Android Pay is officially coming to the UK in “the next few months” according to Google.

Android Pay will support MasterCard and Visa credit and debit cards. Initially the banks that will be supported are: Bank of Scotland; First Direct; Halifax; HSBC; Lloyds Bank; M&S Bank; MBNA and Nationwide Building Society, although Google say that new banks will be added in due course.

Interestingly five of these eight banks were also the first to support Apple Pay when it launched in the UK (Bank of Scotland; Halifax; Lloyds Bank; MBNA; M&S Bank). Coutts and TSB Bank were launch partners for Apple Pay but are replaced by First Direct; HSBC and Nationwide Building Society for the Android Pay launch. Banks missing from both initial launches include Barclays (annoyingly who I bank with) that appear not to want to (or aren’t ready to) jump in on launch day but doubtless will want to add support at some point.

You will be able to use Android Pay everywhere contactless payments are accepted, including many retailers and Transport for London (TfL). Android Pay will also speed up checkout in many apps.

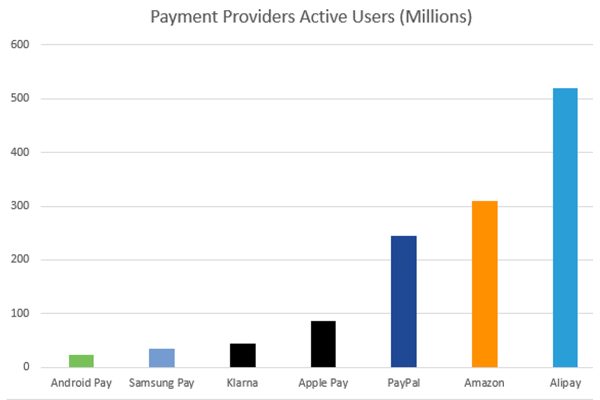

What’s really interesting is to read down the list of developer partners and see Braintree alongside the likes of Worldpay, Stripe, Klarna and CyberSource. Braintree is of course a part of the PayPal camp and one can’t help wondering how much Android Pay (and Apple Pay) will eat into PayPal’s share of the contactless payments market.

PayPal are to launch a solution in partnership with Vodafone later this year and already have solutions such as PayPal Here and PayPal Check In, but to date I’ve found that PayPal’s most convenient contactless payment method is bizarrely with their PayPal Access MasterCard. It’s somewhat unfortunate that a world class payment tech company’s easiest to use and most widely accepted payment method is still plastic and not mobile.

Will you use Android Pay? Do you already use Apple Pay? Doubtless all of us will soon be using some form of mobile wallet for payments, but in my view the market is still too fragmented with no single solution available to all. Current solutions still depend upon if you’re an Android or Apple user, who you bank with and there’s no single solution that’s available for everyone.

For me the only current viable smartphone contactless payment option is still Vodafone Wallet which is a top up as you go solution. I can’t be bothered to top up a wallet before I go shopping so I still simply present my debit card and use Chip and Pin and from seeing other consumers in the shops this is still the method the vast majority choose to pay by. Plus of course there’s still good old cash which is still acceptable almost everywhere in the UK.

One Response

I wonder how Android and Apple pay affects chargebacks? If I dispute a transaction it’s really Google I’m issuing the chargeback against, not the retailer. I can’t imagine buyers would be out of pocket as the whole system would fall down if they were, just interested how it affects anything.