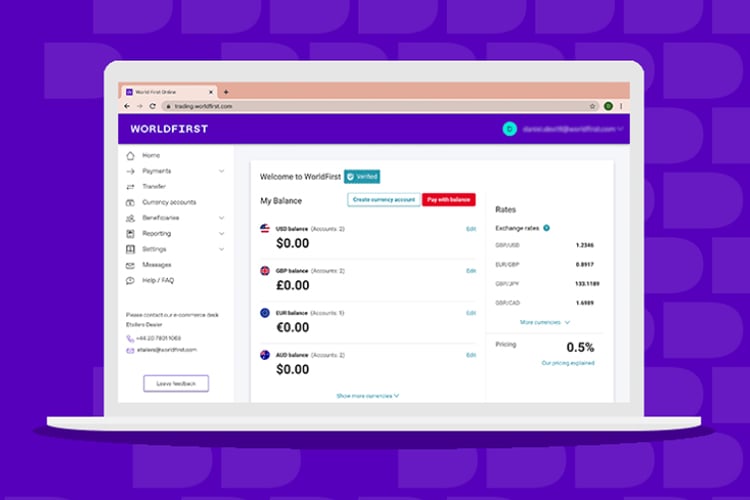

Doing business globally shouldn’t be complicated. Our friends at WorldFirst have launched their new and improved World Account, so you can stay in control of your finances with a real-time overview of your currency account balances, live market movements and your fixed FX transfer fee in one central dashboard.

World Account has been designed to help customers receive international funds with faster and easier cross-currency and same-currency payment capabilities. Free to open and maintain, World Account is the simple way to collect locally, convert, and make payments, anywhere in the world. We asked Theo Sprague at WorldFirst to tell us more:

World Account has been designed to help customers receive international funds with faster and easier cross-currency and same-currency payment capabilities. Free to open and maintain, World Account is the simple way to collect locally, convert, and make payments, anywhere in the world. We asked Theo Sprague at WorldFirst to tell us more:

What is World Account?

Free to open and maintain, the World Account is the simple way to collect, convert, and make payments locally, practically anywhere in the world. Designed with SMEs and online sellers in mind, it enables you to receive international funds, and make same-currency and cross-currency payments faster and easier, giving you more control than ever before.

https://www.youtube.com/watch?v=qC77ZjnX2oE

What are the main benefits of a World Account

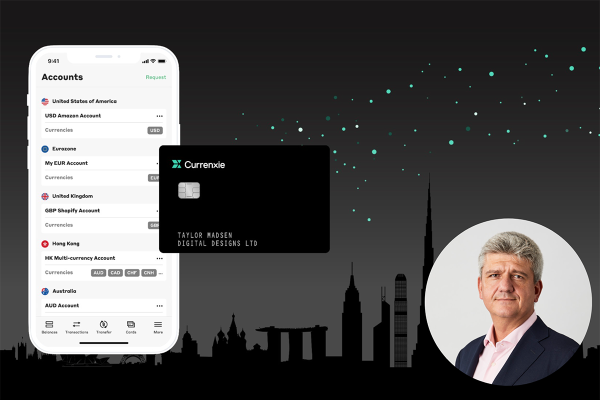

The World Account is a complete solution for your business when selling selling online or via online marketplaces. The World Account offers:

- Free and easy account set up, to start receiving funds internationally with local currency accounts – without the need for local banking relationships

- Free to receive money from marketplaces and payment gateways to your own GBP, USD, EUR, CAD, JPY, AUD, SGD, NZD, HKD & CNH accounts

- Hold funds to pay suppliers, repatriate funds, and make international transfers

- Seamless Xero integration for all your accounting needs

- Transparent pricing from 0.15% to 0.50%

- Dedicated account managers based in the UK to support you with any queries you may have

- Flexible hedging solutions to help mitigate exchange rate risk and secure long-term profit margins with the WorldFirst Corporate Account

Four ways to use your World Account

If your business regularly receives payments in different currencies from overseas payment gateways and marketplaces, or makes payments in different currencies to international suppliers, then the World Account is for you. Examples of when the World Account can assist you include:

- Marketplace sellers

If you sell with online marketplaces such as Amazon, Rakuten, eBay, Newegg or Cdiscount, and want to save on transfer fees repatriating sales proceeds back to your local currency the World Account is for you. What’s more, you can hold currency to pay out to suppliers.

