Insurance is one of life’s necessary evils. A bit on the tedious side? Yes. Something you’d rather not spend money on? Certainly. But also vital for protecting your business.

That being the case, we figure buying the right cover at a fair price is something you’d rather get over and done with as quickly and painlessly as possible.

That being the case, we figure buying the right cover at a fair price is something you’d rather get over and done with as quickly and painlessly as possible.

That’s where PolicyBee comes in. They’re business insurance specialists with a customised package for online retailers. What’s more, they’re digital, so you can buy a tailored policy online in a few quick clicks.

We spoke to Kerri-Ann Hockley, Head of Customer Service at PolicyBee, to find out more:

Who is PolicyBee?

We’re an independent online insurance broker specialising in cover for small businesses and sole traders like online retailers.

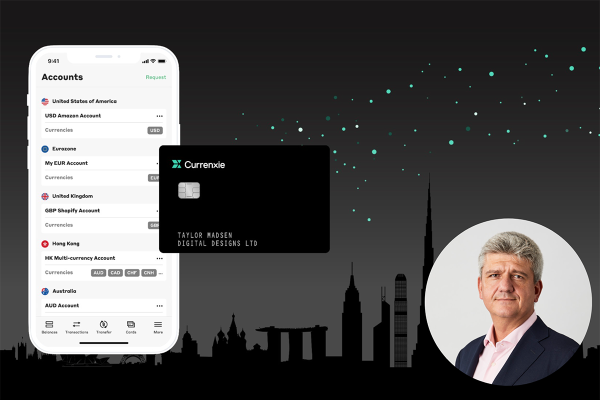

Our chairman Iain Hatfield founded the company because he knew business insurance should and could be done better. So, out went the complicated forms and confusing jargon that makes buying a policy such an effort. And in came a shiny new online quote process that matches customers with the best cover in a few quick clicks.

We still have friendly humans who answer the phone if you call us though. And these days we have around 27,000 customers, so we must be doing something right.

Why do online retailers need insurance?

Because even though your sales are virtual, real things can still go wrong.

Take your stock. What if it’s stolen in a burglary or gets damaged? No stock means no business.

What if something you sell not only fails to earn a good review but actually harms someone? What if a visitor, a courier say, trips on your garden path and is injured?

Harm of any sort, to people or their property, can mean big claims for compensation. Insurance helps deal with these and other threats to your business by covering costs and providing expert help.

What insurance do online retailers need?

Different professions face different risks, so we have an insurance package specifically for online retailers. It protects you from the most typical things that could go wrong.

From £14 a month, you get £100,000 worth of products liability to cover legal costs and compensation if something you sell causes damage to someone or their property. It’s useful if a collapsing chair leaves someone with a back injury or a kitchen gadget bites back.

It covers you for worldwide sales from the UK, although there’s a few products that aren’t eligible, so check what you sell isn’t on the no-go list first. Any new electrical items must be sourced from, manufactured or assembled in the European Union.

Plus, you get £1 million worth of public liability to cover slips, trips and other mishaps that end in injury or damage to your visitors and their property. You’re also covered if you do occasional selling at shows and events.

What other cover is a good idea for online retailers?

Employers’ liability is a legal requirement if anyone works for you. Without it you can be fined £2,500 a day. It pays legal costs and damages if an employee claims they suffered illness or injury because of what they do for you.

Your equipment and stock is the lifeblood of your business. Stock and property insurance pays to replace your business equipment and the things you sell if they’re lost, damaged or stolen.

Floods, fires and other unexpected events can play havoc. If something stops you trading as normal, business interruption covers your lost revenue and pays to set you up elsewhere temporarily.

What makes PolicyBee the best choice?

We’re experts at what we do, and we’re smart enough to know that just because we love all things insurance, not everyone else does.

So we take the pain out of buying a policy. Our online quote process is fast and jargon-free, and gets you the best cover at the best price, with documents sent straight to your inbox. We don’t charge admin fees either.

We’re human too, and we have friendly experts ready to help if you need it. Even better, there’s no call centre and no phone menu to navigate.

But it’s what our customers think that really counts. We figure our excellent Feefo feedback and our Platinum Trusted Service Award speak volumes.

How do I get a quote?

You can get an online quote in just a couple of minutes by clicking here. Or, if you’d prefer to speak to a member of the team, phone 0345 222 5370.

Case Study

So far, so successful.

That’s until an official-looking envelope dropped onto Laura’s doormat, with a letter from a solicitor. Through the legal jargon, Laura learned that a customer had found out the hard way that a bath mat he’d bought was anything but non-slip as advertised.

In fact, the moveable mat had caused an accident that left the man who stepped onto its slippy surface flat on his back with a broken pelvis. Now he wanted compensating for his suffering and the fact he couldn’t do his job as a self-employed plasterer.

Bang to rights, then. So it’s just as well Laura had insurance. It paid for an expert legal brain to negotiate on her behalf and also covered the amount of compensation agreed. So nearly £65,000 in all, making her monthly premium cheap at the price.