There are many aspects to eBay fees which make it worth being a business seller. You can only have a Featured or Anchor shop if you are registered as a business, but with VAT to be added to eBay fees later this year as announced in the latest eBay Seller Release, there is a legitimate concern that some businesses could start masquerading as private sellers.

Of course once you’ve upgraded your account to a business account you can’t downgrade to revert to being a private seller and if you sell too much on a private account eBay are likely to start questioning if you should register as a business. However, faced with the fee differential coming down the line, some traders who are businesses might be reluctant to register as businesses preferring to stick paying private seller fees.

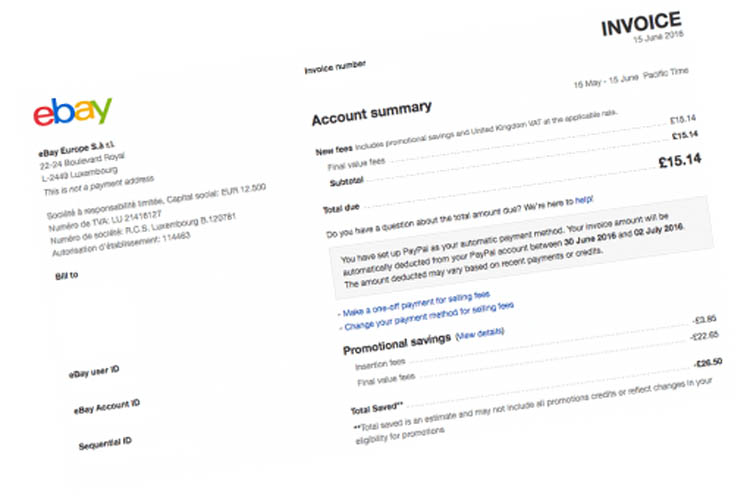

Registering as a business could add 50% to your eBay invoice

Take a popular category such as clothing for example. A private seller will pay a flat 10% final value fees (including VAT), but a business seller will end up paying 10% plus VAT making a total of 12%. Register for a basic eBay shop as a private seller and you’ll pay 8% final value fees compared to the same clothing seller paying 12% (including VAT) if they’re a business.

Registering as a business could add 50% your eBay final value fee bill.

Will businesses masquerade as private eBay sellers?

Dodgy sellers are thankfully few and far between on eBay, much as the mainstream press loves to jump on, what is in the grand scheme of things, the odd case of a buyer being ripped off, money talks and there will be a big incentive for traders to pretend to be private sellers. This could avoid a 50% hike in their fees putting businesses at a disadvantage, but also enables the faux private seller to avoid giving buyers their legal rights such as returns.

Below we examine eBay fees and what impact VAT will have for sellers who are unable to reclaim it, but the question remains, will businesses masquerade as private sellers to take monetary advantage of the fee differential?

Private eBay Sellers (8%-10% Fees inc VAT)

Private sellers pay eBay a fee of 10% of the final transaction value, including postage. This final value fee is also capped so a private seller will never pay more than £250 for a single item.

Subscribe to a basic eBay shop, which for private a seller costs £19.99 compared to £25 (plus VAT from the 1st of August) for a business seller, and the final value fees drop to 8% (which includes VAT).

When eBay announced that from the 1st of August 2017, eBay sellers living in the UK will start contracting with eBay (UK) Limited instead of eBay Europe S.à r.l., they said “We currently apply UK VAT at the standard rate of 20% to all fees incurred by UK based sellers that are not registered with eBay as a business seller“. They further clarified this saying that the “changes only apply to business sellers on eBay. We will continue to charge VAT at the standard rate on eBay fees for private sellers“.

What this means is that private sellers will continue to pay final value fees of 10% (or 8% with a shop) which includes VAT at 20%.

Business eBay sellers and VAT

From the 1st of August 2017, business sellers on eBay will start to pay eBay fees plus 20% VAT. If you’re registered to pay VAT (on some VAT schemes) you’ll be able to reclaim the 20% from HMRC on your VAT returns.

Previously, since the 1st of January 2015, eBay received a special dispensation from HMRC to charge all business sellers net of VAT. Up until the 1st of August this year, sellers have never been able to reclaim VAT. Prior to 2015 VAT registered sellers had to submit their VAT number to eBay for VAT exemption (if you failed to do so you still couldn’t reclaim the VAT) and since then non-VAT registered sellers have enjoyed a Brucie Bonus of not paying VAT.

Business eBay sellers (up to 13.2% Fees inc VAT)

Now, from August sellers who are not VAT registered (or who are unable to reclaim VAT due to the VAT scheme they have chosen) will start seeing 20% VAT added to their eBay bill and won’t be able to claim it back.

Final value fees for business sellers on eBay range from 6% to 11%, but for the vast majority of categories are 9%. Add on 20% VAT and sellers who can’t claim VAT will end up paying 10.8% final value fees once VAT is added on.

If you sell in the Business, Office & Industrial, Clothes, Shoes & Accessories or Home, Furniture & DIY then your 10% fees will tot up to 12% including VAT.

