butter has one tax rate while peanut butter cookies is taxed at another rate [contains sugar])

You buy online, you owe Use Tax. The biggest reason is is not paid is that US consumers do not know this law exists. Government has done little to educate the public. Next, like breaking the speed limit, they jnow they can get away with it, and third, they are sending a message that government has a spending problem.

As I have read the various US based postings I find myself thinking back over the years in the UK. At various times Politicians(mainly Lib-Dems) have suggested replacing Council Tax with a Local Sales Tax. The idea being that those that spend the money in a locality in the shops, garages etc would pay for the local services. I would think that they have looked(slightly) at the US and said to themselves “Thats a good idea”. But reading the postings I think that we had better stick with Council Tax. We might all hate it but at least we know what it is and how its supposed to work.

Use Tax is the great ticking time bomb in the USA. There isnt a statute of limitations if you havent filed a form and at some future date your state could say — You bought a computer online in 1983 and didnt pay use tax on it We want our 5% of $2000 plus interest and penalties going back 29 years.