Even though it seems everyone is talking about virtual assistants devices and smartwatches, the majority of consumers don’t own these new devices, and even fewer use them to complete purchases, according to a recently released study by Episerver.

35% of consumers now own a smartwatch, two-thirds (66 percent) of smartwatch owners never browse on them and 70% never purchase through them. Similarly, two in five consumers now own voice-assisted devices, but 60% never browse on them and even fewer use them to complete purchases.

In contrast, the good old smartphone which has been around for a decade is more established. 75% of all consumers report using smartphones to browse, and over half (57%) report making purchases on these devices. Additionally, 29% of smartphone owners report browsing for purchases on their smartphone daily and half report doing so weekly, indicating a sizeable base of highly connected consumers.

“Voice assistants such as Amazon Echo and Google Home may not be the retail disruptors that many have said they could be.

In fact, a lot of technology such as smartwatches, dedicated product buttons and connected appliances are all failing to tickle the shopping fancy of many consumers. The only thing that does seem to be of interest to shoppers are drone deliveries.”

– Paul Skeldon, Tamebay Editor

Reading the accompanying survey report, you might be forgiven for thinking that virtual assistants and wearables are a failure in retail terms but we need to dig a little deeper to understand why new technology is failing to grab the hearts of consumers. Whilst Episerver find that that consumers aren’t using voice assistants and smartwatches to make purchases this doesn’t necessarily correlate with their importance to retail and in particular ecommerce. Yes they are nascent technologies, but we shouldn’t underestimate their importance based on a survey of 4,000 consumers.

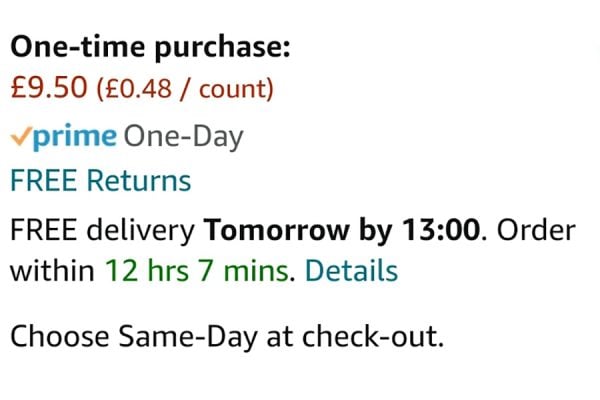

Amazon have reported that Echo owners are their most engaged customers purchasing an amazing 66% more than the average Amazon customer. That smashed the uplift from being a Prime subscriber – Prime members spend what in comparison looks like a paltry 27% more than the average shopper.

Amazon’s numbers suggest that new technology are most definitely retail disruptors, but perhaps just not yet in the way that we were promised with a utopia of voice purchasing and devices that would find the products we want and have them delivered. There is no doubt from Amazon that new technology might be a driver of retail but as an assist and in a manner that marketeers will find even harder to measure than the assists from social media add to traditional ecommerce.

There is yet another aspect to the Episerver findings which may skew the numbers and that is consumer might not actually understand the questions. For instance, if you build a shopping list by asking Amazon Alexa to add them, but then go on to manage your shopping list on your tablet, laptop or smartphone, would you count this as shopping on a voice assistant? Many wouldn’t but we also shouldn’t rely on survey questions to extract this type of complex information from consumers unfamiliar with marketing concepts of sales funnels and sales assists.

It may yet turn out that virtual assistants and smartwatches aren’t the drivers of retail that we’ve been promised. Equally it may prove that they will be, but it’s far too early for them to be customarily used to date. We’ve not even gotten to the point where consumers can routinely ask their voice assistant to display results on the living room TV and shopping on new technology is about as enjoyable as online retail was in the late 1990s when eBay didn’t support images!

Ultimately I remember when smartphones first appeared and Tamebay’s Sue Bailey was raving about the ability to shop on a mobile. I looked at a minuscule screen on an prohibitively slow mobile connection with listings tailored for a desktop and couldn’t see why anyone would shop on a mobile. Time proved we were both right – Sue was a visionary that could see the future and I was the typical consumer who refused to use the technology until it had developed to the stage where is was worth using.

I would add that I’ve never made a purchase on a Virtual Assistant but that’s not quite true, I regularly use voice search on marketplace apps and but would the typical consumer in the survey count that as a virtual assistant purchase?

As mobile was a decade ago, Virtual Assistants and smart watches may simply still be so new that retailers and marketplaces haven’t caught up to offer experiences compelling enough that will engage the majority of consumers in a memorable manner. However Amazon’s revelation of consumer loyalty suggests that retailers should take every opportunity going to create experiences that consumers will engage with – even if they’re not directly driving sales they should generate loyalty to the brand.