Despite its slowing economy, China is poised to become the world’s top retail market in 2019, displacing the US. China’s retail sales this year will surpass that of the US by more than $100 billion, according to eMarketer’s latest worldwide retail and ecommerce forecast.

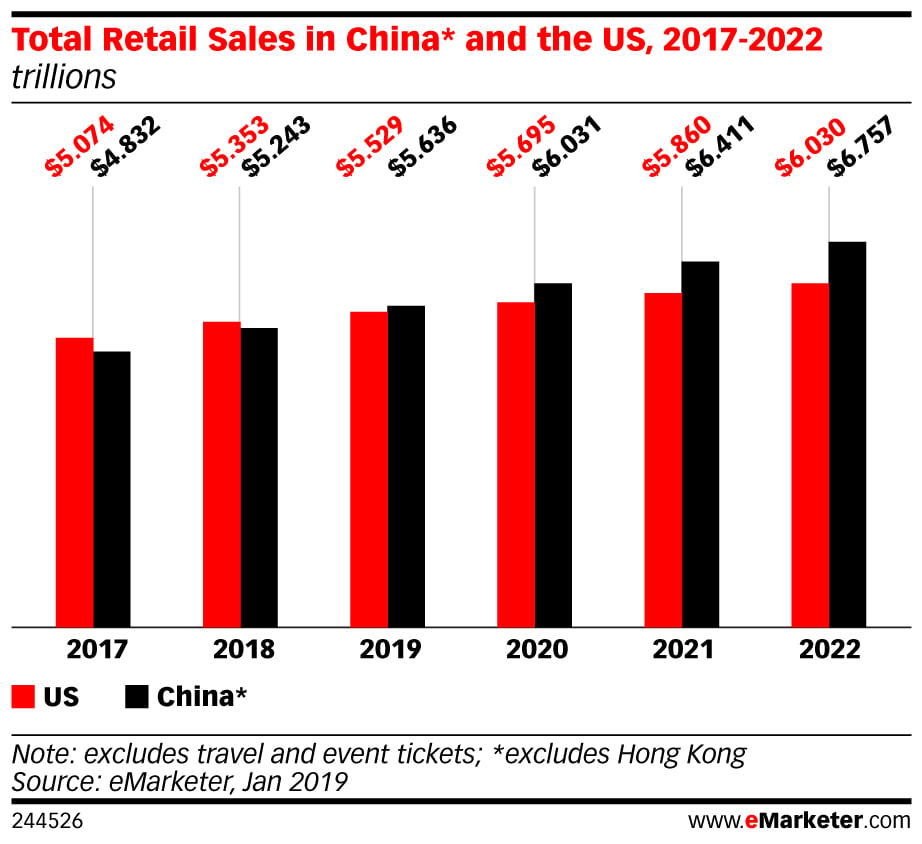

This year, China’s total retail sales will grow 7.5% to reach $5.636 trillion. For comparison, US retail sales will grow 3.3% to reach $5.529 trillion. Growth rates are slowing for both countries, but China’s growth rate will exceed that of the US through 2022.

“In recent years, consumers in China have experienced rising incomes, catapulting millions into the new middle class. The result has been marked rise in purchasing power and average spending per person.”

– Monica Peart, senior forecasting director, eMarketer

Ecommerce is a major driver of China’s retail economy, with sales growing more than 30% in 2019 to reach $1.989 trillion. That means 35.3% of China’s retail sales occur online, by far the highest rate in the world. The US lags far behind, with ecommerce on track to represent 10.9% of its retail sales. China surpassed the US in ecommerce sales in 2013.

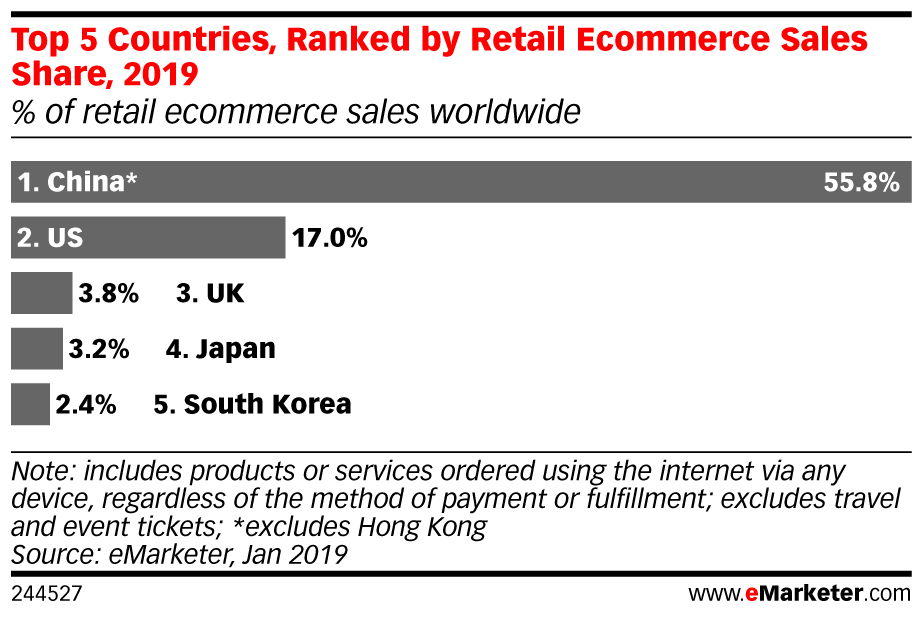

By the end of this year, China will have 55.8% of all online retail sales globally, with that figure expected to exceed 63% by 2022. The US’s share of the global ecommerce market is expected to drop to 15% by 2022.

Alibaba will lead ecommerce sales in China with a 53.3% share (see attachment for company break-outs). Its share has been steadily declining for the past several years, as smaller players chip away at the ecommerce giant’s dominance. In particular, social commerce platform Pinduoduo has seen triple-digit growth since 2016, although its share remains small.

“Relative newcomers and multichannel retailers continue to take share from giants Alibaba and JD.com. The mature players set their sights on further international expansion. Smaller local players are finding their niche in the Chinese ecommerce market by integrating WeChat and using online-to-offline data to better target consumers.”

– Monica Peart, senior forecasting director, eMarketer

One Response

How much is exported thou, Id say tons and tons sells on platforms, where the Chinese are clearly dominant.