PayPal introduced Interchange fees which came into effect last month. Interchange fees were an option instead of the normal fixed rate PayPal fees which might save you money but might cost you more.

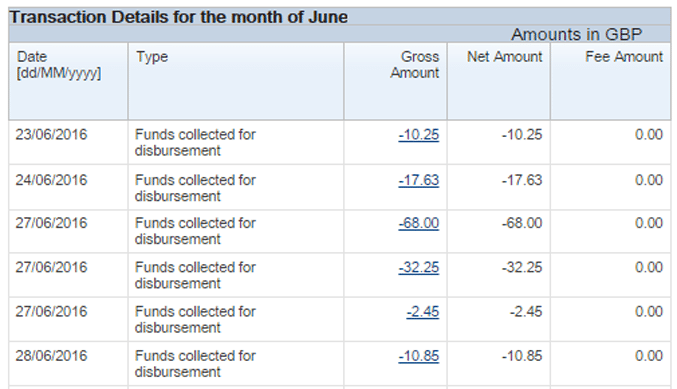

Now the fees have been running for a month we’ve had our first look at some fees and frankly we and the account holder are confused. There are a ton of transactions on the account, listed as “Funds collected for disbursement”, but no one is quite sure what they’re for.

They’re not small sums ranging from a couple of quid up to £68 and it was only when telephoning PayPal it transpired that these were interchange fees.

The thing is, we don’t know what the fees relate to – are they individual transaction fees? Are the fees for multiple transactions rolled up into one payment? Are they debited transactions which somewhere are re-credited less the applicable fee?

Because there are no notes explaining what the fees are and as it’s just too confusing, this PayPal account owner has asked PayPal just to put them back on the normal fee schedule. Regardless of what it’s costing (or saving), the Interchange fees with these seeming random transactions and the monetary value of them simply make accounting and reconciliation of PayPal funds too painful.

Did you opt for PayPal Interchange Fees? Can you make sense of the various disbursement payments appearing in your PayPal account?

One Response

Looks to me like these fees are calculated daily, given the dates they fall on. 25th and 26th were a weekend, so the weekends fees are added on Monday and that’s why there’s an increase in value – sales would (presumably) have been higher on a Saturday and Sunday.