As part of Apple’s iPhone 6 announcements they also revealed Apple Pay, a new payments system intended to rival PayPal, Stripe, Amazon, Google and everyone else vying in the digital wallet arena.

As part of Apple’s iPhone 6 announcements they also revealed Apple Pay, a new payments system intended to rival PayPal, Stripe, Amazon, Google and everyone else vying in the digital wallet arena.

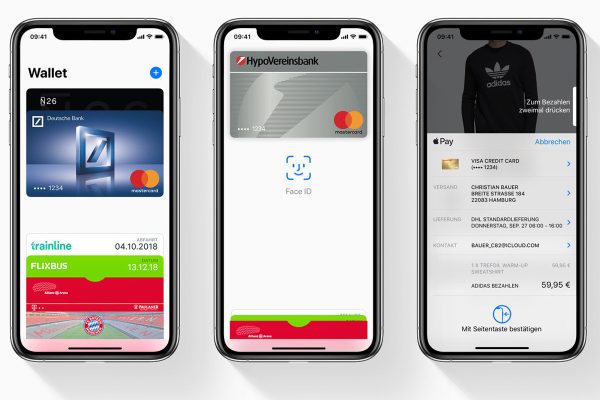

Apple’s solution is NFC (near field communication). Many credit cards are already NFC enabled and can be used for low value purchases without the need for chip and pin or signing a receipt.

According to Tim Cook, Apple CEO, “Payments are broken and it’s exactly the kind of problem Apple is in the perfect position to fix”. He added “This whole process is based on this little piece of plastic, whether its a credit or debit card,” Cook said on stage today. “We’re totally reliant on the exposed numbers, and the outdated and vulnerable magnetic interface — which by the way is five decades old — and the security codes which all of us know aren’t so secure.”

Of course his comments are much more relevant in the US, where Chip and Pin hasn’t been adopted – It’s hard to find somewhere where you can swipe your credit card in the UK today with Chip and Pin being the defacto standard.

You’ll basically add credit cards to your Passbook, either those already registered in iTunes or by snapping an image of the card with iSight. Then when it’s time to pay you hold your iPhone close to the card reader and place your finger over the fingerprint sensor to confirm.

You’ll basically add credit cards to your Passbook, either those already registered in iTunes or by snapping an image of the card with iSight. Then when it’s time to pay you hold your iPhone close to the card reader and place your finger over the fingerprint sensor to confirm.

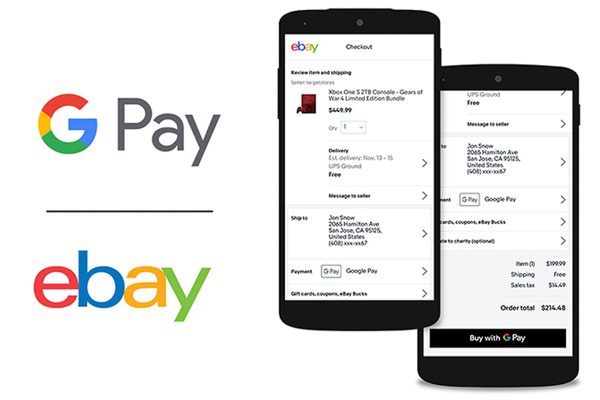

There are just two major problems with Apple Pay. First is of course to use it you need an Apple device and not everyone carries an iPhone around in their pocket. Apple’s payment system is firmly tied to a single manufacturer, whereas PayPal, Stripe, Google and Amazon’s payment systems are manufacturer independent.

The second problem is that with notable exceptions such as the likes of McDonalds, hardly any retailers have NFC ready hardware in store. Apple are reliant on retailers adopting NFC technology to make this work and especially for smaller retailers that’s not likely to happen any time soon. Retailers don’t refresh their POS equipment anywhere near as often as consumer buy new mobile devices.

Perhaps the biggest barrier to Apple Pay becoming a success is whether people are ready to pay with their mobiles. It’s one thing to choose whether to pay on a retailers website and select between Apple Pay and PayPal. It’s quite another to walk into a pub and try to figure out if they accept PayPal CheckIn or if they have an NFC card reader. Most people will just pull cash out of their physical wallet or swipe their credit card and not even consider using an alternative payment method.

Apple Pay is launching in the US to start with, so it’ll be a while before we Brits have to worry about whether London Underground just charged our Oyster card or if our iPhone decided to pay as well. In the meantime payments are going to continue to become ever more interesting and Apple Pay is just the latest in a long line of as yet unproven alternatives which, whilst currently are little more than gimmicks, may one day be mainstream.