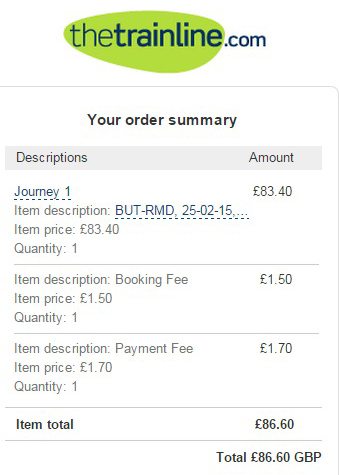

I’ve just discovered that The Train Line are charging consumers extra for paying with PayPal, they’re slapping on an extra £1.70, the same charge that they make if you pay by credit card.

I’ve just discovered that The Train Line are charging consumers extra for paying with PayPal, they’re slapping on an extra £1.70, the same charge that they make if you pay by credit card.

Companies are allowed to levy a “small charge” to cover the cost of processing a card payment. The question is does the legislation cover PayPal? One thing’s pretty certain and that is that the PayPal fees will be significantly higher than any credit card charges and the £1.70 charged in this instance certainly won’t cover the costs.

I’ve not seen other companies surcharging if you decide to pay with PayPal. Have you? Are PayPal surcharges the norm, or is The Train Line a one off exception?

13 Responses

Anyone using the Trainline needs to wise up.

Use the Journey Planner at Network Rail Enquiries and buy direct from the linked TOC(s). There are no booking fees via NRE and some TOC(s) give a further small discount for going direct (eg East Coast).

Not sure if any take PayPal though so if you must use PayPal you may never go as cheaply as me!

Just noticed that the journey shown is to RMD on 25th Feb. Are you attending eBay Seller Council on that day Chris?

I use Interparcel every now and then and they add 2% of the transaction if you pay by PayPal.

“and the £1.70 charged in this instance certainly won’t cover the costs.”

Have you forgotten about Paypal’s merchant rates (https://www.paypal.com/uk/merchantrate) ?

If Trainline are turning over more than £55k through Paypal per month (not unlikely), fees on this transaction would be £1.41ish.

If they’re receiving a mere £15k per month through Paypal then their fees on this transaction would be £1.85 – granted, a little more than the processing fee.

My money’s on them turning over at least £55k per month through Paypal; possibly quite a lot more to the point that they’ve been able to negotiate a lower rate than 1.4% + 20p.

Also: CEO of the Trainline is one Clare Gilmartin previously the head of eBay UK.

Paypal fees are often passed on to customers. I’ve seen 3% charged at many online firms

It’s only Ebay where it’s banned.

My local Chinese takeway accepts it and charges 3%.

Very popular with students apparently, who don’t care about the surcharge.

If they did not charge a fee on Paypal then no customers would ever pay the credit card fee (as they could use paypal instead).

Travel and online ticket booking agencies levy paypal surcharges. They claim the additional costs and onerous terms and conditions of Paypal add to payment overhead compared to debit cards and make the costs equivalent to if not higher than the costs of accepting credit cards.

Ryanair now have a Paypal option with a slight increase

Such surcharges are outragous.

You can’t apply them to a debit card (yet the payment merchant processing the amount still typically charges the retailer between 3 and 4% regardless of what card is used so retaillers expect a processing charge on all transactions and build this into prices, pay cash and you just increased the retailers profit by 3 or 4% !) yet they can get away with adding a surcharge to a PayPal transaction which PayPal still charge the retailer 3 or 4%.

Parcel2Go also apply a 2% surcharge to payment paymant by PayPal but if you pay by PayPal MasterCard (basically Visa) then there is no fee.

ADVICE: Get a PayPal MasterCard. Its a pre-paid card that debits your PP account but you can use it anywhere so it has many benefits.

Long live The Revolution!! 🙂

Typical Merchant rates for debit cards are 15p per transaction and a little over 1% for visamastercard credit cards. These fees are approx as it depends on your negotiating skills 🙂 Paypal fees at 3-4% are ridiculous so I am not surprised some businesses charge extra for using paypal.