Chris from Chris Turton Ecommerce is an ecommerce and marketplace consultant passionate about understanding how online businesses tick. He writes from experience and tries to answer questions from sellers to improve and share his knowledge. Today, Chris shares his experience of pricing by performance to maximise margins.

Chris from Chris Turton Ecommerce is an ecommerce and marketplace consultant passionate about understanding how online businesses tick. He writes from experience and tries to answer questions from sellers to improve and share his knowledge. Today, Chris shares his experience of pricing by performance to maximise margins.

Pricing by Performance

So, your competitor is beating you on price, your immediate reaction is to match or even undercut them. That may not always be the best strategy and Pricing by performance is a better strategy

A common practise with marketplaces is to achieve sales velocity and position by being the cheapest in the results page and this is where the faithful repricer tool makes its appearance. This is not always the best strategy; Countless SKUs have shown that on eBay, products with the best match rank are ones which return the best for eBay. Many opinions by marketplace experts show that eBays’ “Cassini” and search ranking algorithm include product and buyer feedback, shipping, historical sales volume and conversion rate.

This structure is also the same in Amazon and other marketplaces. Price is one of the highest factors for acquiring the buy box on Amazon but is not the only one. The buy box does rotate on many items. expert opinions agree that shipping methods such as FBA (fulfilment by Amazon) or SFP (Seller fulfilled prime), seller rating and shipping time have a major influence on ranking.

One of my clients has a product that has sold over 2,000 units in the last 12 months and is 25% more expensive than competitive identical SKUs – some from bigger retailers, yet its sales velocity and rank remain extremely strong and within the parameters of what we want to achieve.

Being cheaper is not always the best strategy!

So, what is pricing by performance?

Essentially, It’s the principle of pricing your products in relation to how they sell in a single marketplace. If your product sells 5 a week for a few weeks and then starts selling 20 a week consistently and you don’t adjust your price, your losing out on margin and overworking your team and supply chain.

On the flip side, if your products performance is not optimal and your stock value is high, you can quickly analyse if a products margin requires dropping.

It helps you quickly see if a competitor runs out of stock or stops selling a line.

Pricing by performance assists with stock planning and forecasting. It gives a clear snapshot of good and poor product performance.

Repricing tools are a great idea for certain products and to improve sales, they are superb for new items and poor performing products, where your key goal is to shift dead or slow-moving stock.

Repricing tools work typically on machine-based rules and tend to focus on the “race to the bottom”. Repricing technology also means that they are stronger in performance on Amazon as multiple prices fall under the same ASIN, but as there can be 1000’s of identical products on eBay, only a small handful of tools such as Streetpricer can analyse AI image definitions.

How to price by performance

Review your products sales by week over a period of 8 to 12 weeks, look for recent sustained increases or decreases to make pricing decisions, do not make knee jerk decisions based on performance over a one week, sales performance can fluctuate based on many factors including competitors being out of stock or seasonal changes, I only review price changes once every 2 to 3 weeks.

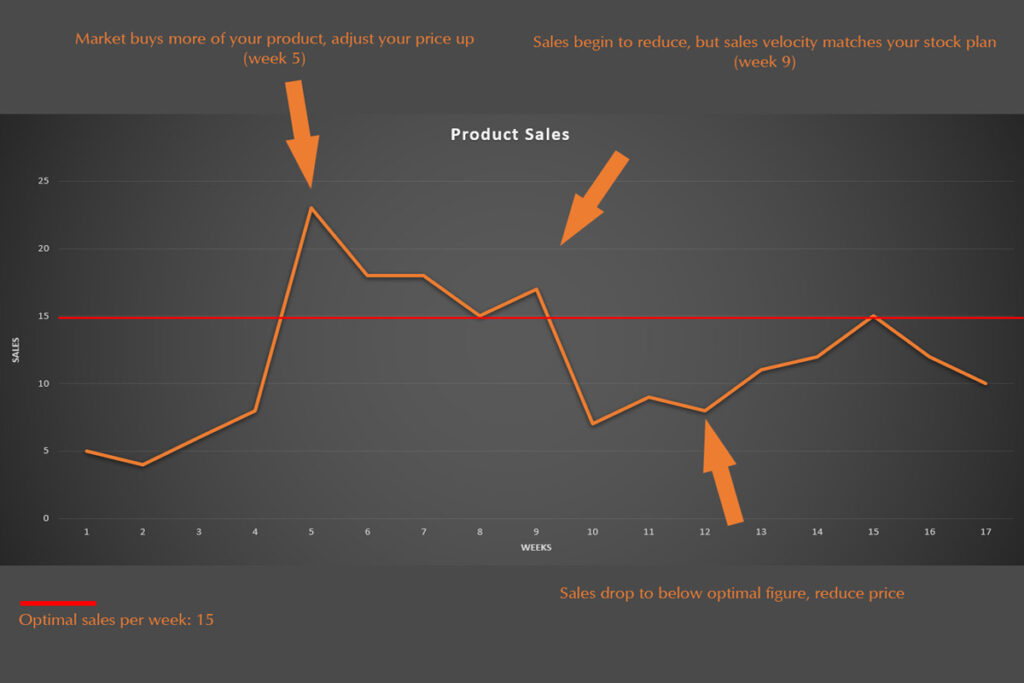

Here is an example showing the 4 months of a products performance. The red line shows that your supply chain is forecasting 15 sales per week. Your pricing strategy is to get to that red line as closely as possible.

Only make small pricing changes. Large adjustments are likely to trigger changes in best match on eBay.

If you can’t clear margin on a product and your competitors are still selling cheaper than you – reassess the product altogether with your supply team or get rid of it from your marketplace offerings!

3 Responses

Been doing this for years…. however on the likes of ebay, often price is king. Wtih either the Chinese or the mega discounters selling things at stupidly low prices.

What we have noticed though that seems to go against this, is the sponsered listinsg on ebay… if you are top then the price seesm not to matter. See things selling loads at £15 when the very next listing is only £10 and hardly sold any…. yet listings almost identical! I’m guessing in my trade it is very item dependant.

The SFP on Amazon is now defunct we were selling at a price matching our rivals and they and us were both offering free shipping we could just hang on in there. suddenly the 2 day option has gone and so every SFP purchase is now 24 next day so we cannot match that so Amazons great idea is to send us an email in the morning saying your slow selling products try lowering the price Haha!

then the next message said if you are unabvle to offer the nextday shipping increase your pricing to include the extra cost Haha!

so now we are alongside our rivals at the following.

we were all

£20 plus free shipping.

we then joined Prime in a bid to increase sales and it slightly did at £20 Prime.

Now the items are rivals £20 free shipping. and ours is £21 Prime so prime customers on Amazon are now moaning things are more expensive to them. plus our sales have dropped again.

So the only answer will be back to £20 free shipping without Prime.

What a mess.

Prices on eBay are a race to the bottom because that’s what they push and what they propose themselves to be. They’ve done it to themselves over the years and it’s getting worse. Many associate eBay with being “cheap junk” and that’s the reputation they’ve gotten. Another major factor in this is seller desperation. No visibility and no sales forces sellers to lower prices even more to have a chance to sell anything. Buyers and sales on eBay are in decline. Don’t believe any buyer and sales numbers that eBay presents because it’s likely to be fabricated. You know, eBay needs to show themselves as being competitive so they present numbers that they need to Wall Street and shareholders. This company is operated like Enron. All smokescreens and lies.