Choosing an online payment provider can make the difference between winning a sale and losing a customer. With that in mind it’s crucial to offer the payment services that your customer wants to use, but which is best?

The default for many retailers is to use a merchant gateway and accept credit or debit cards. This worked well for years, but consumers are tiring of having to type in their card details every time they wish to make a purchase. With the increasing number of mobile and tablet purchases there’s no guarantee that a consumer will even have their bank card with them, although it’s almost a certainty that they’ll have their mobile phone close to hand.

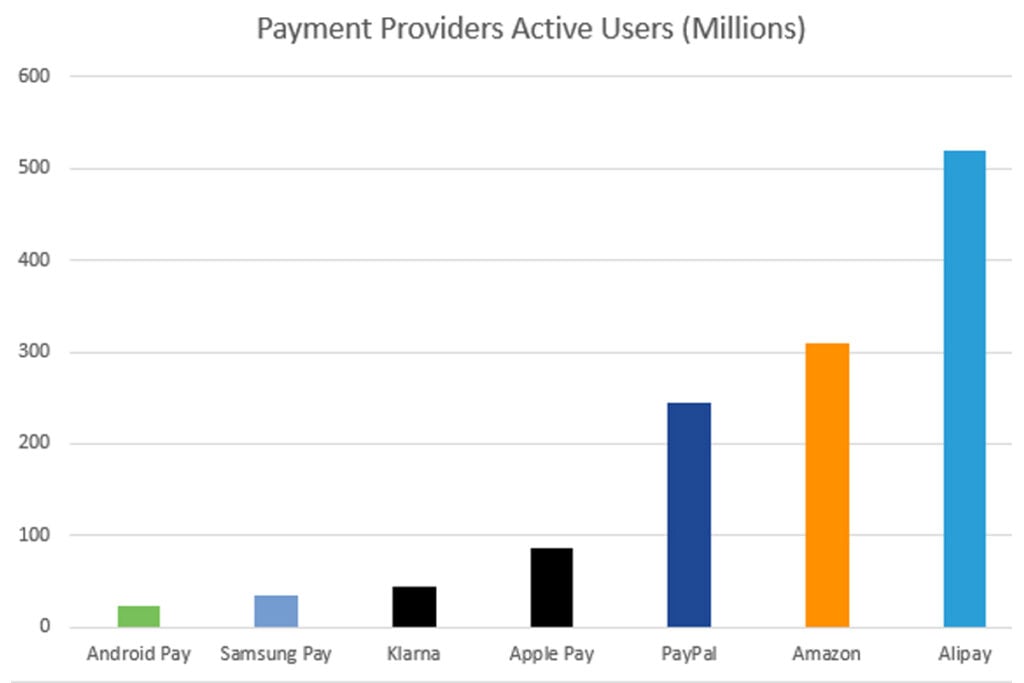

The largest payment provider is AliPay with some 510 million active users. However as a Chinese payment provider it’s of considerably less interest if you are targeting customer in the West. For China however, Alipay is a defacto choice.

One might expect PayPal with 244 million active users to be the first choice to offer as an alternative to bank cards and for many merchants, especially those active on eBay, it’s the go to option. However Amazon Pay is increasingly interesting, albeit with lower adoption by merchants. Amazon Pay enables a consumer to pay on any website offering the service by logging in with their Amazon credentials and Amazon have some 310 million active customers. That makes Amazon Pay in some ways a more compelling proposition to PayPal, although consumer usage and merchant integrations are not as common.

Klarna is an interesting option for low friction payments with the ability to complete the purchase with just an email address and pay later. But with an estimated 45 million active users it’s less popular than Apple Pay who have an estimated 86 million users.

Apple Pay is the runaway leader for mobile smart phone payments with Samsung Pay estimated to have 34 million users and Android Pay lagging with an estimated 24 million users.

For merchants based in the West, PayPal should be the first consideration but it would be remiss not to at least consider Amazon Pay. Seeing the considerably larger usage of Apple Pay than other smart phone options, it’s not surprising that eBay have chosen Apple as their mobile first payment provider integration into the new eBay Payment service rolling out in beta in the US.

Accepting credit or debit card payments can’t be ignored, but the more convenient a payment option you offer the lower the chance of an abandoned cart and certainly the easier you make payments the more likely you are to see impulse purchases from your customers.

One Response

Amazon Pay and PayPal are what we use and consumer usage is defo up on Amazon pay, and PayPal is a bit less than it used to be…a lot of causal users might have few spare quid in their paypal accounts from eBay sales from the last few years which may encourage them to use the PayPal account, but with the decline in eBay and rise of Amazon that is maybe one of the answers for less spend with PayPal….Both still need more options for merchants.