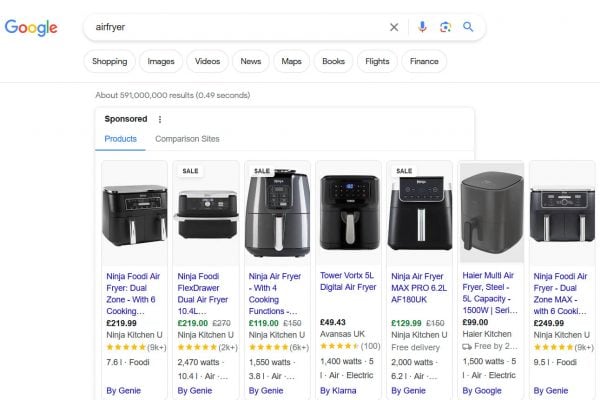

China’s JD are to join Google Shopping as part of a new JD & Google strategic partnership which will see also see Google invest $550 million in JD. A curated selection of

high-quality products from JD will be advertised in multiple regions through Google.

As the second largest ecommerce player in China, JD and Google will work together to reduce friction in ecommerce. Leveraging JD’s supply chain and logistics expertise and Google’s technology strengths, the two companies aim to explore the creation of next generation retail infrastructure solutions, with the goal of offering helpful, personalized and frictionless shopping experiences.

“This partnership with Google opens up a broad range of possibilities to offer a superior retail experience to consumers throughout the world. This marks an important step in the process of modernizing global retail. As we celebrate our June 18 anniversary sale, this partnership opens a new chapter in our history.”

– Jianwen Liao, Chief Strategy Officer, JD

Google will receive 27,106,948 newly issued JD.com Class A ordinary shares at an issue price of $20.29 per share, equivalent to $40.58 per American Depositary Share.

Partnering with Google is an important step for JD to attract sales from outside China and this could be key for JD in a longer term ambition to break into Western markets. Just as we see western retailers investing in Asian territories, Chinese marketplaces and retailers are keen to exploit the West and introduce their offerings to a whole new range of consumers. While Alibaba and Rakuten have both struggled to establish a foothold in the West, JD may find it easier to strike up partnerships with retailers and certainly getting products visible on Google Shopping around the world won’t do them any harm at all.

For Google, the $550 million is a decimal place in their accounts. Their parent company Alphabet’s latest balance sheet shows $101.87 billion in cash and short term investments with total assets of $197.3 billion. However, it’s not so much the size of the investment as it signifying the start of a new interest in expanding Chinese commerce to the West that’s interesting.