Sellers of Crafts, Event Tickets, Jewellery & Watches, Pet Supplies, Wholesale & Job Lots and Everything Else pay 11% final value fees so this will add up to 13.2% with VAT.

Business sellers who will pay less than Private Sellers

Sellers of Books, Comics & Magazines, Cameras & Photography, Computers, Tablets & Networking, DVDs, Films & TV,Mobile Phones & Communication, Music, Sound & Vision or Video Games & Consoles pay 8% fees so their total including VAT will rise to 9.6%.

In the electronics categories there are some notable exceptions where fees are 5% (capped at £20) for which the fees with VAT will rise to 6%.

The final value fees for Vehicle Parts & Accessories are 7% and here the final value fee including VAT will be 8.4%.

Finally, sellers of Holidays & Travel pay 6% (max £40) which including VAT works out to be 7.2%.

38 Responses

Hopefully, ebay will do the sensible thing and absorb the VAT in the existing fee % to support business sellers (… I can already hear laughing at that one…)

Will eBay businesses masquerade as private sellers to avoid 50% fee hike?

“IS THE POPE CATHOLIC”

even without the incentive of the coming Vat increase

there are many masquerading for various tax and fee avoidance reasons

why should things be different now

Selling fees are already subject to VAT. A business with a standard VAT registration currently pays eBay fees net of VAT. All that should be altering is that we pay the full fee and and then claim the VAT back from HMRC.

I doubt even the mighty eBay can charge VAT twice over.

I can not see one example where the VAT increase adds up to a 50% increase in fees. 10% fees + 20% VAT is not a 50% increase. It’s a 20% increase. Some businesses are not required to pay VAT. If you sell used books for instance.

Where do you get the figure 50% from? Maths please.

Will they? What planet are you on? They’ve been doing it for years.

So, hang on, as a business seller with a Basic Shop subscription:

Was £17.38 / month (no vat paid due to exemption)

Now £25 / month (price increase, but briefly, still no vat paid due to exemption)

Soon £30 / month (recent price increase, plus 20% vat payable & probably not recoverable for many small sellers).

So in monthly invoicing terms, within the space of a few months, the real price of a basic shop shoots up from £17.38 to £30, a 72% increase …… all with sweet FA in return?! Oh, those extra free listings. wow. 50 more a month fixed price & 50 auctions (which have to be 7, no 10 day option). Listings cost nothing, if they didn’t they would still be happy to throw 100/day to personal accounts.

Switching to private account is a double whammy; pay lower fees and get 100’s of listings for nowt!

Of course people are going to masquerade as private sellers – you’d be mad or exceptionally honest not to (sadly for my bank balance, I’m both).

If people are tempted to go under a private banner, they risk being caught by Inland Revenue’s profiling software, that picks up activity looking like business rather than private transactions.

Customs & Revenue receive fee data from Ebay and Amazon from which they could quickly sort the sheep from the goats.

Porridge, anyone?

yeah yeah how many here know anyone who has been prosecuted for tax avoidance? never mind Jailed ?

Derek duval | apsales15 = SAIRAM ENTERPRISES UK LIMITED = GB 263119517

https://vat-search.co.uk/gGKZy_Sairam+Enterprises+UK+Limited+%7C+Sairam+Enterprises+UK+Limited

Being VAT registered means paying the VAT has no change for me, however, I am disadvantaged by the amount of VAT I pay the VAT man every 3 months compared to a non VAT registered businesses.

All I can say, if you had a visit, like we had in 2014 from IR, you wouldn’t be taking the p***, Derek Duval.

We had a 6 hour shake down as they (wrongly) thought we were underdeclaring our profits to HMRC by 40 grand a year.

The basis of this was the reports they got from Ebay, which they showed us.

We had to present seven years of back Paypal receipts and bank statements before they went away.

They do check.

@Derek duval

Your right, my VAT number is not shown on my Ebay page, not sure how you would know that? I have just not been bothered to put it on, too lazy…

To be fair, I am guessing that you are assuming I am the owner of apsales15, which I am not. The director is registered as a Nirav Patel, I was just pointing out that your “rant” had no substance and to show you how easy it was to find out publicly available information, should you wish to.

I have no idea how much apsales15 pay for their stock, although I see they have sold 14,414 of their MENS HAWAIIAN SHIRT STAG BEACH HAWAII ALOHA PARTY, maybe they get them for a great price….

I have myself sold items and only made 20-30p on them, due to cost of included postage, this can sometimes be mitigated by the person buying 2 of the said items or another product to go with it, saving £2.40 on the second items postage, as they go together.

Looks like they are quite a successful business!

It’s not putting fees up if you get to claim the VAT. It’s just part of the money merry-go-round. Whatever you give ebay in VAT, you get to claim 100% of that back off HMRC at your VAT quarter.

Think of it as lending a mate a tenner, then another mate giving you a tenner back a few months later. Have you lost out? Aside from not having that tenner for a period of time, no.

not listed as its some scam….there is no way vat is being paid on them sales. if it was they simply would not be selling for 8.50

hopefully you will find hmrc have a closer look at the scam you and your alias are running.

ebayers like you me sick

typical of eBay taking advantage of business sellers – when it is the business sellers who generate the majority of the revenue for eBay….I hope eBay get a taste of their own medicine one day

first of why are they charging vat on comics.magazines as they are zero rated they are not a vatable item we will not be able to claim it back so why are they charging vat they need to get this sorted out

@David duval, apart from many of your comments not actually making sense;

Personally I think you are jealous of your competitor and are just making things up, you have no evidence of what you accuse them of.

