In the Autumn Budget the Chancellor Philip Hammond announced a number of measures which will impact small businesses trading on marketplaces which we reported on earlier. Now it’s time to take a deeper dive into the announcements regarding VAT and examine what we can expect to see over the next couple of years and it doesn’t make pretty reading.

VAT Threshold Frozen for the first time in 30 years

The VAT Threshold wasn’t decreased in this Autumn Budget which many are lauding as a plus point. I see it as quite the opposite in fact as the Chancellor didn’t just say it wouldn’t be reduced bringing thousands more businesses into the VAT umbrella, he said that there would be no change for two years.

No increase in the VAT threshold is bad for micro businesses

This is really bad news on two counts. Firstly for those businesses who trade below the VAT threshold it means you can’t grow your business for two years without being forced to register for VAT.

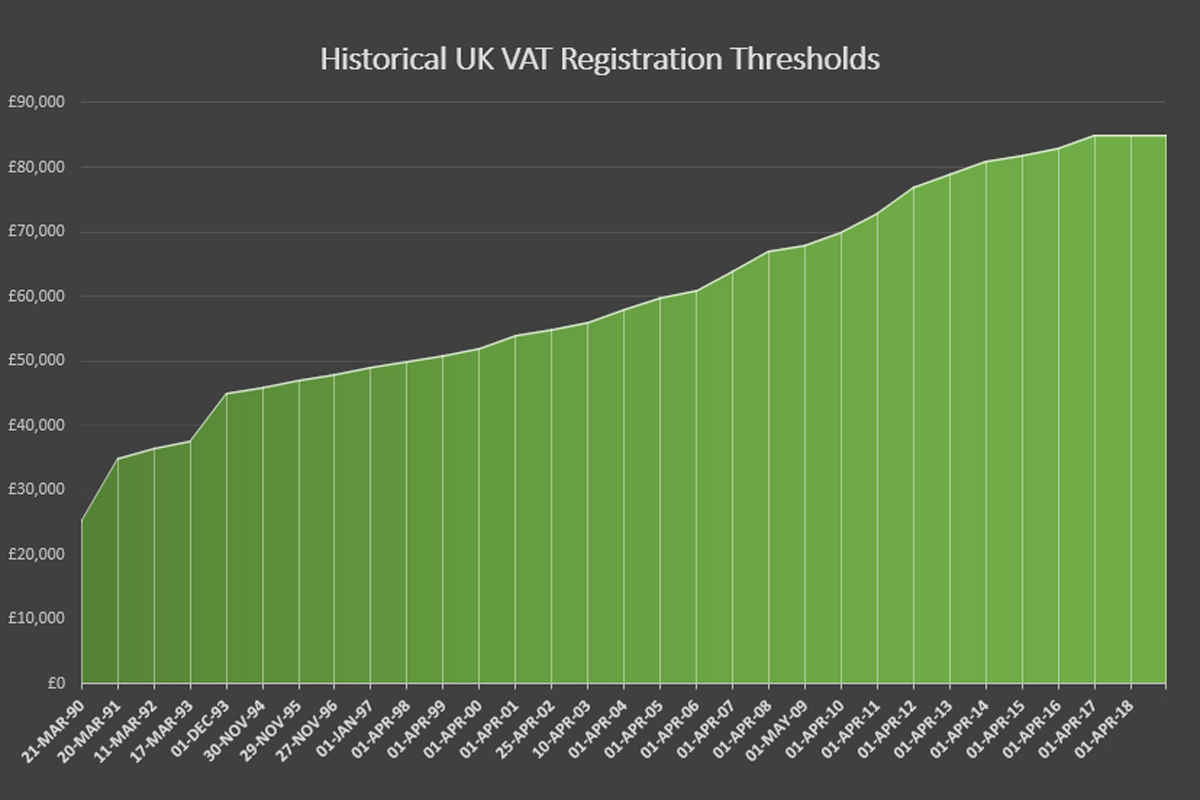

Looking at our graph you will see that the threshold at which you must register for VAT has risen steadily by a couple of thousand pounds a year since the early 1990s. Pegging the threshold at £85,000 for two years is not only bad news for small retailers wishing to grow in the short term, but terrible news in the long term as inflation will eat away at the value of the VAT Threshold.

Review of VAT Thresholds

Even worse news than not applying an annual increase to the VAT registration Threshold is the suggestion of a consultation to consider slashing VAT to registration levels similar to those in other EU countries. A threshold of £20,000 for example would see just about every eBay seller having to register for VAT – it’s only £1,666 per month turnover.

This is a bad thing – it’s a ton of paperwork and at that level it’s punitive for the business turning over say £1500 a month who very slightly increases their business as they’ll lose 20% of their turnover (not profit) in VAT. Turn over £20,000 per year and pay £4,000 in VAT could mean many businesses don’t just see their profits slashed but could quite conceivably suddenly be running at a loss. It’s a huge barrier to entry for someone just starting out on a new marketplace business venture.

