eBay are making some changes to the way that VAT will be charged. There is no change to the fees themselves and these changes apply only to eBay sellers living in the UK.

Not to put too fine a point on it, Brexit is coming, the way that companies (such as Amazon, Starbucks and Google) have been paying (or avoiding paying) tax in the UK, and the incidence of Chinese sellers avoiding paying UK taxes have doubtlessly all been a contributing factor in this change being implemented. Sadly, for some sellers it’s going to cost you more, but it’s hard to argue against the change against the political backdrop and the way that some sellers themselves have been lobbying MPs to make changes.

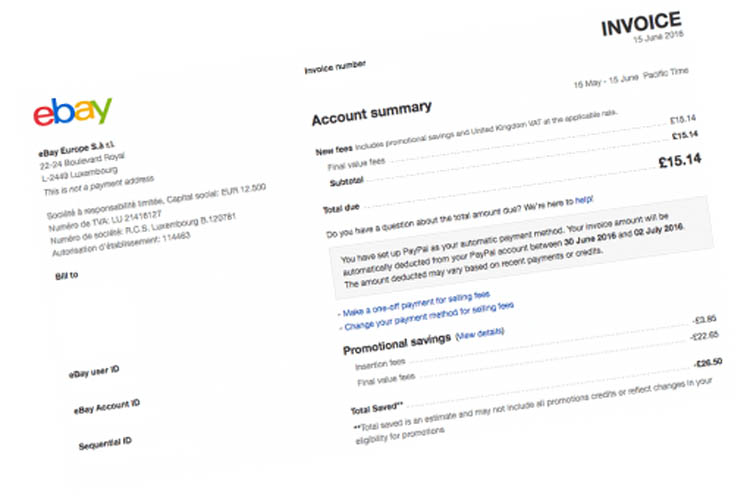

What’s happening with VAT on eBay fees

From 1 August 2017, eBay sellers living in the UK will start contracting with eBay (UK) Limited instead of eBay Europe S.à r.l.

If you’re not registered as a UK Business Seller on eBay

eBay currently apply UK VAT at the standard rate of 20% to all fees incurred by UK based sellers that are not registered with eBay as a business seller. Nothing changes bar the billing entity.

If you’re a business seller Registered for VAT with HMRC

As a VAT registered business seller, eBay have always charged your fees net of VAT if you registered your VAT number with them.

From the 1st of August, you’ll begin paying 20% UK VAT to eBay (UK) Limited on taxable fees. The UK VAT paid will be identified on your eBay invoice and you can claim an input tax credit if you are entitled to deduct VAT. Although VAT registered sellers will begin to pay UK VAT on their eBay fees, you will likely be entitled to deduct this VAT according to UK VAT rules. As a result, VAT should not represent an additional cost to you.

Of course if you are on schemes (such as the Flat Rate VAT scheme) you will not be able to reclaim VAT.

If you’re a business seller NOT Registered for VAT with HMRC

From the 1st of August, you’ll begin paying 20% UK VAT to eBay (UK) Limited on taxable fees. The UK VAT paid will be identified on your eBay invoice but you won’t be able to reclaim it unless you register for VAT and enrol on a VAT scheme which allows you to reclaim input VAT.

The history and the perk that’s coming to an end

Many years ago all sellers paid VAT on their eBay fees – both businesses and private sellers. Eligible VAT Registered businesses could register their VAT number with eBay and eBay would then not charge VAT, but VAT Registered businesses were never allowed to claim the VAT back as an input on their VAT returns.

From the 1st of January 2015, eBay received a special dispensation from HMRC to charge all business sellers net of VAT. This meant that sellers who weren’t VAT registered didn’t pay VAT on their eBay fees and so effectively had a bonus of what looked like a smaller eBay invoice. Doubtless sellers in this position have become accustomed to not paying VAT but this dispensation is coming to an end as of August.

