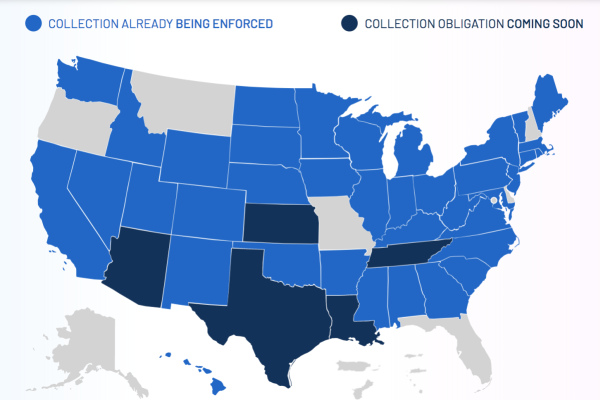

eBay say the US sales tax is too onerous for small businesses due to its short timeframes for businesses to begin the tax collection. In some cases, sellers have as little as 2 months to comply in the multiple US states.

“In 2019, eBay has tracked marketplace legislation in 37 states, including several states which had previously enacted marketplace laws. The legislation has taken different forms and, in some cases, established very expedited timeframes for businesses to begin the collection. For example, New York recently enacted legislation giving marketplace facilitators less than two months to begin collecting and remitting tax, lending to potential compliance challenges for businesses.”

– eBay Main Street

However, eBay promises to work with lawmakers to promote workable tax policies which would provide reasonable small business protections.

“As states continue their efforts to establish marketplace collection requirements, eBay will work with lawmakers to promote workable tax policies which provide reasonable small business protections and streamline collecting and remitting standards across the states to avoid confusion, mistakes, and costly penalties.”

– eBay Main Street

This issue isn’t going to go away and its a lot of work for small-to-medium sized businesses so keep an eye out for this law to avoid any penalties associated with the new regulation.