Yesterday I heard a comment regarding the eBay Q3 2019 results pretty much slating eBay for mentioning foreign exchange and sales taxes and suggesting it was unlikely that Amazon would use the same excuses today. Well hold on to your seats because Amazon’s Amazon Q3 2019 results disappointed investors and one of their reasons was a $500 million unfavourable impact due to foreign exchange rates plus for the future they’re facing increased scrutiny from regulators. In truth however, that’s a footnote and the real upset was in the other numbers.

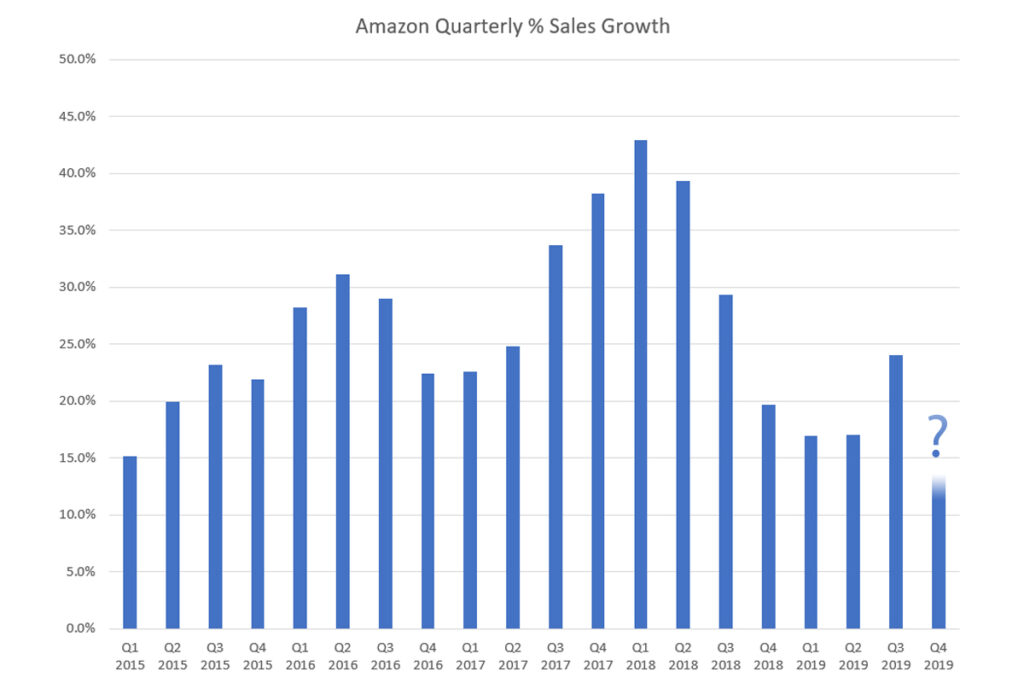

What disappointed investors and drove their stock down about 9% in after hours trading wasn’t performance but forecasts. Net income decreased to $2.1 billion in Q3 2019 compared with net income of $2.9 billion in Q3 2018. EPS was at $4.23, about 40 cents below what investors were anticipating and again less than the $5.75 in Q3 2018. But the really bad news is Amazon’s guidance for the fourth quarter (which includes the Black Friday week and Christmas) of between $80.0 billion and $86.5 billion, or to grow between 11% and 20% compared to Q4 2018 and that’s well below the $87.4 investors wanted to see.

Now the good news, Amazon Q3 2019 sales were up 24% to $70.0 Billion, right at the top of their Q3 guidance. There aren’t many companies the size of Amazon that are growing at 24% and so it’s not really a surprise that their forecast for Q4 2019 is subdued in comparison although if they come in at their lower 11% that would be a shocker. However it should also be a concern for online retailers across the board that Amazon are anticipating subdued sales over the Christmas period – If Amazon aren’t expecting bumper sales then maybe we should all start worrying!

The problem at Amazon is they are investing like mad – they spent around $800 million on shipping in Q2 as they migrate from two-day shipping to one-day shipping in the US but in Q4 the cost is likely to explode to $1.5 billion. Investors have in the past typically been happy to see Amazon investing so long as they also saw stellar growth. The growth was there this quarter even though they bombed on other metrics and that coupled with a subdued growth outlook for Christmas hasn’t pleased.

One Response

classic case of diminishing returns in a maturing business?

nothing that would surprise 18th/19th century economists.