Here at Tamebay HQ we know that this is going to hit you hard – no one wants to pay more. The only way to look at it is with a touch of realism and be grateful for the past 30 months when you’ve paid fees net of VAT and accept that in the future the government is going to take it’s cut.

For sellers who are VAT registered, you’ll have to front the VAT when you pay your monthly eBay bill and reclaim the money from your next quarterly VAT return. Whilst you’ll pay out more to eBay, you’ll pay less when you come to settle up with the VAT man so for you it’s merely a cash flow issue, not a change to your business costs.

What it does mean, and what many sellers have been lobbying for, is that those sellers who masquerade as businesses and haven’t hitherto paid VAT on their eBay fees will have to start coughing up. Sellers who use fake VAT numbers on eBay or ‘borrow’ them from legitimate businesses will end up paying VAT on their eBay fees and won’t be able to reclaim it. That’s a good thing.

The only real losers are the business sellers who aren’t VAT registered and have enjoyed eBay’s VAT dispensation for a year and a half. Sadly we haven’t any good news or ruses for you to avoid paying VAT on your eBay fees going forward.

47 Responses

I know you briefly mentioned this but I would add to the list of real losers at the end people who are VAT registered but on the flat rate VAT scheme who this will simply be an increase in costs for with nothing in return.

I wonder if my local shop would get away with asking me if I was buying for a business and adding 20% to the price if I said yes. The gap between private seller fees and business seller fees is now embarrassingly large.

While private sellers are protected by consumer rules and so have wonderfully simple capped fees, even tiny businesses face an overwhelmingly complicated array of fees, nearly all of which are much higher than the consumer offering.

Yes we’ll have to cough up the VAT upfront (but at the end of the day so do our customers on every purchase they make from us) and reclaim every quarter, but on the whole this is great news! Hopefully this will help level the playing field a little!

There are a lot of small businesses on Ebay who use the Flat Rate Scheme and will be hit hard by this.

Ebay have hugely underestimated the numbers here. All the sellers we associate with are on one scheme or another and will now have a 20% hike in all their Ebay fees, following on from the recent fee hikes already imposed by Ebay. This is yet more unwelcome news from Ebay in 2017.

And why reduce the top rated performance from 4% to 3% ?

Has the performance of delivery companies improved that much recently??

Buyer expectations is one thing, but unless you get in a van and deliver it yourself, sellers are reliant upon Royal Mail or a courier.

As their performance will be unchanged, it’s hard to see anything other than more sellers being penalised again.

Which fees are included, is it add 20% to the whole bill?

Im on the flat rate for VAT. My business currently turns over £220,000 on eBay. The introduction of the 20% VAT on fees would mean an increase in the actual fee itself of around 3.5% making the fee to trade on eBay 15.5%. Although eBay will argue that my fee has not increased per say on the site, the overall cost will be 15.5%. After speaking to my accountant, going on to the 20% bracket so i could claim back the 20% on the final value fee would enviably cost me more. Is this the final nail in the coffin. Its looking like it for me.

I’m all for this. Helps level the playing field a little between legit and dodgy.

I have a “competitor” that I am sure is not only dodging his taxes but also claiming unemployment benefits. It’s the only way he could still be in “business”.

Im on the flat rate for VAT. My business currently turns over £220,000 on eBay. The introduction of the 20% VAT on fees would mean an increase in the actual fee itself of around 3.5% making the fee to trade on eBay 15.5%. Although eBay will argue that my fee has not increased per say on the site, the overall cost will be 15.5%. After speaking to my accountant, going on to the 20% bracket so i could claim back the 20% on the final value fee would enviably cost me more. Is this the final nail in the coffin. Its looking like it for me.

