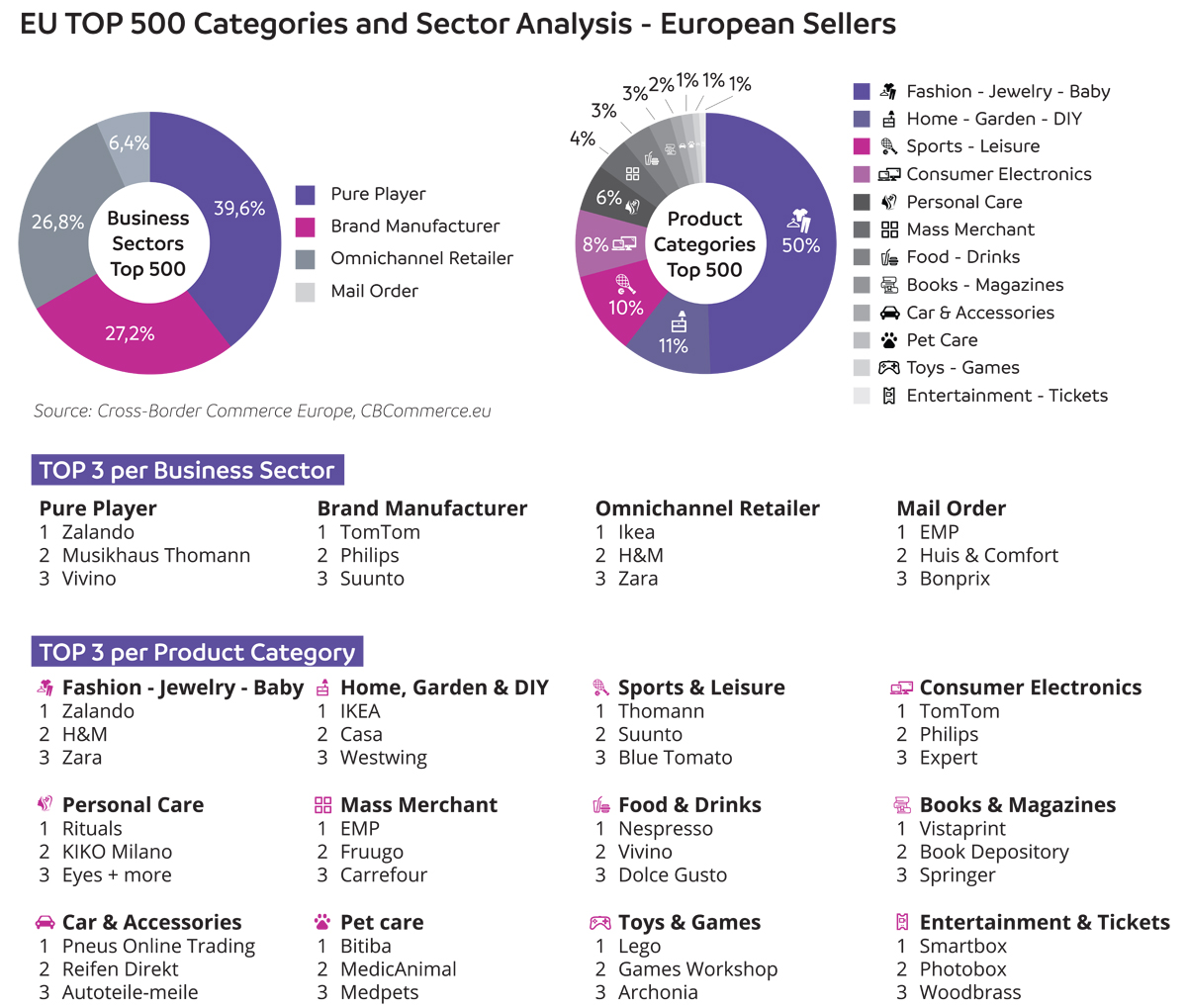

Cross-Border Commerce Europe have published a new study revealing European retailers’ Top 500 Categories and Sectors. This shows that the ‘fashion / jewellery / baby’ category is the big winner, with the best business sector ‘Pure Players’ taking the major share of the cake.

This study of European Cross-Border online retail reveals the Top 3 rankings for 4 business sectors: Pure Players, Brand Manufacturers, Retailers and Mail Order Companies. It also contains the Top 3 rankings for the following 12 product categories: Fashion / Jewellery / Baby – Home / Garden / DIY – Sports / Leisure – Consumer electronics – Personal Care – Mass Merchant – Food / Drinks – Books / Magazines – Car & Accessories – Pet Care – Toys & Games – Entertainment / Tickets

The study gives an overview of consumer preferences for their Cross-Border online purchases and gives the ‘Fashion Pure Players’ as winners, with the following scores:

– Top 1 : Zalando (Germany)

– Top 2 : Asos (UK)

– Top 3 : Farfetch (UK)

– Top 4 : Chronext (Switzerland)

– Top 5 : Nelly (Sweden)

– Top 6 : Spreadshirt (Germany)

– Top 7 : MyTheresa (Germany)

– Top 8 : Mona Mode (Germany)

– Top 9 : Vestiaire Collective (Germany)

– Top 10 : Yoox (Italy)

Ranking per sector

The first sector, Pure Players – selling only via the internet, represents 39.6% or 198 of the 500 largest Cross-Border European online stores. The Top 3 in this sector consists of Zalando, Musikhaus Thomann and Vivino.

