It looks like the PayPal Credit services offered by the payments firm are likely to be expanded as PayPal develops its relationship with the firm that powers the lending.

Synchrony Financial has apparently agreed to acquire PayPal’s U.S. consumer credit receivables portfolio with the idea of further delivering new services in the months and years to come.

In a statement from PayPal they say: “Our customers tell us time and again that credit is one of their most important needs when it comes to managing their financial lives. At PayPal, we see providing access to credit as an important part of our mission to democratize financial services. Credit helps people and businesses grow and achieve their aspirations. Since 2008, we’ve been proud to offer our U.S. customers online consumer financing that gives shoppers greater financial flexibility and helps merchants sell more, driving greater engagement on our platform.”

“Today, we are expanding our relationship with Synchrony Financial to further enhance and grow our consumer credit product offerings. Through this transaction, Synchrony Financial has agreed to acquire PayPal’s U.S. consumer credit receivables portfolio. Together, PayPal and Synchrony Financial are committed to working together to build innovative, more personalized payment experiences for consumers and merchants on our unrivaled two-sided network.”

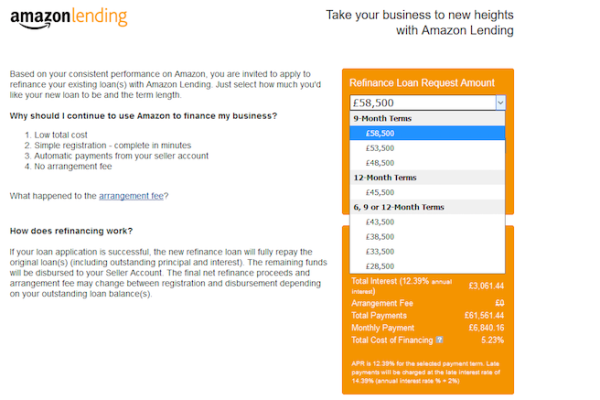

Credit and lending offers PayPal a huge opportunity to make money. Not least because there are two distinct areas of possibility. Obviously, they can lend money to shoppers and increase ecommerce velocity by encouraging purchases and payments in instalments. But PayPal can also help out sellers with a line of credit. SME lending is a key area of concern for many and PayPal is in a unique position to know what an online merchant can afford to borrow and help them out.

Have you taken a loan from PayPal to buy stock or invest in your business? And if so, what was your experience? Let us know.