Capify has been formed as a new global company in the SME alternative financing sector. They’ll be competing with established providers such as iwoca, Ezbob and Amazon Lending in the UK, plus of course Kabbage in the US.

Capify has been formed as a new global company in the SME alternative financing sector. They’ll be competing with established providers such as iwoca, Ezbob and Amazon Lending in the UK, plus of course Kabbage in the US.

Capify has been formed from two of the UK companies – United Kapital and Capiota as well as three established finance providers from the US, Canada and Australia (AmeriMerchant, True North Capital, and AUSvance). Capiota is the only company still with their own website, United Kapital, AmeriMerchant, True North Capital, and AUSvance websites all now redirect to Capify.

PayPal are apparently involved in as a partner and have a history of working with United Kapital since 2012, starting with a Merchant Cash Advance trial which later launched as PayPal Working Capital.

The Capify solution offers merchant cash advances (different to loans), which allows SMEs to borrow against future credit/debit sales. If you take more than £3,000 per month in credit and debit card payments from your customers, you qualify for a merchant cash advance and can usually raise up to 150% of your monthly average card takings.

Loans are repaid by taking a small agreed percentage of your daily credit and debit card transactions until your advance (plus fees and interest – we don’t know what they are as they’re hidden on the website until you apply for an advance) is paid.

Capify say that they have already provided £75m in financing to UK SMEs with loans ranging between £3,500 to £500,000. That’s likely of course to be loans issued individually through United Kapital and Capiota, seeing as the launch of Capify only took place yesterday.

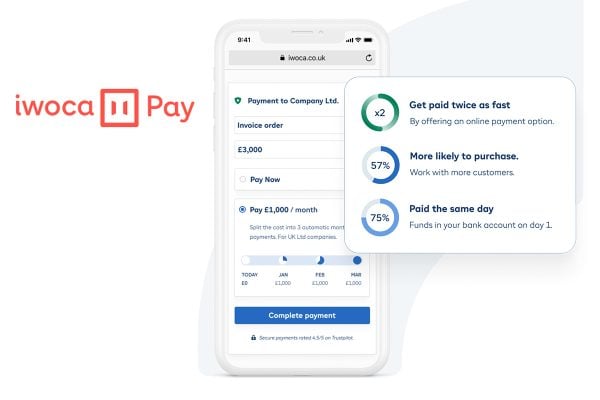

In Australia, Alibaba have added Capify as a lending partner and Capify expect to lend around $40 million to Australian small businesses through the Alibaba partnership. For UK customers iwoca have a partnership with Alibaba for loans up to £50k and Ezbob for loans in excess of £50k.

We know from the appetite of small businesses to take loans from ezbob and iwoca that there’s a real need for alternative forms of finance. If you’re in the market for a loan your real decision should be how you’d like to apply for the loan (based on marketplace sales or credit/debit card loans) and if you’d like to be tied into a regular monthly payment or if a daily deduction which will rise and fall as a percentage of your takings would work better for you.