- Online sellers

And it’s not just on marketplaces, if you sell internationally on your own websites and repatriate sales proceeds back to your local currency, the World Account is the simple way to collect, convert, and make payments locally, in key markets around the world.

- Amazon Associates

If you make money from affiliate schemes such as Amazon Associates, earning referral fees from Amazon.com, you can receive payments in your local currency and then bring them home at low fixed rates.

- Importers

If you are looking to send or receive money abroad when sourcing stock, then the World Account is a fast and secure way to send money internationally with low fees — much cheaper than using your regular bank.

Speed up your supply chain with same day availability on 97% of currency pairs actively traded through the platform (cut-off times apply).

What’s new with World Account?

At WorldFirst, it’s not just about the big changes. We continually make small but transformative changes to our products to ensure we are always addressing our customer’s needs. We believe that changes big and small add up. Find out more on how we are leveraging innovation and technology to meet your needs and discover our latest product improvements.

- Faster same-currency and cross-currency payments to speed up your supply chain

- New and improved payment capabilities West to East, including payments into China

- Seamless currency account management

- Simple, single-view dashboard with real-time balances

- On demand statements and proof of account ownership

- Add payees (beneficiaries) easily with our smart new functionality

- Easy-to-use live chat services with responses from our experts

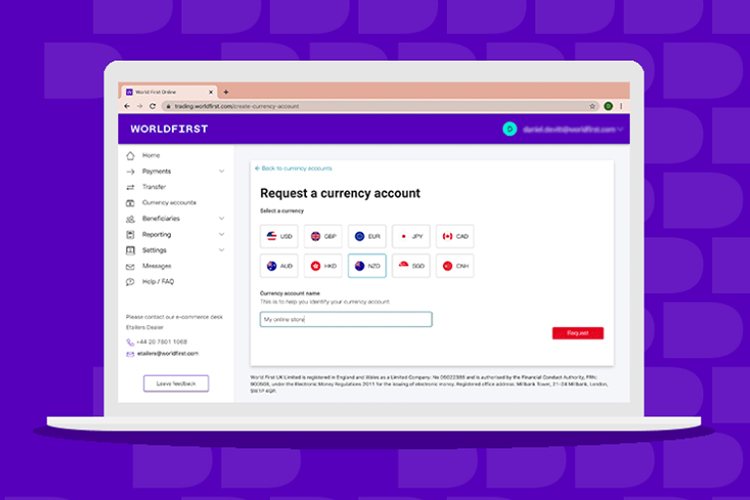

How quickly can I set up overseas currency accounts with World Account?

World Account customers can open local currency accounts directly from the dashboard at the click of a button – and use straight away. Most requests will be activated instantly; but in some cases, this can take up to one business day. EUR and JPY will be activated within one business day.

World Account customers can open local currency accounts directly from the dashboard at the click of a button – and use straight away. Most requests will be activated instantly; but in some cases, this can take up to one business day. EUR and JPY will be activated within one business day.

- Fast and free to set up, with no annual fees, deposit requirements or minimum transaction level

- Open one or multiple local currency accounts online

- Personalised account details, including your own unique account number under your business name

Tell us about your transparent pricing

It’s free to set-up your World Account, free to open multiple local currency accounts, free to get personalised account details, including your own unique account number, and free to receive money using those bank account details. Your customers won’t be charged a fee to pay you locally, and you won’t be charged a fee to receive that payment

In 2019, WorldFirst rolled out a new pricing structure offering simplicity and transparency, with just three pricing tiers for all customers. With our standardised pricing, you receive a fixed fee based on your annual trading volume, using three clear FX margin bands applied across 28 currencies with a FX margin from as low as 0.15%

As well as simplicity and transparency, WorldFirst is up to 85% cheaper than high street banks.

How can I get a World Account today?

Go to worldfirst.com/uk/world-account and open your World Account to get started now.

One Response

Interesting way Ro short circuit the banks which overcharge on all FX transactions. You need a clear statement of fax risks in joining your system;how are rates set vis a vis the market ?