In the UK there are almost 5 million self-employed workers – just over 15% of the workforce and until today they hadn’t been included in the Government’s Coronavirus Job Retention Scheme.

Many self-employed workers have seen their income vanish as soon as the Coronavirus crisis started whilst a few have seen their income soar as their services are suddenly in high demand. That, coupled with the fact that income for self-employed workers can fluctuate dramatically throughout the year and from year to year makes determining who needs assistance and how much income they’ve actually lost difficult. And that’s on top of the fact tax returns for self-employed workers are filed up to 18 months in arrears.

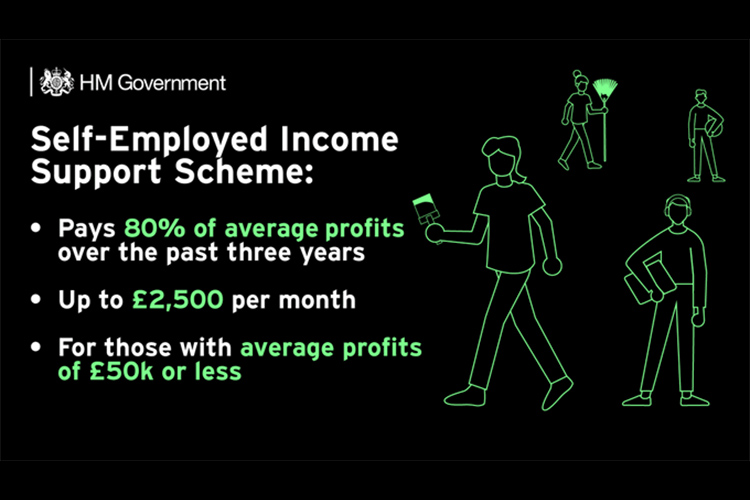

To solve this problem, today Rishi Sunak announced a new Coronavirus self-employed income support scheme in which the Government will cover the loss of your average monthly profits over last three years up to £2,500 a month. This will last for at least three months and you will be allowed to carry on working. The aim is for the entire three month’s payment to be made as a lump sum grant in June.

It will be open for anyone with trading profits of up to £50,000 and only to those who make the majority of their income from self-employment and only those that have a tax return for 2019 (ie you can’t just claim to be self employed today and start claiming). HMRC will contact you directly and pay the grant directly into your bank account and it should be in place and paid by June. If you’re a plonker and didn’t submit your tax return, you have a four week grace period to get it in starting today.

You don’t currently have anything to do – if you are eligible HMRC will be in touch with you when the scheme is up and running.

HMRC is already warning of scams

You will access this scheme only through GOV.UK. If someone texts, calls or emails claiming to be from HMRC, saying that you can claim financial help or are owed a tax refund, and asks you to click on a link or to give information such as your name, credit card or bank details, it is a scam.

– HMRC

6 Responses

Once they have explored every possible alternative, this government will finally do the right thing ?

What concerns me was the comments about the ‘future’ of self employed people in the statement.

I don’t qualify for this “help”. Neither my wife. We both moved to self employment 10 months ago only.

Before we were employees and we contributed approx £60,000 in taxes over last 3 years.

How many more people like us out there???

Mr Sunak’s saying the 5% of non-qualifers are people earning 200k on average. Hmm looks like his Excel formula might be wrong.

Were the dividends utilised for avoid tax (legally).