For those turning over significantly more trading close to the current £85,000 threshold it would mean up to a £17,000 slice of your turnover going to HMRC. Sure you can reclaim input VAT, but for many small businesses cost of goods is low and much of their value charged to customers comes from their time (i.e. no VAT to reclaim).

It will be even worse for other industries, think window cleaners, taxi drivers, hair dresses etc who will also lose 20% of their turnover.

VAT Joint and Several Liability

The Chancellor announced the introduction of joint and several liability legislation for all online marketplaces (that’s not just eBay, Amazon, Etsy, NotOnTheHighStreet, Yumbles and OnBuy, but also Airbnb, Uber, JustPark and any number of other marketplace services).

Also consider new marketplaces who may launch in the future – they will be lumbered with VAT worries from day one potentially putting them off and lessening competition. Retailers following Tesco, Halfords and GAME (who all launched their own marketplaces) might think twice about doing likewise if they are liable for any VAT their retailers don’t pay and fewer marketplaces is bad for the industry.

The legislation will enable HMRC to hold online marketplaces jointly and severally liable for any unpaid VAT of a non-UK business arising from sales of goods in the UK via that online marketplace where that marketplace knew or should have known that the non-UK business should be registered for VAT in the UK. It will also require online marketplaces to display a valid VAT number for all their sellers using their platform, when they are provided with one. They will also be required to ensure that VAT numbers displayed on their website are valid ot ensures that fictitious and hijacked VAT numbers are not displayed.

The legislation only applies to those businesses who are not compliant with their VAT obligations and HMRC will only issue notices to online marketplaces where it is satisfied that a business is non-compliant.

The thing is here, whilst we absolutely believe that marketplaces should do their bit to ensure sellers pay their taxes, often the marketplace has no idea where stock is held or what your total turnover is (apart from the bit on that particular marketplace). Amazon of course know exactly where you stock is if it’s in FBA, eBay frankly haven’t got a clue as they don’t hold your stock and don’t get to see you tax affairs so it’s tough for them to be held to account. Of course as soon as HMRC notify them of a suspicious account that may be dodgy we expect them to take action, but they appear to have been more than willing to do this.

eBay reported in September this year that they had only received a paltry 77 Joint and Several Liability Notices from HMRC resulting in blocking 184 sellers. Amazon have acted on 416 notices from HMRC (Unlike eBay, Amazon have a strict one account per retailer on their platform so we can assume they’ve blocked 416 accounts). It’s worth noting that from their own internal efforts eBay blocked a further 893 accounts with no imput from HMRC.

You might well think that HMRC could be a little more active in spotting VAT evaders but I couldn’t possibly comment.

VAT Split Payments

The thing marketplace traders should be most concerned about is what the review of VAT Thresholds and long term effect of Joint and Several Liability could be. It would be no surprise if within a couple of years marketplaces were ordered to collect VAT on every sale and remit to HMRC.

This would be an administrative nightmare and instantly hike prices on eBay overnight. Traders who are VAT registered would have to account for VAT already collected by the marketplace and report it on their VAT returns, but who will ensure that the marketplace applies the correct rates of VAT?

Merchants on special VAT schemes such as the Flat Rate or Margin Schemes would have to reclaim the VAT from HMRC, as would those who aren’t even VAT registered. Yes that’s right, if the marketplace collects VAT on your sales and you are not VAT registered you would have to register to reclaim the VAT that wasn’t due!

There is also the issue of VAT invoices – on some VAT schemes such as the Margin Scheme you aren’t allowed to give out VAT invoices. How would the marketplace know which VAT scheme you were on before they issued incorrect VAT invoices in your name?

We’ve already seen split payments announced for the US State of Washington from 2018 and similar measures are being introduced in Australia. With the will to eradicate VAT evasion it will be no real surprise if such measures are introduced in the UK within the next 2 to 5 years.

18 Responses

Yep, VAT and the reduction in dividend allowances make this the budget that punches small business squarely in the face. Not the ideal way to stimulate growth in an industry already hit hard by the pound and Brexit.

Displaying a VALID VAT number:

This is easy for the marketplace to introduce. They simply need an API link to the EU VIES system. This will remove bogus VAT numbers, sharing of VAT numbers etc.

It puts the onus on the marketplace to ensure the VAT number belongs to the seller. If not the new law states the market place is liable for allowing non-compliant sellers to sell. Imagine a scenario where Amazon/eBay finds a bogus vat number on an account. No longer can they just bat it back to HMRC. They have to self police.

Item location:

Yes it is simple on Amazon but also on eBay we do know where the stock is declared to be as the seller states it on the item location. Therefore if a Chinese seller says stock location is UK then it must be assumed it is UK and if they are not displaying a valid VAT number then they are off.

