JD.com says that their biggest Singles Day yet saw pan-European goods soar up in sales.

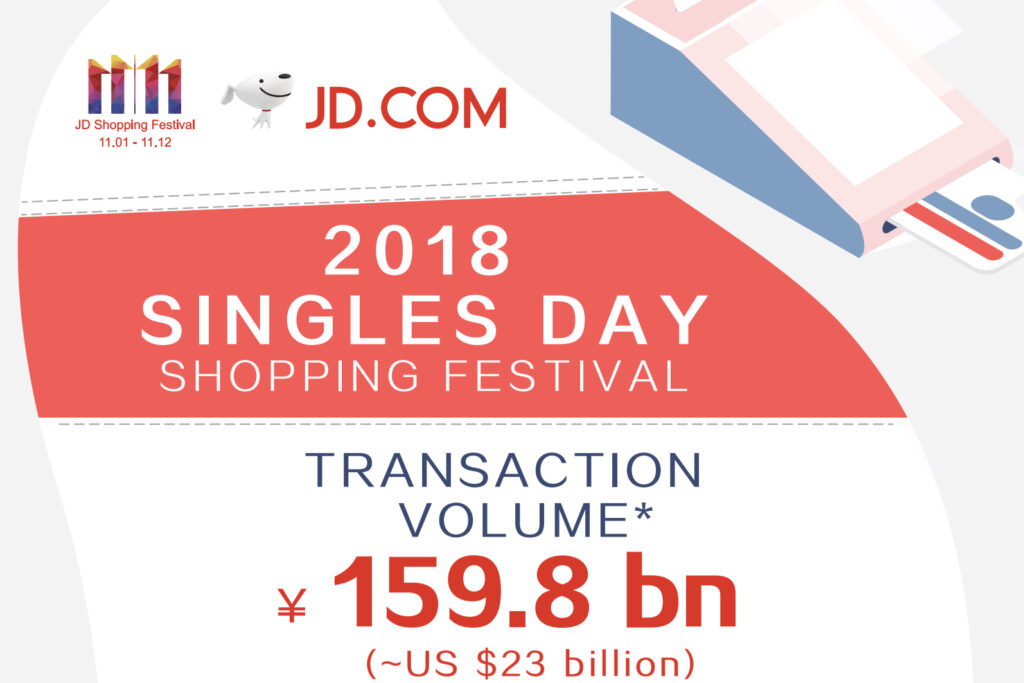

Online sales on JD.com saw a record of $23bn (£17.98bn) during the Singles Day, with the highest ever year-on-year (YoY) rate of European products being purchased on site.

Pan-European goods consumption

Shoppers purchased more than 25m European items from home, electronics and beauty categories during the sales event. More than 60% of Dyson Airwrap products contributed to the volume of transactions, with Sephora sales saw 3.5 times higher uplift, and German brands including Hansgrohe and Grohe made 220% more sales than during the Singles Day 2017.

“After more than a decade of building out technology and infrastructure for our own retail business, we will spend the next decade extending our capabilities to enable and empower both online and offline retail innovator. We see the future of retail as one without boundaries, and we are working to bring consumers true boundaryless retail, where they can buy whatever they want, whenever and wherever they want it.”

– Dr. Jianwen Liao, chief strategy officer at JD.com

JD.com and Alibaba aim for Europe expansion plans

This follows JD.com’s recent announcement at the China International Import Expo 2018 to purchase €13bn (£11.4bn) of imported goods.

Earlier this year, JD.com’s chief executive officer Richard Liu confirmed the retailer’s plans to tap into European consumers:

“By the end of this year, we will launch a concrete strategy for tapping the European market. For me, it’s no longer just about selling products from Germany in China. I would also like to sell products in Europe. I want to sell different products – even local products.”

– Richard Liu, CEO JD.com

Alibaba have also said during the event, that they aim to help global businesses sell $200bn (£156.3bn) of goods in China in the next five years.

As it appears, JD.com and Alibaba want to become bigger in Europe as they’re already investing in logistics and offline retail to move beyond their homeland in China and Southeast Asia to establish a presence in other markets that present more financial opportunities. It is also evident that pan-European goods are seeing a good selling rate, which presents a good likelihood for Chinese retailers accomplishes their expansion plans.

Meanwhile, Amazon is expanding in China

Earlier this year, Amazon have announced the opening of their third ecommerce park in Ningbo, China as part of thier global selling initiative. The marketplace says that the location is built specifically for a localised cross-border ecommerce export industry to support merchants expand their business.

Amazon also will set up a support team to gain an understanding of the regional market demand to create localised services. But, will this present a competitive advantage for Amazon aiming to be the marketplace of choice for Chinese consumers?