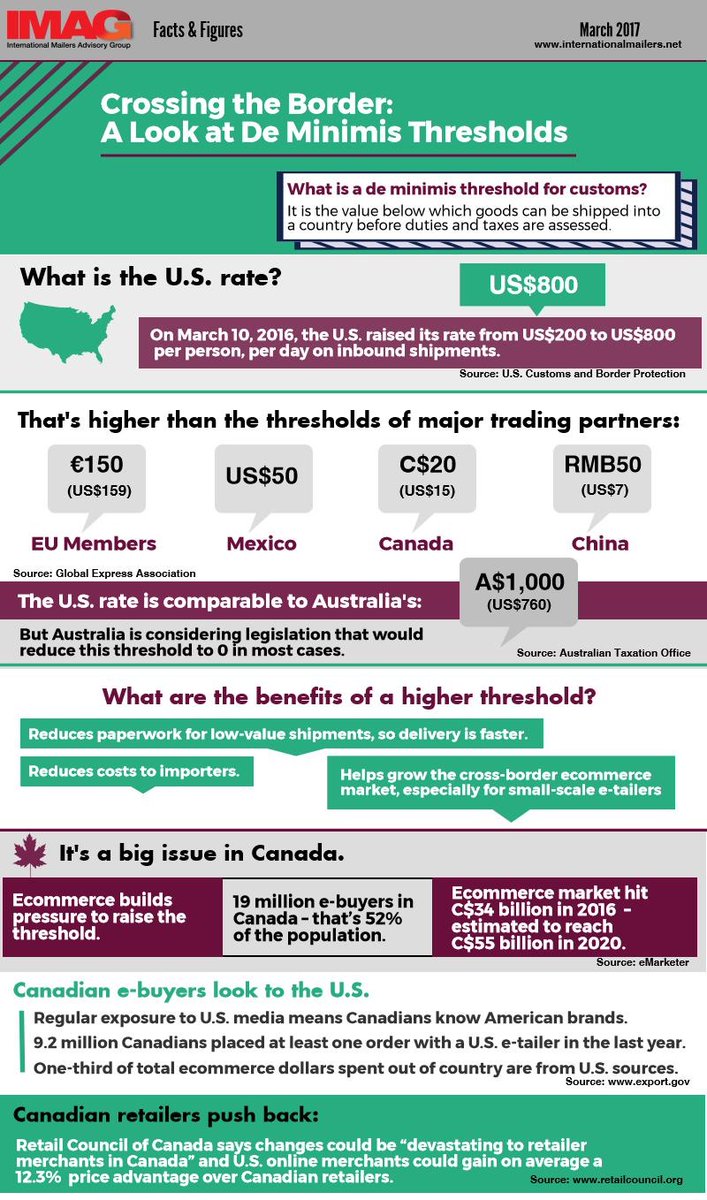

When you’re selling online, probably one of the last things you think about is import taxes and duties that an overseas buyer may have to pay. It’s worth considering though – a year ago the US raised what’s know as their de minimis threshold (the amount you can import without paying taxes) to $800, this was the first review in 20 years.

Compare the US with Canada who have a de minimis of just C$20 (about $15 US Dollars) and suddenly selling to the US becomes a lot easier and more attractive than selling to Canada. Put very simply the total price the end user will end up paying will be less.

Whilst of course selling to countries with low de minimis thesholds can still be profitable, consider the total price the end customer may pay when deciding which products to sell into which territories.

With Article 50 about to be triggered, everyone will of course be watching over the next two years to see what the UK’s new trading relationships with the EU will end up looking like. As a country we will of course also be able to set our own de minimis thresholds and that could accelerate or impede cross border sales into the UK. A report by Marketplace Pulse has revealed that most European sellers are also selling their products on Amazon UK, percentage wise, there are more EU sellers selling into the UK on Amazon than UK sellers selling to the EU.

The infographic below from the IMAG has more information on de minimums thresholds:

One Response

Very helpful for Customs Duty both in and outbound (sales and purchases).

UK buyers should also consider VAT on imports.

This may help .

Royal Mail apply an import Customs Duty threshold of £135 [the €150 in the infographic] but a VAT threshold as low as £15.01 (‘over’ £15) for commercial traffic.

The underlying government info is here