Many retailers are looking at Bitcoin and other cryptocurrencies and will still be considering whether it’s time to adopt them as a payment option. It may appear at face value that offering alternative payment options could only reduce friction at checkout, cryptocurrencies may still have more downsides making them impractical for most ecommerce transactions.

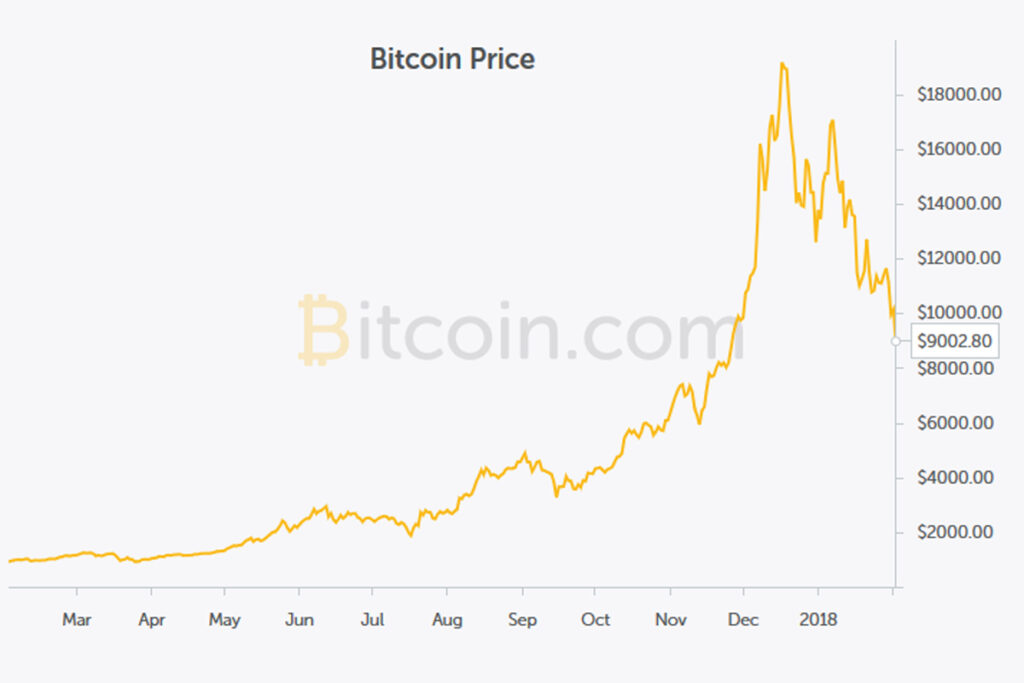

Bitcoin is in the news again this week with the value plummeting and currently settled at just over $9,000, in contrast to a high of just over $19,000 on the 17th of December. That’s a loss of $10,000 in just 48 days or an average loss in value of $208 per day. Compare that with the 17th December 2016 and Bitcoins were only worth around $780.

The volatility of Bitcoin over time is one issue for ecommerce and whilst over the past year (Dec to Dec) if your business has accepted Bitcoins you’d have made money simply by sitting on them, any retailer who owned Bitcoin a week ago has made a massive loss if they didn’t exchange them for hard currency immediately.

What’s more important for retailers than the long term violent fluctuations of Bitcoins is the short term value measured in minutes and seconds. In an ideal world, the value of Bitcoin would be represented by a straight line graph but in reality the currency value fluctuates up and down to such an extent that if a buyer commences checkout on your website the value the retailer ends up with can be vastly different just in the time it takes to complete the transaction.

The rise and fall in the value of Bitcoin isn’t simply limited to retailers who may choose to accept Bitcoins, but also those who select a checkout partner who immediately sells the Bitcoin through an exchange so that the retailer receives hard currency. Again Bitcoin is so volative that the seconds it takes to complete a transaction can result in a wildly different exchange rate and settlement value for the retailer.

Bitcoin is of course not the only cryptocurrency available, but is possibly the best known among consumers. Whilst alternatives could perhaps be more stable currently, they still lack the regulation which protect hard currencies and could therefore still face wildly fluctuating values making them risky for ecommerce in the short term.