The second sector is represented by the Brand Manufacturers, with 136 companies, representing 27.2% of the total. The Top 3 in this sector consists of TomTom, Philips and Suunto.

The third sector comprises Retailers with 134 Cross-Border online stores that make up 26.8% of the total. The Top 3 in this retailers sector includes Ikea, H&M and Zara.

The smallest sector, Mail Order companies, comprises 32 online stores, or 6.4% of the total, with Top 3 EMP Large, Huis & Comfort and Bonprix as the most important store of the OTTO group.

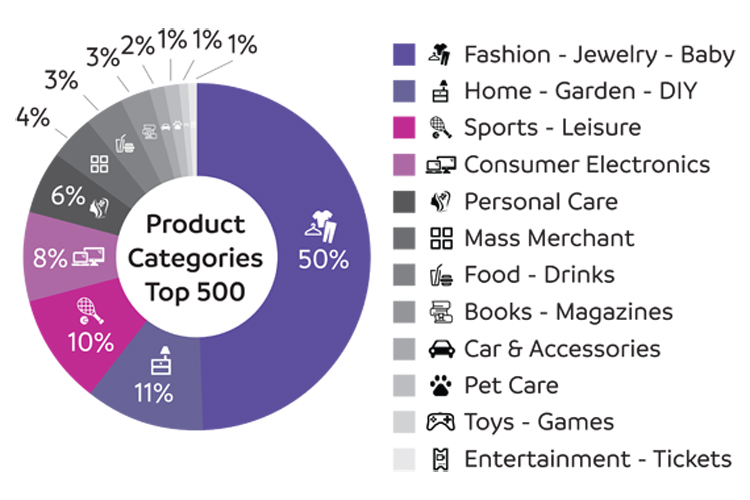

Top 500 Categories by product

The first category is Fashion / Jewellery / Baby, which represents 50%, or 250 online stores that are among the TOP 500 of the best Cross-Border Europeans. This Top 3 consists of Zalando, H&M and Zara.

The second category is Home / Garden / DIY, with 55 online stores and 11% of the TOP 500 with Top 3 Ikea, Casa and Westwing.

The third category, Sports / Leisure, accounts for 10% of the total with 50 online stores and the Top 3 are Thomann, Suunto and Blue Tomato.

Finally, the fourth category, Consumer Electronics represents 8% of this TOP 500 European Retail with 40 online stores and Top 3 TomTom, Philips and Expert.

The ‘Pure Players’ from the fashion category are the leaders in all sectors and categories.

From the 198 ‘Pure Players’, 55 are in the Fashion / Jewellery / Baby category. Amazon USA has a 26.9% market share in fashion ecommerce, while Amazon in Europe ‘only’ has a share of 8%, and competes closely with the Top 1 Cross-Border European Marketplace Zalando. The fragmented fashion sector is an obstacle for Amazon that is confronted with the strong online presence of Germany’s Otto, UK’s Next and Marketplace Asos, as well as France’s Veepee and La Redoute. And starting 2020, the Dutch company Bol.com will also start focusing on the fashion sector.

Zalando expects an 11.5% online fashion market share by 2025 (currently 7.9%), as well as a 2.8% share of the total fashion sector (today 1.2%): Cross-Border sales now represent 71% of Zalando’s total sales and will rise above 80% in the coming 3 years.

Space for growth for the European Cross-Border sellers – by 2025, ecommerce will represent more than 25% of fashion retail for the following reasons:

- The penetration rate of online fashion is approximately twice that of the total retail trade. A prediction shows that ecommerce accounts for more than 24% of total fashion sales, compared to 18.5% of total retail sales in 2025. Today, the fashion market share in ecommerce is 15%.

- More consumers are buying fashion Cross-Border online. 58% percent of online consumers made a purchase in 2018 – about half of these shoppers in the fashion category. Online fashion buyers are expected to realize 113 billion euros in revenue by 2025 (currently 68 billion euros), making it the largest category of online buyers.

- The rise of Cross-Border Marketplaces and Artificial Intelligence in fashion continues. Online Marketplaces such as Asos, Farfetch and Zalando are important influencers in the purchasing process of a fashion shopper. Shoppers spend more time on Marketplaces to discover and research products, giving retailers insights into buyers’ purchasing decisions. With Artificial Intelligence and other tools, retailers can leverage this wealth of consumer data for responsive design and better recommendations for products and formats. This allows Marketplaces to launch private-label fashion brands for entry-level customers.