Merkle has released its Q4 2018 Digital Marketing Report (DMR). This comprehensive report analyzes trends across paid search, organic search, social, display, and Amazon Ads. It also provides insights into the performance of major industry players such as Google, Facebook, Amazon, Bing, Yahoo, and Instagram.

Top takeaways from the report include Google Shopping ads growth of 42% Y/Y in Q4 2018, the highest growth rate for Shopping investment since mid-2016. On the flip side, text ad spending fell 9% Y/Y, following three quarters of single-digit growth. For retailers, Google Shopping ads accounted for 63% of all Google search ad clicks, an all-time high.

Facebook spend, excluding Instagram, slowed by 10% Y/Y, driven not by headlines or advertiser pull-back, but platform maturation. Instagram saw a 138% increase in spend Y/Y for the quarter, thanks in part to the strong adoption of Instagram Stories.

Amazon Advertising Trends

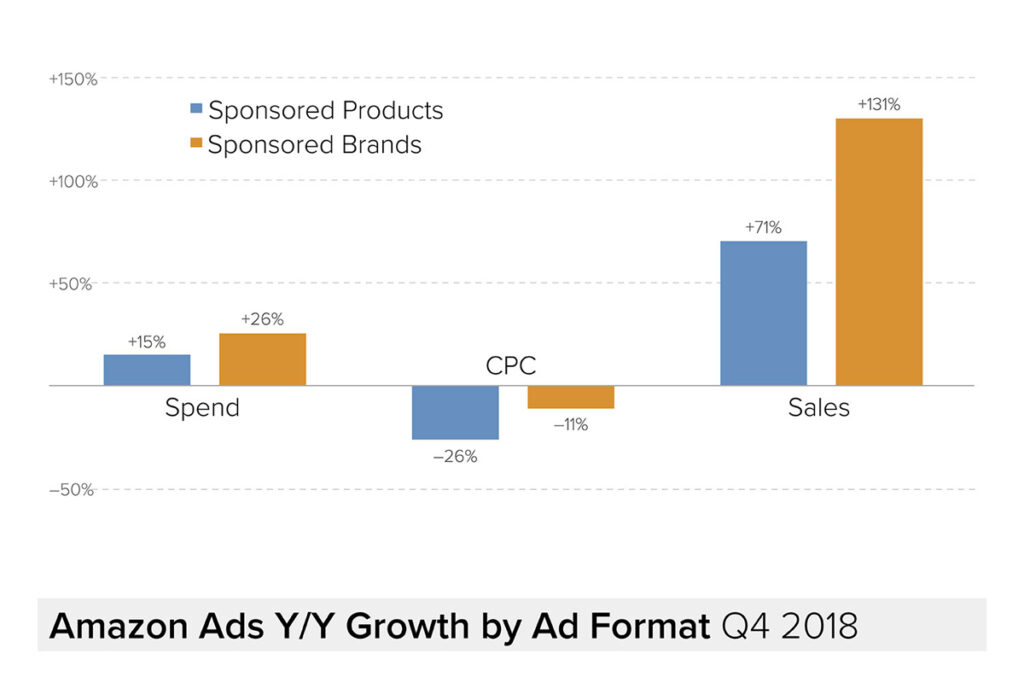

Amazon Sponsored Products and Sponsored Brands spend growth slowed from previous quarters to 15% and 26% Y/Y, respectively, but the sales revenue produced by both formats skyrocketed as advertisers continued to make campaign optimizations to maximize their return.

Amazon Sponsored Products spend grew 15% Y/Y, while Sponsored Brands (formerly known as Headline Search Ads) grew 26%. Sponsored Products accounted for 87% of all Amazon ad spend in Q4.

Brand keywords accounted for 64% of Sponsored Brands sales and 47% of Sponsored Products sales in Q4, slight increases from Q3. With an influx of impressions on Sponsored Brands driving CTR for the format down, both Sponsored Products and Sponsored Brands have significantly lower CTR than that of Google Shopping.

“Coming off of a very healthy holiday shopping season for retailers, our Digital Marketing Report sheds light on digital marketing strategies and how they are shifting to suit consumer shopping habits. Google Shopping ads are gaining in popularity and Amazon continues its steady growth. Advertising on Facebook is declining as the company is looking to grow its other social media properties like Instagram and engage with new users and younger generations.”

– Erin Hutchinson, senior vice president of marketing, Merkle

For Bing Ads and Yahoo Gemini paid search, spending across the two platforms fell 7% Y/Y overall. Bing faced much stronger comparables a year ago, due to a major ramp in traffic for Bing Product Ads in Q4 2017.

Following the recent partnership announcement from Microsoft and Verizon that Bing Ads will become the exclusive search ad provider for Yahoo, the future looks brighter for Bing. This partnership will include the sunsetting of Yahoo Gemini, which produced 1% of search ad clicks in Q4 2018. Yahoo will also cease running Google Shopping Ads, which it has relied on since early 2016.

To provide additional detail on the research findings, Merkle is hosting a complimentary webinar on Thursday, January 31, at 2 p.m. ET.