A survey of 1,500 US Shoppers on how and why they buy clothes online survey wasn’t supposed to revolve around Amazon – but, as with most ecommerce conversations, Amazon ended up being a key focus. The report focuses on how shoppers will browse and buy clothing in 2018.

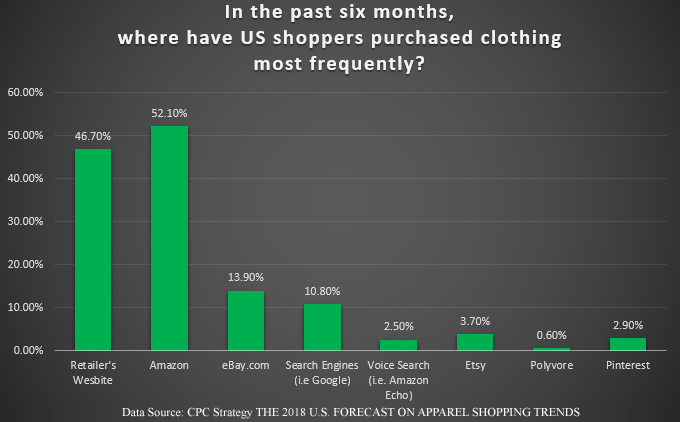

CPC Strategy discovered that in the past six months 52.1% of US shoppers purchased clothing on Amazon most frequently. Another touch point is that a further 2.5% purchased most frequently using Voice Search and it’s a fair bet that most of these were on Amazon Echo as only that and Google Home have a high user base.

53% of women reported they were more likely to buy clothing in 2018 directly from a retailer’s website, while 56% of men were more likely to purchase clothing from Amazon.

Cowen & Co. forecast that Amazon will sell $28 billion worth of clothing in 2018 and that’s expected to grow to some $62 billion by the year 2021.

Don’t think this is all good news for Amazon clothing sellers however, in recent years Amazon have grown their own private label brands such as The Find in the UK and One Click Retail reported that Amazon’s private-label apparel business had pulled in $21 million in the US in 2017.

“We already know how much Amazon shoppers value price, shipping, and convenience (more on that later in the guide). For some, there’s an added layer of confidence that comes with purchasing apparel via Prime. Retailers’ websites are still a destination for apparel shopping. However, retailers should stay vigilant to stay tuned into their audience and focus on creating new value additions customers can’t get anywhere else.”

– CPC Strategy The 2018 U.S. Forecast on Apparel Shopping trends Report

Regardless of Amazon growing their own private label clothing sales, the marketplace is still a massive opportunity for third party retailers. Free and fast shipping, low prices and convenience were the top reasons for consumers surveyed to shop on Amazon, beating wide selection and high quality clothing by a considerable margin. This may explain why casual clothing took was purchased online by 54.9% of all survey respondents.

The report contains a ton of useful information to enable clothing retailers to tailor their website and channel strategies to appeal to US consumers. From brands right down to smaller retailers, if you’re a clothing retailer then read the full report but the key message has to be, Don’t ignore the power of Amazon.

One Response

As the clothing sectors biggest problem is returns how do third party retailers cope with Amazon still taking a percentage of the sale even if the item is refunded.

I recently had to refund a sale of £106.62 as the buyer changed their mind and returned the item. Amazon charged me a £12.82 fee for the transaction.