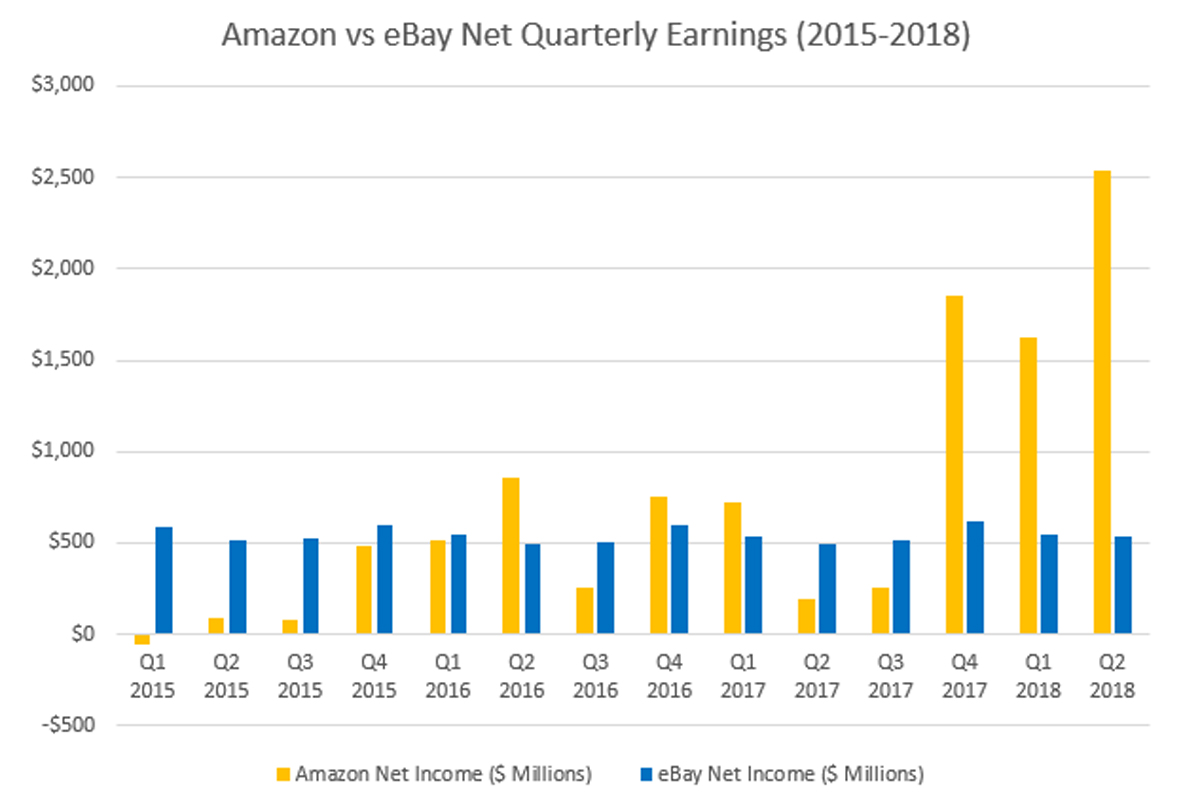

If you’re wondering why there is so much investor interest in Amazon after a decade of loss making, it’s because for the last straight 13 quarters they’ve turned a profit culminating in the 2nd quarter of 2018 where Amazon earnings topped over $2.5 billion.

Q2 2018 was also Amazon’s third consecutive quarter of turning in over a billion dollars in quarterly Amazon earnings profit having topped the billion dollar profit mark for the first time in Q4 2017.

It’s worth comparing Amazon earnings with eBay who have been profitable for years but not to the same stratospheric extent. eBay turned a net profit of $0.533 billon on revenues of $2.6 billion (eBay gross merchandise volume was $23.6 billion). That means Amazon’s net profit of $2.534 billion was almost as large as eBay’s entire revenues and five times eBay’s net profit for the last quarter, which is a truly staggering achievement.

Most of Amazon’s profit comes from their AWS cloud hosting and advertising businesses, both of which are extremely profitable. It’s thought that their retail sales operate no more than about 5% margins after costs whilst third party sales from merchants generate in the region of 10% profit margins.