It might help weed out dodgy sellers but just because you aren’t VAT registered doesn’t mean you are dodgy. I’m sure there are tons of small time sellers who will be severely impacted by this. My business is just a small time business, we file our tax returns and everything is above board, you can hardly hide ebay income! We are already struggling on ebay, our visibility on ebay has got worse and worse with less and less sales. We have tried changing so many different things but nothing helps. The only things that sell well are when we have multiple quantites of something, sell one and the rest flies out. But that is rare for us to get more than 1 of them. Having an increase of 20% is huge. I don’t mind the listing fee, that used to be 5p for us, but went down to 4p in 2015. But the shop fee is pretty high and adding another 20% to that is going to be massive! Also doesn’t that mean a 10% fvf will then be 12%? I thought VAT registered sellers claim that back, but for the sellers stuck in the middle we have to foot this bill when money is tight. I say stuck in the middle as private sellers get so many deals and free listings etc. I would assume most seller who are VAT registered must be making way more money than those who aren’t VAT registered. If they will be charging us sellers the same as a private sellers with this 20% VAT, then why aren’t private sellers paying 12% fvf. I average my sales on mostly 10% fvf.

I am a bit confused on this. The UK is STILL in the EU and as I have an EU (German) VAT number registered, then the fees should still be EXCLUSIVE of VAT as in the past.

Does anyone know how this will work with the EU Vat number.

Basically any service provided in the UK to a holder of a registered EU Vat number should be invoiced exclusive of VAT

Thanks

The people who lose here are specifically those on vat schemes.

You don’t offset the vat you pay against returns, in return for a lower flat rate %.

Which means those sellers now have to pay the full 20%, without being able to claim back a bean from HMG.

So we’ve had the postal price hike.

The Ebay shop fee and listing fee hike.

And now this.

Not to mention the botched attempt to hike NI for the self employed.

Maybe it’s time to find another country – one that’s actually friendly to small business.

Am I right in thinking that there was a very significant FVF increase a couple of years ago. Just after eBay stopped charging VAT for ALL business sellers.

This is brilliant news. We currently turn over £2m on Ebay and we’re sick of the small-timers who don’t pay any VAT. Great news – thanks Ebay!!!

@LDW – yeah yeah, twos up to all the legitimate small businesses out there delivering a quality service and working all the hours of the day on their tod to make an honest buck. Delighted you’re happy…

Am I correct in thinking the VAT is applied to everything including FVF’s? Presumably this is already charged to sellers on eBay UK who are not resident in the UK?

It seems a few of the larger sellers are joyous about it, thinking only of their own circumstances. It’s a hard kick in the teeth for all those legitimate self-employed businesses that operate beneath the VAT threshold.

vat is included in the sale price,Is it correct that Ebay should get comission from the vat amount.

welcome news, hmrc is finally rolling it up its sleeves

Now this has happened with EBay I bet Amazon will be next without a doubt as they normally follow each other.

As VAT is a EU wide concept presumably with brexit the government will be cancelling this tax in it entirety ?

It’s ok the ebay packing voucher for over priced goods will help offset the cost of VAT that will be getting added on to monthly bills soon.

It was not a dispensation. It’s the law that B2B sales are taxed where the recipient belongs.

It was never the law (and is not now either) that this only applied to VAT registered businesses. Try telling that to EBay, Amazon, LinkedIn etc who all get this rule wrong, often costing business customers money as they are not required to pay under reverse charge rules being under the threshold.

Hi All

I understand that eBay are just charging VAT on their fees accross the board. I’m a UK business seller but am well below the VAT threshhold and not registered for VAT. I do pay my taxes and am registered as a sole trader with HMRC.

I sell second hand vinyl records, most of which are sold to outside of the EU (China and the Far East mainly) so would not be subject to VAT anyway. Is there any way eBay will reduce the VAT element based on this? I live in hope (probably falsely).

Thanks

Hi there,

Anybody knows what would happen with UK sellers with residence in other European countries? I see many greek sellers registered as Business sellers, yet their address at the bottom of their listing is either a “rented” UK address or an address elsewhere in Europe (perhaps their own home or office)

Thanks