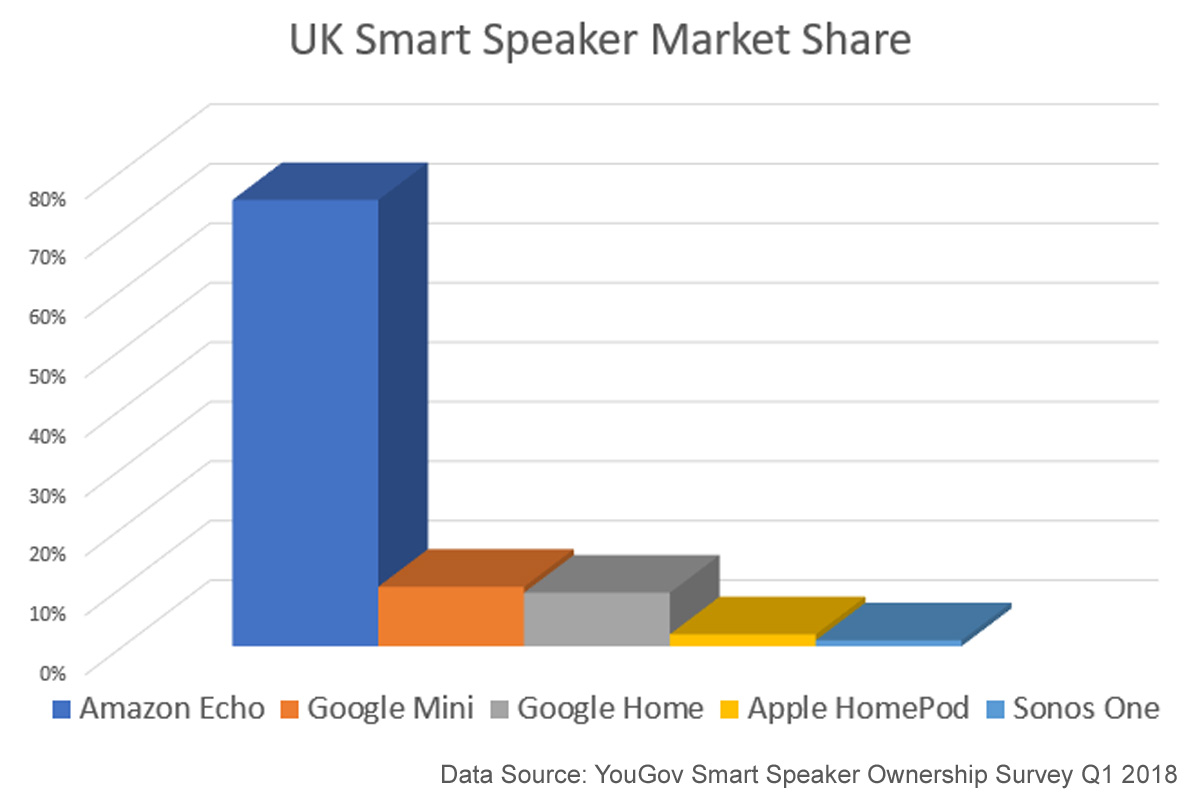

It would appear that Apple are failing with their HomePod smart speaker launch when measured in terms of the UK smart speaker market share. With a launch that missed the critical Christmas deadline, they’ve only managed to capture a 2% market share.

Amazon have motored ahead with a 75% Smart Speaker market share, although their position has slipped from a high of 88%. It’s not particularly surprising that their market share has been diluted as they were first to market and naturally as other manufacturers launch and sell products their market share will rise.

Google have managed to capture a solid 29% share when you combine their Google Home and Google Mini products (YouGov didn’t split out market share for the various Amazon Echo form factors).

What’s really interesting is that in Q3 2017 just 5% of Brits owned a smart speaker, but by Q1 2018 ownership had doubled with 10% of the population owning a smart speaker. There is demand, but it’s limited for the Apple device

Apple’s big problem is two fold – coming late to the party is routine for Apple but unlike mobile phones which a consumer might replace on an annual basis and are often considered as a fashion accessory to be upgraded, there’s little reason to upgrade a device that sits in your home and works and consumers are more likely to simply add additional devices in more rooms than they are to stop using a device they’ve become accustomed to.

Apple’s second issue is price – at £319.00 in the UK, you could buy up to six competitor devices and kit out your entire house for the cost of a single HomePod. Even the Sonos who traditionally compete on high audio quality which Apple are extolling for their HomePod, have priced the Sonos One at £199.00 which confirms how expensive Apple are.

Consumers appear to be viewing smart speakers as optional accessories and in the main use them for listening to music. Competitors to Apple are able to play music synchronised across multiple devices and yet Apple intend consumers to buy two devices for the same room to get the best sound – that’s an eye-watering £638.00 Apple suggest you should spend for the main room in your house. There’s no argument that some people will demand superb audio, but for most, especially in rooms such as bedrooms and kitchens, a low cost Amazon Dot or Google Mini will more than suffice as there’s likely to be background noise anyway.

With a 53% share of smartphones in the UK (Android lags on 44%), Apple might have expected their loyal following to buy a HomePod at any price, but if they’ve already invested in a competitor device it’s a tough call to justify a replacement.

The other aspect to consider is just how good Apple Siri is compared to competitors. Frankly Amazon’s Echo was rubbish at launch compared to Google Assistant on Google Home devices, but Amazon have worked hard to improve Alexa capabilities. Amazon and Google also have the advantage that their offerings are compatible with more home control devices in the UK than Apple.

“While Amazon has lost smart speaker market share in the past six months, ownership of its devices continues to grow and it remains the dominant player in the industry. However, because demand among the public for a smart speaker is only modest, the brands that stand to gain most are likely to be ones who can either bundle ownership up with other services or can demonstrate how useful devices can be when it comes to accessing information, goods and services. From both standpoints, Amazon is well placed.”

– YouGov

It’s also worth noting that Amazon are integrating Alexa with multiple devices, you can link the latest Fire TV devices with your Amazon Echo to voice control your programmes. Plus of course, Amazon have voice shopping enabled with one-click ordering and this will be coming soon with Google Home (it’s already being rolled out in the US). Smart Speakers with the most services in addition to music capabilities will be more attractive in the long term and Apple don’t have a shopping catalogue back end, let alone a fully fledged shopping solution.

This isn’t Apple’s first foray into the speaker market, in 2006 they launched the iPod Hi-Fi but that only lasted 18 months before being discontinued. Time will tell whether they succeed with the HomePod or if they’ve misjudged the market and it follows the iPod Hi-Fi into the history books.