Pitney Bowes have announced data on UK carrier market share as an update to its latest Parcel Shipping Index, in which Amazon Logistics is now revealed to be the 2nd biggest UK courier .

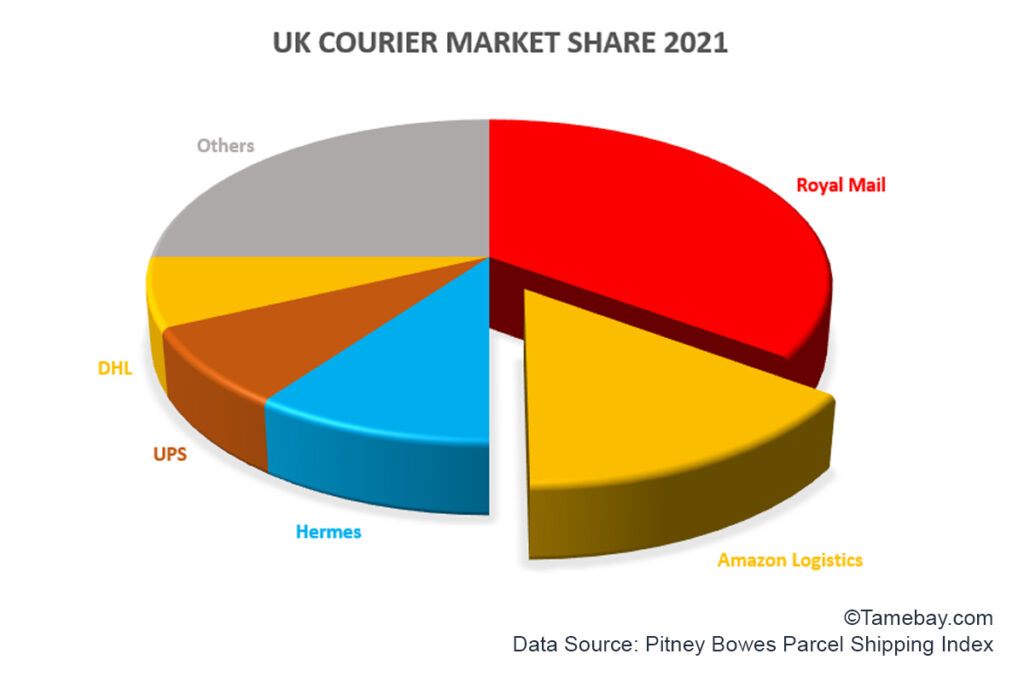

The updated Index now charts parcel volumes, revenue and market share by carrier for the UK, as well as for 12 other major markets. It reveals that, as a highly consolidated market, the top five carriers in the UK account for 75% of UK parcel shipments by volume. These are Royal Mail (35%), Amazon Logistics (15%), Hermes (10%), UPS (8%) and DHL (7%) Amazon Logistics generated significant growth of 72% compound annual growth rate (CAGR) in volume from 2013-19 and 80% CAGR in revenue growth during the same timeframe.

The Pitney Bowes Parcel Shipping Index measures parcel volume and spend for business-to-business, business-to-consumer, consumer-to-business and consumer consigned shipments with weight up to 31.5kg (70 pounds) across Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Norway, Sweden, the United Kingdom and the United States. Population data points were sourced from the International Monetary Fund, World Economic Outlook Database published in October 2018. The Pitney Bowes Parcel Shipping Index spans 13 countries and represents the parcel shipping activity of 3.7 billion people.

To become the 2nd biggest UK courier represents massive growth for Amazon, just three years ago they were the fourth biggest UK courier with a 7% market share so to have grown to be 2nd biggest UK courier with a 15% market share is explosive growth.

Also telling is that in the past three years, Royal Mail have remained by far the dominant courier, but according to the Pitney Bowes Parcel Shipping Index their market share has slipped from 47% to 35%. This is a significant drop in market share, but (as is also true for Amazon) this is against a back drop of a fast growing market as we all send and receive ever more parcels. Royal Mail’s volumes may have grown but Amazon’s have grown faster.

Pitney Bowes also found that the UK B2C ecommerce market is estimated to be the third largest in the world after China and the US respectively. 2021 could see carriers experience an increase in domestic shipments, while cross-border shipments could temporarily slow. Their BOXpoll™ data finds that one in four French and German online consumers currently plan to either stop purchasing or purchase less often from UK brands now that the UK is post-Brexit.

2 Responses

HOW SHOCKINGLY SURPRISING IS THAT.

If anyone sells on SFP they will slowly be forced to use Amazon logistics.

1) you ship on time with one of their chosen carriers and the carrier dsoes not deliver on time.

BANG you get a warning

2) the same thing happens a few weeks later even though all the metrics show it was the carrier as you shipped on time.

BANG you have to tell them what you are going to do about it.

so i told them i was going to visit the CEO of Royal mail and threaten him with the sack or even corporal punishment because i knew he would listen to little of me.

I ring them and ask what they think i should do and am advised the only solution is to use Amazon Logistics. I mention that 6 of 8 orders i placed from Amazon were delivered late so surely it will still happen?

Their reply was “oh no because if its our fault we dont penalise you”.

we just ignore it

BANG they remove our prime badge.

surely somewhere in that there is something bordering on bullying if not illegal.

we dropped everything to 2 day dispatch remove prime and sale are actually slightly up.

Maybe customers are not likeing prime either. we wont go back on it.

as royal mail and my hermes deliver for amazon

this data could be a little out of balance