Today eBay hosted an analyst day, intended to lay out the companies goals for the next three years and set the scene for the Wall Street Analysts.

Today eBay hosted an analyst day, intended to lay out the companies goals for the next three years and set the scene for the Wall Street Analysts.

The quick version is that the news was well received with eBay shares bumping up over 4% to $54.22 and they were still rising after trading hours finished.

Omni-channel commerce

The longer version is that eBay have moved far away from just being a marketplace, with John Donahoe today talking of the three key pillars of the eBay family – eBay, GSI Commerce and PayPal as the basis of the eBay Inc platform. It reminded me of Meg Whitman and the days of her “Power of Three”, which back then were eBay, PayPal and Skype! However, back to now, eBay GSI and PayPal are the building blocks of the platform, but all three are wrapped in a new layer which is mobile.

John Donohoe talked of omni-channel commerce and multi-screen access. No longer is there talk of “online” and “offline” commerce, it’s rapidly becoming indistinguishable with mobile being the always present easy route to access. Not only that, but in developing countries a smartphone is often the first way new users will log onto the Internet for the first time.

Mobile

It’s not just the third world either, mobile only Internet is already happening even in the UK with the younger generation getting a smartphone with mobile broadband before they get a landline and laptop. Dan and I were only talking the other day and agreed that there’s no more being “offline”. With a smartphone in your pocket you’re always online and even when not actively browsing the chances are your phone will ping with an email, alert or update from the net.

Local

Around the mobile experience is wrapped another layer, local commerce. At times consumers might want to go straight to a local store and collect an item, whilst for another purchase they may prefer to have the item delivered. Shopping instore and buying online was once a major worry for retailers, but that’s rapidly changing as retailers embrace the net.

Take the example of failed retailer Jessops, which re-opened on the UK high streets today having been bought by a group including Peter Jones of Dragons’ Den fame. The first promise he’s made is that there will be strong Internet offering with all Internet prices matched in store. Give buyers the choice of where and how to purchase and in Jessop’s case a more interactive, customer-friendly experience is promised with each site offering photography courses and training to attract new shoppers.

Global

Cross border trade has been the byword at eBay over the last few years, but some of the numbers are staggering. In 2012 Russians bought $400m of goods on eBay – around 30,000 orders a day.

According to comScore Russia has the largest Internet user base in Europe, with 61.3 million Russians online that’s about 15% of the European web population. The number of Russians online is also growing faster than anywhere else in Europe barring Italy.

BRIC (Brazil, Russia, India and China), the emerging markets represent huge growth opportunities and we’ll be looking more closely at these markets in future articles on Tamebay.

Data and Personalisation

Where eBay’s real strength lies according to John Donahoe is that whilst all the omnichannel, mobile, local and global commerce is great, what really sets eBay apart is data. They’re about the only company in the world that has the data on which buyer prefers to buy from which retailer (both on marketplaces, from online retailers and offline), sees their payments, knows which promotions get which consumers buying and when they prefer to buy locally and when they’re happy to wait for a product to be delivered.

With the new eBay Feed (live on eBay.com) eBay are able to increasing personalise shopping experiences on the marketplace, but also elsewhere online and offline with the mobile often being the delivery vehicle to trigger a purchase from voucher or check-in.

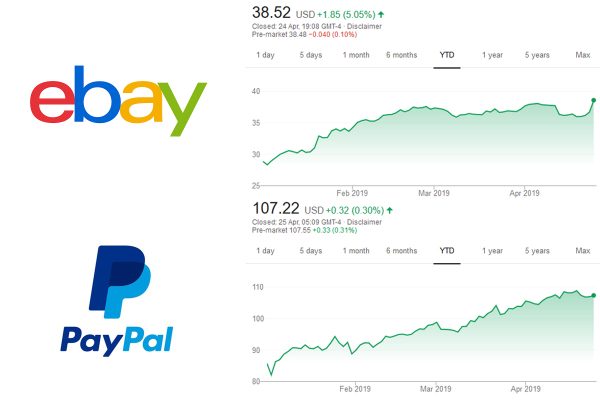

Forecast

Across it’s portfolio eBay expect to handle $300 billion of commerce by 2015, a 71% increase from 2012. The eBay marketplace handled some $75 billion sales in 2012, that’s expected to grown to £110 billion by 2015 and PayPal is expected to double the payment volume from $145 billion at the end of 2012 to around $290 billion at the end of 2015.

That’s pretty healthy figures so no surprise that the share price edged up following the announcements.

When John Donahoe took over the helm at eBay and promised the turnaround would take three years. He reckons he’s delivered on all promises and is done with defensive firefighting saying “The turnaround is behind us, and we are now playing offense”. If he delivers on his 2015 forecast he will have done what’s almost impossible, turning a flagging internet giant around and turning it back to the sort of growth normally only seen in a start up.

One Response

Thinking back over yesterday’s analyst day the most striking thing is the non-existent nod towards X.Commerce. Does that mean it’s officially mothballed and dead for the foreseeable future?