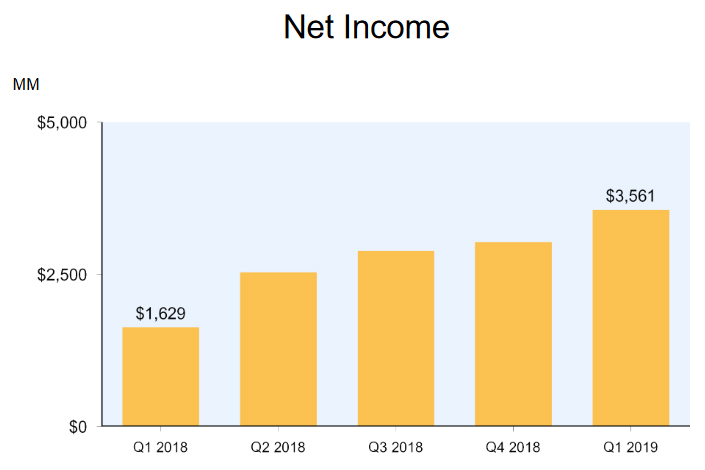

Amazon saw a slowing in growth across all their business units in the first quarter of 2019 but we still saw Amazon’s $3.6 billion profit which is a record. It’s worth looking into how this came about and it’s largely due to their cost base not growing at the same pace as sales in the quarter.

Contributing factors to Amazon’s $3.6 billion profit

Reduced fulfillment investment

Amazon’s fulfillment capacity, which have been growing over 30% a year in 2016 and 2017, dropped to 15% last year. Amazon didn’t put a lot of new fulfillment center capacity or infrastructure into place at least compared to Q1 of last year. Amazon expect to spend around $800 million in Q2 as they start drive Prime delivery times down from two-day to one-day.

Slower headcount growth

Headcount growth was 48% in 2016, 38% if you exclude Whole Foods and Souq acquisitions in 2017. That dropped to 14% last year. Hiring was moderate – down to 12% on a trailing 12-month basis.

Leases

Financial leases for infrastructure, which are good proxy for capital investment and infrastructure, after growing 69% in 2017, grew 10%.

Hitting revenue target

Amazon also hit the high-end of the revenue range ($56 billion and $60 billion sales) with sales of $59.7 billion, which is always good from an efficiency standpoint and the drop-through on the higher end of the revenue.

Overall lower cost base

All of those trailing 12-month metrics actually stayed the same or slightly declined in Q1 giving Amazon continued efficiency but the expectation is that those growth rates to be higher for all of 2019. Most of the investment will happen in the next three quarters and this is reflected into the Q2 guidance – expected sales of $59.5 billion and $63.5 billion, or for Amazon to grow between 13% and 20% with an operating income between $2.6 billion and $3.6 billion, compared with $3.0 billion in second quarter of 2018.

Finally, Q2 is a time when Amazon grant Restricted Stock Units to employees. Amazon traditionally see a step-up in stock-based compensation expense in Q2 and expect to see the same this year.

All of these factors led to a Q1 with reduced spend and sales towards high end of expectations and that’s how Amazon’s $3.6 billion profit was achieved.