Just days into office, President Trump is tearing up free trade agreements around the world, many even before they have been implemented.

The Trans-Pacific Partnership (TPP) is gone, Japan was only country to have ratified the deal with Australia, Brunei, Canada, Chile, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam the other potential signatories along with the US. Trump had scrapping TPP as one of his campaign promises so it should come as no surprise that the US will now pull out. China was notably not signing up to TPP and with the US gone at most it will be a much smaller deal.

With TPP gone, the Transatlantic Trade and Investment Partnership (TTIP) deal looks increasingly unlikely to be looked upon favourably by a President who believes free trade deals are a bad thing. Next up for the new President is renegotiating the North American Free Trade Agreement (NAFTA) which details trade between the US, Mexico and Canada.

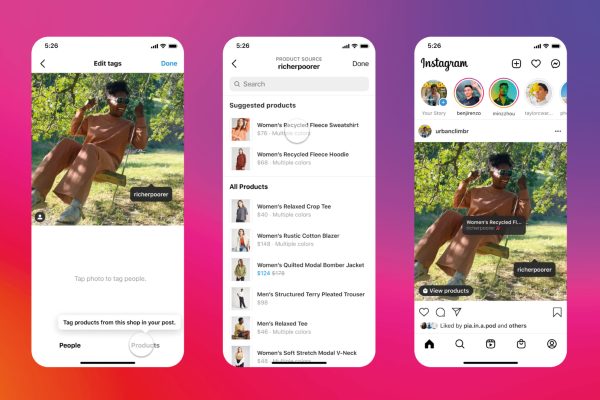

What does this mean for European online retailers? Well the good news is probably in most circumstance not a lot. A couple of decades ago the first eBayers started sending envelopes of dollars across the Atlantic in the first eBay cross border trade deals. No one told them that they could, but no one told them they couldn’t so they just went right ahead and started trading.

There may be some tariffs coming down the line to worry about, but if Trump goes ahead with a suggested 45% tariff on Chinese goods they’ll have more than enough to worry about. Tariffs are more likely to impact businesses in the US who are importing raw materials than consumers making ecommerce purchases.

Currently, due to Obama signing an amendment to the US Tariff Act of 1930, Americans can import shipments valued up to $800 per day free of duties and taxes (up from the previous limit of $200), known as the De Minimis threshold. Unless you hear rumours of Trump changing the De Minimis threshold, it’s likely to be business as normal for most ecommerce retailers exporting to the US, unless of course you’re selling products valued at more than $800.

One Response

Hey Chris

How do you envisage this would affect private label sellers who sell on Amazon.com using FBA, but the seller is based outside the US?

We ship direct from China into US FBA – if Chinese imports are the issue then perhaps a loophole will open where goods are routed via another country on its journey – so in our case the goods would be an import from the UK?