As I said, I also do not display my VAT number but will now get it put on the Ebay system, not displaying it does not mean that I do not pay VAT.

My comment:

“Being VAT registered means paying the VAT has no change for me, however, I am disadvantaged by the amount of VAT I pay the VAT man every 3 months compared to a non VAT registered businesses.”

is a simple to understand, but I can try and explain.

When a business is VAT registered they are usually disadvantaged against their competition who is not VAT registered. Each 3 months a VAT registered business usually has to pay the VAT man more money than they can claim back. That VAT amount comes out of the profits of the business.

Many people are complaining about the VAT payment on Ebay fees, for those who are VAT registered, like myself, it is not a problem. Whilst it may not seem fair to them, I was pointing out that we are already at a disadvantage to those that do not pay VAT.

I have already made it quite clear to you that I have no connection with the company and I am surprised that Tamebay are allowing you to tell such unfounded accusations about your competition on their site, not to mention your saying they were not VAT registered, which was a complete lie, as I proved.

If you’re vat registered, the only difference is cash flow. The fees aren’t going up, because you claim the VAT back. End of.

As to whether you believe some other sellers are “cheating” by claiming to be VAT registered when they aren’t, or paying cash in hand to staff because they must be, so they can sell at those prices etc, that’s a different matter, one for the conspiracy theorists.

Fees are rising (in effect) for those who are not VAT registered and for those on schemes where you can’t claim it back.

My accountant reckons that’s around 2 million businesses on schemes, many of whom will be trading on Ebay.

So I think Ebay has underestimated the impact of these changes on small busineses on schemes.

The number of anchor shops on UK Ebay is shrinking as it is, so this will probably accelerate that.

Suspicion as well that Ebay has got some sort of sweetheart deal from HMRC in return for Vat-ing sellers under UK VAT rules.

Will Ebay be paying the full amount to HMRC, or will they be keeping a bit for themselves as quid pro quo?

Suddenly it makes sense then (for Ebay).

Some interesting comments on here but surely Ebay should be charging sellers VAT for a VATable service that they provide in the UK, I do not see how / why the HMRC has let them get away with it for so long.

On some threads there has been a big criticism against the “big” corporations that get away with paying little or no tax in the UK.

So do we want these companies to be legal and pay their dues here in the UK or not?

“no conspiracy…use your comon sense.

somebody who sells something for 8.50 that costs 2.80 and 1.30 to post is up to no good. add to that a chinnese or indian name then i smell a rat. simple as that.

do the maths its not viable”

I did the maths. Unlike some…

Based on your figures Derek, add 15p for packaging and assume a 2.4% transaction rate with Paypal. They’d be getting somewhere between £1.40 and £1.80 profit per item, depending on the category they sell in and whether they get a 10% FVF discount. There might also be labour, but you don’t know how that is being done. If the seller packs themselves, the labour costs are zero. Even if they have to pay wages to packers, they should still be getting £1+ profit per sale.

For a sale at £8.50 inc VAT, that’s an acceptable return for a lot of sellers. They could certainly do it without needing to run some VAT scam or pay cash in hand.

@ Derek duval – I have a 1 Bed unfurnished flat with a garden you can have for £695.00 per month, just been painted and ready to move into.

Last tenant had 4 happy years there

@derek duval

The competitor you have a beef about are doing it.

Other sellers have told you they could do the same thing too at those margins.

The maths, costs and margins have been explained. There is definitely sufficient profit left, without the need for cash in hand or VAT scams.

And still, you don’t believe it is possible…

You mention minimum wage as “proof” it must be a scam.

So here is some more math for you. Firstly, current rates as of April 2017 are £7.50 an hour… if you’re over 25. If you’re younger it is less. The competitor could be employing under 18s for example on just £4.05ph. But assuming all the workers at your competitor seller are 25 or above and on £7.50ph, divide that by 30 (the number of packets Tyler reckons he can manage an hour – easily done if it’s the same thing over and over – so agreed) and that is ONLY 25p in labour costs per item.

So take that off the figure range given earlier, and you are still over £1+ per item profit. If the seller is getting ebay FVF discounts, is on paypals lowest charge rate, is getting Royal Mails best PPI price, is getting a better price than you for the goods from the factory, they would more likely be closer to £2 whole profit per item. Nothing wrong with any profit anywhere within that range, particularly if you are selling them hand over fist, all day long.

As for what it costs to rent a place in the UK…totally irrelevant! Staff could be living at home with parents, flat-sharing, getting in work benefits. That doesn’t alter whether this seller can be above board or not (they totally can)

The maths don’t lie. No reality checks needed, or coffees.

Do the sums! For the love of god, do the sums!!! This is not rocket science. Get a spreadsheet, put all the costs in. It’s a piece of cake.