If they are actually sending from China but stating UK item location they can be removed for item location mis-representation if poor DSR’s don’t get them.

if your worrying about avoiding registering for vat

its time to think of something else

We are always on the VAT cliffedge. it is a pain in the backside of a tax. It is however not complicated to complete a VAT return, I think we scare people with this, it is not a complicated tax to work out, keeps a lot of accountants in work which are not really required.

However the VAT helpline is pretty useless we have have some terrible info in the past.

I do think such a high threshold does stop people moving on however, but we have it so we have put so many barriers in the way of small biz now in the UK, can you blame people. I knew he was not going to put the threshold down, after the National insurance mess, but he is getting you ready.

For us the VAT avoiders are an issue in our sector. We even got a visit from the VAT fraud team in the summer, basically to make sure we were all ship shape which we are, however some of the competitors are not, it was a bit of an eye opener.

We double our cost and plus VAT it is the only way. So marketplaces are not really any good for us. Simple really these are cheapest price WINS sites, and if you are dodging the VAT, your 20% better priced than us. We have to be so specific with our products.

So I think dealing with the VAT avoidance would be proper step forward, then legit business might find they can compete anyway, as you get rid of the dodgers, after all you are running a business properly and legal you are better than the dodgers.

What I think will happen is the marketplaces will charge at the point of sale now. They hit all the marketplaces sellers with VAT on FEES just like that this year, no real warning, and they may just do it on the whole-sale to cover their own tax avoiding backsides.

As far as smaller markets, they have to Vet the seller’s better. You can easily check to see if a VAT number is valid, and do it every three months. However there is no easy answers here.

The Tories need small biz to PAY for Brexit, as they certainly are not going to make the Multi Nationals PAY. He did not tell us the threshold in Germany was 15K for nothing, and they are booming!!!!

I think getting RID of VAT as it is out of date not fit for purpose, and having a straight forward sales tax like in the States might be better. One thing for sure 2018/19 are going to be tough years.

“A consultation to consider slashing VAT to registration levels similar to those in other EU countries”.

We are leaving the EU and one of the few advantages is that we will not have to do what they do or say!

I completely agree with northumbrian’s comment.

How many business’s can make a living by buying and selling AND keep below the VAT threshold legitimately? Not very many at all is the completely honest answer.

On the flat rate scheme, you are told specifically to provide invoices to customers at the full VAT rate. Irrespective of the % scheme you are on.

Not sure you are right about the effect of a VAT threshold at a low level. Yes, it takes additional accounting, but if you use Sage or Quickbooks it does it for you, and even files online automatically. In the years i have been trading it has become much less of a hassle.

Secondly, how does this affect profitability? If you are not VAT registered you can not reclaim VAT on purchases of stock and consumables. When you register you can do this so it is not an outright loss of margin. You can also reclaim VAT on previous stock purchases you are still selling which were bought on a VAT paid basis. All that is happening is that tax collection is moving from HMRC through the tax return to you. I was never worse off as a result of registering, and overall I think it would have been better to register before I achieved the threshold

I think the benefit of a high threshold – giving micro-businesses a tax subsidy – is admirable. However, the point is that it is distorting market behaviour (‘bunching’ and ‘splitting’), and failing to raise taxes (hospitals, schools, roads etc.).

So perhaps better to target small businesses with a less distorting tax break – through the income tax / corporation tax regime?

How does this affect all the non paying foreign sellers that haven’t paid a penny for over 15 years.

It doesn’t.

Like housing promises, make all the right noises and do nothing.

The government should not even be talking about vat cause it’s just a big joke and so is HMRC.

Paradise papers and lack of.action says it all really

” it’s a ton of paperwork” – Why?

If your in business then you should be doing your accounts, on entering the amounts into your account package it will calculate the VAT for you.

Here is the full HMRC statement on the new measures.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/661739/7183_guidance_note_-_extending_joint_and_several_liability.pdf

This is very interesting:

However, the online marketplace can avoid being held jointly and severally liable for

the unpaid VAT if, within 60 days of knowing, it ensures that the un-registered nonUK

business cannot sell goods to UK consumers through its website.

This 60 day period allows time for the online marketplace to contact the non-UK

business to alert it to its UK VAT obligations. This period of time also takes account

of the situation where the non-UK business has applied to register for VAT in the UK

and is waiting to receive their VAT registration number.

Many times sellers have been reported to online marketplaces where they have even admitted they are not compliant and nothing has been done. Tell HMRC they say. They cannot use that excuse anymore.

Not all small businesses seek to grow (or are capable of doing so). Many opt to stay below the VAT limits knowing the problems that can be caused if they can only just manage to rise slightly above it. Many of us, just want enough to pay the monthly bills, and nothing more.