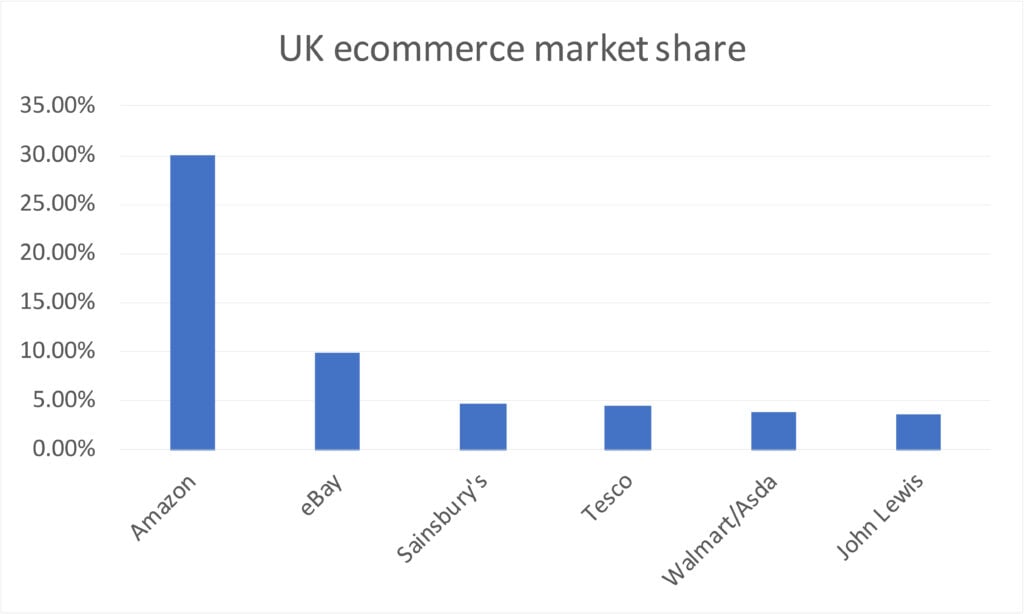

Amazon have raised their UK ecommerce market share from 28.8% in 2018 to 30.1% in 2019 Edge by Ascential announce. Amazon find themselves triumphantly leading ecommerce in the UK and have seen a staggering $30bn in sales this year.

The data released shows just how ahead Amazon are with eBay coming in second (9.8%) followed by Sainsburys (4.6%), Tesco (4.5%), Walmart/Asda (3.9%) and John Lewis (3.6%).

The UK are currently the third largest ecommerce market globally behind China and the US.

Edge by Ascential’s Trends for 2020

- The demand for speed and convenience is high and continues to grow. Sellers will focus more on this demand and ensure supply chains & delivery services support them through improved, reliable and efficient service.

- Brexit will disrupt trade across borders and even though uncertain, brands and retailers will need to keep an eye out for future delays, tariffs and regulations.

- Omnichannel shopping will continue to rise and grocery will be one of the main contenders in this growth through its huge potential. Online marketplaces will need to develop clear strategies and keep a close eye on data to keep up with the changes heading our way in 2020.

“The UK ecommerce market is the third largest in the world, and the largest in Europe, and with increasing connectivity coupled with growing consumer demand for convenience, UK retailers are under serious pressure to revolutionise their omnichannel experience in 2020.

“This is all the more crucial as pure-play online platforms such as Amazon and eBay continue to expand and dominate in the UK market, driving third party operations that give greater control to brands selling on the platform but open up fierce competition and require care and attention from those selling in the marketplace.

“Finding the right balance between a sophisticated online offering and an engaging in-store presence is a key aspect to sustaining success.

“However, it’s important that retailers focus on their entire offering across the supply chain in order to meet the needs of consumers, whilst preparing in advance for impending challenges like Brexit along the way.”

– Nick Everitt, Director of Advisory EMEA, Edge by Ascential

10 Responses

No surprises there, but it’s interesting how online sales of groceries in future will maybe change the leaderboard. The grocery market in the UK is just below the £200B mark, which means there’s TONS of potential in growth for online sales in that sector.

Even though Amazon is trying, I don’t think they will take the leader position in grocery shopping – traditional grocery stores (Tesco etc.), has a much better chance of winning that battle and I think they will. Imagine, just 25% of that pie equals to 50 BILLION pounds of annual sales, which is more than the current eCommerce market in the UK altogether!

“Grocery will be one of the main contenders in this growth through its huge potential”.

I have been working PT driving for Sainsburys for over a year for extra cash. For such a growing part of the business it seems to get ignored a lot of the time.

There will be over 200 staff in there this afternoon, and in the online Dept there will be a whooping 2 Drivers myself and another lad (for night-shift) who will sort our loads out ourselves as normal and just get on with it, zero support…and this is the growing bit of Sainsburys.

You get sent out with the LORRY sat NAV which is lucky if you find 50% of the drops with (we end up buying our own kit for a easy life)..

You can go days not seeing any sort of manager ( who have zero idea about what happens on the road anyway) and there are loads of them on the shop floor, we are virtually the odd bods out the back…sometimes is seems so disorganised and overlooked (and Sainsburys is the best at this), Speaking to ASDA Tescos drivers they all have the same issues, and Waitrose is a complete shocker.

Thing is Amazon will want this market as that online grocery shop will be done every week without fail and constant income.

The Supermarkets actually have the head start here but I expect they will be complacent and Amazon will pick up Morrisons probably and dominate that market also, and it will be done with race to the bottom tactics, zero hours drivers and staff etc and pricewars as normal.

What surprises me is that Ebay is still 1/3 the size of Amazon, as I have sold professionally on Ebay now for 10 years and sold on both for around 9 years, Amazon became my biggest market place place within a year of this by 2012 and my sales on Ebay UK haven’t been 1/3 the size of my Amazon sales since some point in 2015 (not even counting sales on other Amazon’s just UK marketplace). However I guess those ebay sale values includes second hand clothes, cars, car parts, rare collectables etc etc and anything else that people wish to clear out along with stuff sold by professional sellers. Which is kind of know how I view Ebay as a online car boot sale. Where as I sell New Cosmetics. I guess what I’m saying is maybe I should try alittle harder on Ebay as my focus is and has been on Amazon for long time.

£5 billion in VAT payments, not a bad start. (I know Inputs less Outputs does not give £5bn)

How about if e-commerce business’s with a UK turnover of over £2m had to pay the UK median high street rates on either their, or 3rd Party warehouses used instead of warehouse rates? This would then provide a more level playing field.

Amazon claimed their turnover in the UK to be £10.40billion so is your quoted £30billion worldwide? Apples and pears ??

Amazon sales were £10.4 billion in the UK last year, so your quoted £30 billion I assume is worldwide?

Hey Andrew! Great to see a familiar face here.

Anyway, UK marketplace is certainly something we considered and put effort into. So far our performance is not as great as we want it to be. That said, we’re still going for it. We need to change a few things, optimize here and there and see how successful UK sellers are doing it.