As is now the case in the UK, the Chancellor of the Exchequer delivers an autumn statement to the House of Commons at this time of year.

In effect it’s a mini-budget and the chance for the government to reveal plans and note successes.

We’ll resist the urge to mention little red books and rather focus on measures that Chancellor George Osborne announced that will be of interest to small businesses.

To read a full and detailed digest, Enterprise Nation’s summary is recommended.

For our money, the big change coming that will have a genuine everyday impact on SMEs regards the changes to tax returns and how, come 2016-17, everyone will have access to the new digital tax accounts system. The Government is going to invest £1.3bn in the technology and by 2020 all SMEs will be legally required to submit returns at least quarterly. It will be interesting to see if they can make it work.

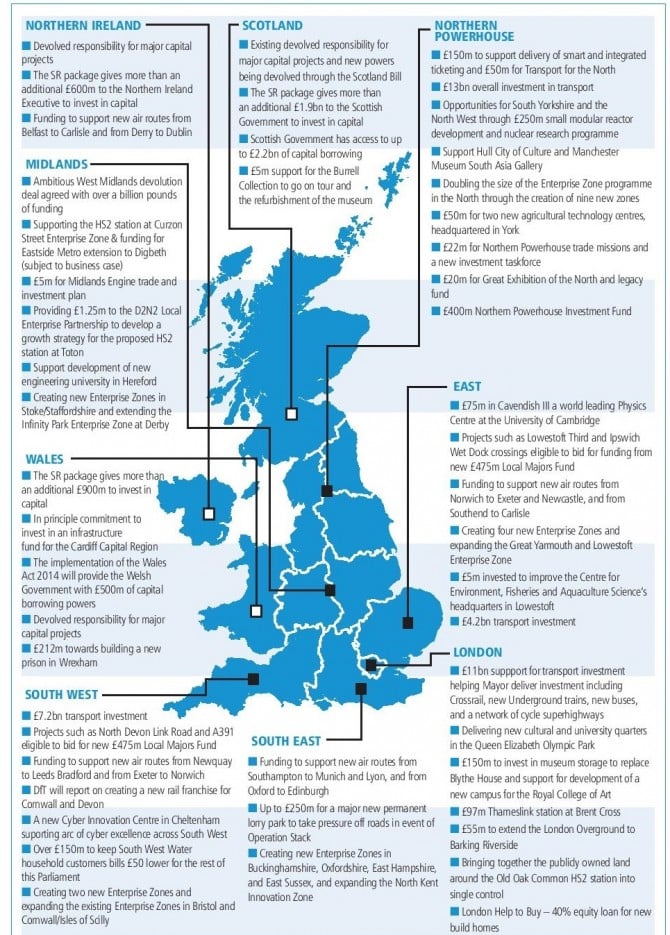

That’s just one measure. And the graphic below is from the Government and looks at regional measures that were announced:

2 Responses

Great for collecting taxes from the registered, not so good for those that are not.

In that regard, its a pointless system. They need a system to target those that dont give a FF about paying tax.

5millon support for an effin scottish art collection to go on tour , and 20 million for a northen exhibition of art , crying out loud the worlds crazy