Prior to 2009, Amazon was in the red for it’s entire public trading history and it’s only in recent years that profits have started to come in, but investors have always bet for the long term on Amazon even through Amazon never pays a dividend to their share holders – Investors have to rely on Amazon’s share price continuing to rise rather then see a direct income from their holdings.

How Amazon grows

Amazon have largely ignored share holders for their history, other than mandatory reporting of results and an annual letter to shareholders from Jeff Bezos, Amazon’s founder. They have always concentrated their efforts on the consumers with a relentless desire to do what’s right for the customer. Then they build out services which are needed to run their operations and effectively rent them out to third parties.

Amazon built a retail operation and then allowed merchants to sell on the platform (and naturally brands and manufacturers to sell direct to Amazon retail through Vendor Central which they have also fully automated along the lines of Seller Central for merchants).

Amazon needed servers and a cloud infrastructure to run their business and to scale started to rent space to anyone and everyone until they had one of the largest cloud computing businesses in the world. This again helped Amazon to scale far beyond if they had kept their servers as a closed business.

Amazon built warehouses and again to help them scale quickly rented out space in their warehouses to their merchants enabling them to store stock and for Amazon to fulfil it.

Amazon’s next big growth areas

Amazon have new businesses which investors are eyeing up, both of which are almost ready to explode onto the market – logistics and advertising and Alexa.

Advertising

Advertising is already paying dividends for Amazon with a healthy contribution towards their profits but this is just the start. Amazon are looking at the likes of Google and Bing with an eye towards launching adverts on non-Amazon websites which will generate serious amounts of future revenues. Google makes almost all of their income from advertising and if Amazon get’s it right then Amazon Advertising could dwarf revenues and income from the Amazon marketplace.

Logistics

Amazon Logistics is growing at such a rate, fuelled by the relentless desire of consumers to receive products next day, 7 days a week, that they will soon be in a position to start carrying products for third parties and compete head to head with national postal services and courier companies. Once Amazon have a courier delivering to every street in the country every day, they could easily start to deliver large letter type post and parcels for third parties. It may be a stretch to imagine them replacing Royal Mail or USPS in the short term, but it wouldn’t be too much to imagine businesses, such as Whistl, Secured Mail and UK Mail, who access Royal Mail downstream services diverting their parcels business to Amazon and leaving just their credit card bill type letter post to Royal Mail.

Devices

Amazon’s Echo range powered by Alexa and their other devices ranging from Dash to Fire Tablets, Kindles and Amazon Fire TV are all fledgling businesses with no clear end goal in site. Yes they are immensely profitable, but other than retail sales there is not currently a way for Amazon to monetise them as a third party service in a similar way to the obvious services aspects of Advertising and Logistics. This is a ‘watch this space’ area as Amazon are innovators, quick to dump projects that don’t work (e.g. the Fire Smartphone) and zero in on products that do. Amazon devices are immensely popular and sooner or later Amazon will figure out a way to turn them into a service which can be monetised and sold to third parties.

Amazon’s future

Expect Amazon’s revenues and profits to continue to grow, but also expect them to grow stratospherically in the next few years as Logistics and Advertising revenues start to kick in. In future years, it’s quite likely that their marketplace and especially their retail businesses could be almost irrelevant.

Amazon are not really in the retail business. Amazon’s entire future is as a services business and that’s where investors will see the company’s future revenues and profits soar.

One Response

For a company that sells Billions of pounds worth of stuff every year, to say they are not a retailer is ridiculous, their retail arm doesn’t make them money, that does not mean they are not a retailer. It’s like Uber saying that are not a Taxi company (they claim to be a platform). They are a retailer who found it more profitable to rent out there retail services, to 3rd parties, then to actually retail. They use there retail arm as a loss leader for all there other ventures and to keep other 3rd party sellers prices low on popular items, even if they lose money or break only even on their sales they are taking a 15% cut of everybody elses sales, who prices against them, that does not mean they are not a retailer! They are just aren’t a profitable retailer, they are a very profitable company on all their retail and computing based service, that do along with retail. Which is the point the article made however they are definitely retailer amongst many other things.