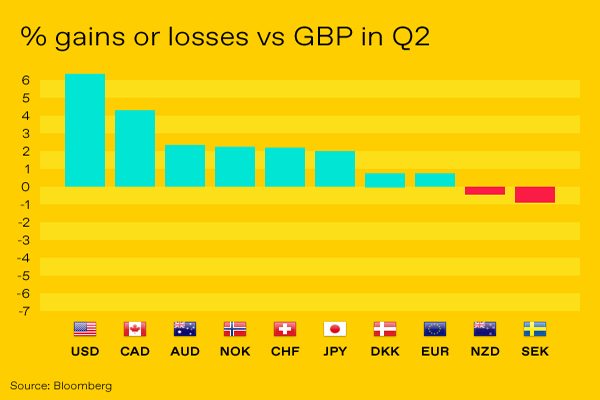

‘Sterling has had a pretty hideous second quarter’ says WorldFirst‘s Chief Economist Jeremy Cook. Sterling dropped against nearly every currency in the G10 between the beginning of April and the end of June, only gaining against the Swedish krona and the New Zealand dollar. The pound also hit a 7-month lows against the US dollar in June.

Wage growth might have overtaken inflation during Q2 but inflation remains an ever-present risk at the moment. Movements in oil markets are starting to concern those who had thought the spectre of inflation had diminished in recent weeks with the cost of a barrel of crude oil rising to the highest level since 2014.

There will be more skirmishes between Brexiteers and Remainers during Q3. By July 24th, for example, two bills on trade and customs have to go before Parliament and the amendments on those will probably generate even more rebel support. For now, Theresa May is safe in No.10 too; more as a result of the fact that nobody actually wants her job until April next year (i.e. after Article 50 expires) rather than any particular endorsement of her premiership.

Coming in August is a Quarterly Inflation Report, and Jeremy goes on to say that WorldFirst are not fans of raising rates at the moment but it does look like it will happen in August as inflation pressures build once again. Unfortunately, sterling has decoupled from Bank of England interest rate expectations and a hike in interest rates therefore will not immediately translate into a run higher for sterling.

The Bank of England’s next meeting is at noon on August 2nd and interest rate expectations markets put an 82% chance of the base rate increasing then for the second time in 12 months.

It’s quite possible that we’ll see further drops in Sterling which will have opposite effects on ecommerce traders. Lower sterling makes international selling more attractive as either prices can be increased or overseas consumers see bargain prices, but equally sourcing goods for the busy Christmas season will be more costly. Merchants who are seeing payments due in foreign currency would be well advised to seek a forward contract to fix rates and build some certainty into their financial forecasts.

You can read more indepth analysis on the WorldFirst blog.