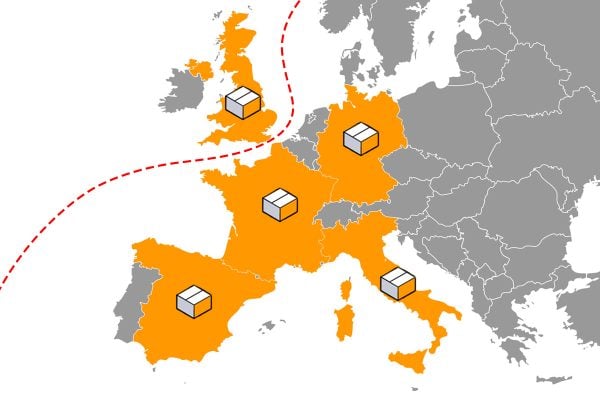

With some form of Brexit potentially on the horizon and even discussions of a deal introducing volatility to the pound, moneycorp’s Trevor Charnley discusses how you can protect your profits when selling overseas. For instance, if you decide to locate a large inventory in the EU you might want to fix the exchange rate to give certainty of the funds you’ll receive when the goods are sold

With some form of Brexit potentially on the horizon and even discussions of a deal introducing volatility to the pound, moneycorp’s Trevor Charnley discusses how you can protect your profits when selling overseas. For instance, if you decide to locate a large inventory in the EU you might want to fix the exchange rate to give certainty of the funds you’ll receive when the goods are sold

As an online seller, we understand your priorities are maximising your revenue and minimising your costs, as it is with any sustainable business. We also recognise that as part of an international community of e-commerce professionals, these profits are extremely susceptible to fluctuating exchange rates. An unfavourable exchange rate movement, whether due to political or economic developments, can take large cuts out of your profit margins in a matter of minutes.

An example of this movement is the volatility that GBP has faced over the last three years of Brexit uncertainty. With the pound lower against the euro and dollar than it was before the 2016 Referendum, the exchange rate you receive and methods you use to protect against further movements as an online sellers can make a huge difference to your business.

Fortunately, you are able to protect your cash flow and profits against currency movements. This can be done by utilising a range of FX tools such as forward contracts (which may require a deposit), in a process known as ‘hedging’.

Hedging acts as a safety net and works to protect a currency pair against an unfavourable shift in the exchange rate. There are a wide range of methods available to hedge your currency and, depending on your individual circumstances, one strategy may be more appropriate than another.

Using a forward contract to hedge currency allows you to lock in a prevailing exchange rate for up to two years. You can then convert your currency with us at a later date and receive your locked-in rate. This can be very beneficial, defending your overseas profit from damaging exchange rates if your forward contract rate is more favourable than the market rate at the time you make your payment. For example, if you were to have secured a forward contract prior to the 2016 Referendum, you could have enjoyed a preferable rate even after GBP/EUR and GBP/USD had fallen in the wake of the result.

Furthermore, by hedging the currency risk, you can guarantee your future cash flow, providing you with peace of mind and reducing the costs that can accompany variable cash flows. With Brexit uncertainty reaching new heights, it is now more essential than ever to hedge any risk you may be exposed to from volatile exchange rates. Just because the markets are uncertain about the future, doesn’t mean you have to be.

We are here to help. We hedge GBP/USD and GBP/EUR as well as over 30 other currency pairings for our community of online sellers who use a number of major online marketplaces such as Amazon, Rakuten, eBay and Etsy. The below diagram illustrates the simplicity and convenience of our online sellers account, detailing the journey in which you can transfer your profits back to your domestic bank account. We provide you with a EUR IBAN number or USD ABA Routing Number to avoid the extortionate fees and margins that most marketplaces charge to convert your foreign earnings.

We offer great rates, low fees and a generous FX margin for Tamebay customers to help you get to the most out of your money and navigate a volatile currency market in the build-up to Brexit. Combining this benefit with our hedging service we can help you secure your revenue, maximise its value in domestic currency and reduce your overall costs to generate more profit.

Find out more about our online sellers accounts, view our guide on how to sell on international marketplaces or contact us for help identifying the most effective strategy for you to limit your currency exposure and maximise your profits.

2 Responses

Most companies on here I hate.

Moneycorp, however, is a great company and offers good services and margins. But the number of articles here shows a drop in volumes no doubt caused by the fall in the £ and the complete carnage of Chinese sellers dominating eccommerce in the UK.

HMRC need to short it out, but no where to be seen.

Nice change of pace to see a company on here offer realistic solutions for online sellers of all sizes which focuses on reducing costs in a practical way and not just increasing revenue in the long run by investing more in the short run.