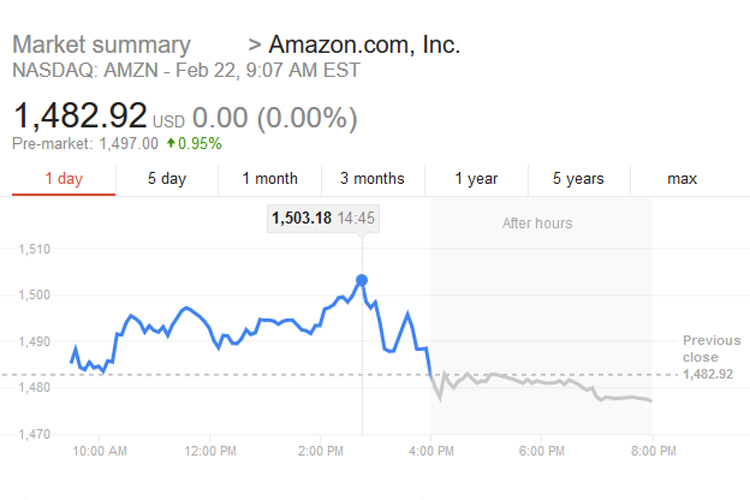

The Amazon share price, already up well over 25% this year, hit a record high rising above $1,500 per share for the first yesterday.

At 14:15 EST, the Amazon share price stood at $1,503.18 before dipping back down. Today the share price started trading at $1,491.61 giving the company a current market cap of $722.22B.

Typically Jeff Bezos has led Amazon with little regard for investor returns or share price, preferring instead to focus on building growth for the future, taking risks with new business opportunities. Amazon’s ethos is that it’s ok to fail, but if you’re going to fail then fail fast and move on to the next project and it’s this strategy that’s propelled them to the forefront of retail. As an example there are rumours that the company are to merge Amazon Fresh into Prime Now – Amazon Fresh is subscription based free delivery with a wider selection of goods than Prime Now with a narrower selection and a per delivery cost (free delivery over a $35 order value).

Interestingly Walmart’s share price took a dive of around 10% this week which has largely been attributed in the press to Amazon’s moves in the grocery sector. This is interesting as Walmart with a turnover of $485.9 billion dwarfs Amazon’s $178 billion and grocery is only a tiny fraction of Amazon’s business. The difference is that Walmart is a legacy bricks and mortar business whereas Amazon’s online operations aren’t held back by a large real estate of stores.