On Thursday the Finance Act 2016 came in to force. It’s the result of the UK Government Budget that was delivered by then Chancellor George Osborne earlier in the year and at first glance sounds inconsequential.

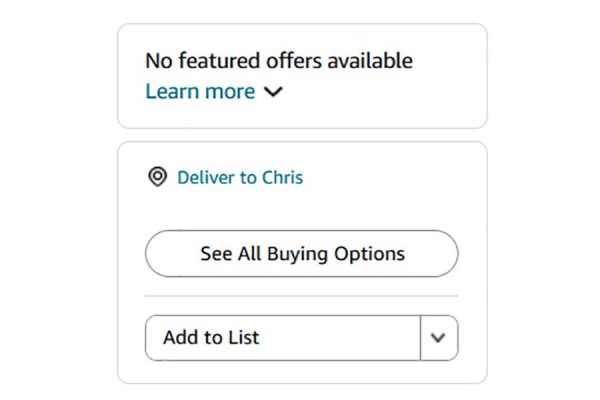

But for marketplace sellers, businesses using eBay and Amazon in particular, there are a few measures now in force that means HMRC has greater powers to tackle sellers from overseas who may be dodging their VAT obligations. We’ve covered this before in several stories and you’ll doubtless be aware of the issue.

What are the new powers?

Here’s the Government’s own summary of the new powers:

“HMRC is strengthening existing VAT legislation for directing overseas businesses that should be registered for VAT in the UK to appoint a UK-established VAT representative and giving HMRC greater flexibility in relation to when it can require some form of security.

To support this, HMRC will also be given new powers to make online marketplaces jointly and severally liable for the unpaid VAT of overseas businesses who are non-compliant with UK VAT rules and using their platforms to sell through.”

What happens next?

Amazon has made its position clear and says it has started to take action clamping down but eBay’s approach has been less transparent. Basically though, the ball is in HMRC’s court now with these enhanced powers. So we hope that they will be quick off the mark and start using them to make demands on the marketplaces and the VAT dodgers.

And don’t forget that about groups like VATFraud.org who have worked hard to get these powers into place. You can also report offenders via their website.

What is notable, though is that there is a huge prize at stake for the UK coffers. Estimates vary but the government’s (probably timid predictions) suggest that cracking down on this could reap the Exchequer coming up to a billion quid by 2020. And that’s a tidy sum.

So watch this space, tell us what you see and hopefully this will be good news for UK sellers paying their way. But when it comes to proofs, we tend to find them in puddings.

19 Responses

lets just hope HMRC actually use these powers and dont just use them as a threat , they need to start being pro active NOW

check all business sellers accounts on ebay/amazon not just chinese sellers , lots of UK sellers on ebay who are not vat registered and have multiple accounts

Would Tamebay be able to contact both marketplaces to see what their response is to these new measures?

Are they going to be pro-active (Amazon have not yet) or are they going to continue to stick their head in the sand and hope this blows over so the many Chinese VAT evading sellers can merrily continue to sell and turn both marketplaces into Alibaba MKII ?

just as many USA fba sellers on amazon uk , have they been given warning by amazon , will HMRC ask for VAT to be back dated and paid , amazon have all there fba sales so it is pretty easy to work out what is owed

hopefully HMRC is a sleeping giant and has finally woken up , but HMRC track record over the last 4 years has me worried to be honest

Great news indeed!! Hope sellers cannot escape anymore from paying VAT in future. Wondering why eBay hasn’t declared any news about this officially. Let’s see how its gonna work

Just a shame that Chinese Sellers which have many ebay accounts belonging to one person which are:

gosourcing

ebuystation2010

rainbow_store

dreamyland

bobob_uk

ddddadi

accenter

These accounts are all now registered VAT however what they are doing is using Hong Kong PayPal accounts to channel all their uk sales which still allows them to dodge the VAT and TAX. How can this be justified?

This news just seems too good to be true, it’s as if the many downtrodden UK sellers are actually writing the legislation. Let’s keep our fingers crossed that they act, and soon.

does this HMRC new powers to tackle overseas sellers dodging VAT, applies to EU sellers or just non-EU sellers?

Thanks

The problem of tax avoiding, off shore fulfilment loading sellers is still rife.

I think the time for rejoice will be when there are no longer 3 or 4 on the first page results on ebay, amazon and google shopping.

To put it mildly this problem isnt exactly hidden.

Well lets see what happens, progress at a snails pace. Amazon, Ebay and HRMC could easily work together and make a big impact/statement by actually doing something.

Lets just say they agreed to verify VAT numbers ( only takes a few seconds on the VIES website). They could collaborate and get a team together spend a few weeks or so to verify VAT numbers..

No need for costly investigations at this stage, if your VAT details are fake, don’t match or belong to someone else then you have 14 days etc to fix it or you will be suspended.

HMRC can then choose how they progress with regards to actual investigations. And the genuine Tax & VAT abiding online sellers may actually have a fair market to compete in.

Its all about sharing and collaborating together…………..

these are the only 2 cases i know of vat fraud prosecution by HMRC

https://www.kinsellatax.co.uk/ebay-trader-jailed-for-20-months-for-avoiding-429000-vat/

https://www.mancunianmatters.co.uk/content/030970471-jail-manchester-online-dvd-trader-dubbed-woolf-e-wall-street-after-hiding-%C2%A314m

the mail lite boxes in the shower cubicle does make me laugh , selling that much he didnt have time to wash

HMRC should be made into a bbc comedy with some frank spencer/david brent character in charge , , arguing over who didnt bring the milk in for the tea and who ate all the digestives instead of doing there real job they are paid for out the public purse chasing blatant tax cheats