With today’s announcements on the Energy Price Cap and Interest Rate change, consumers are going to have a lot less money in their pockets at the end of the month and that will have a knock on effect on retail.

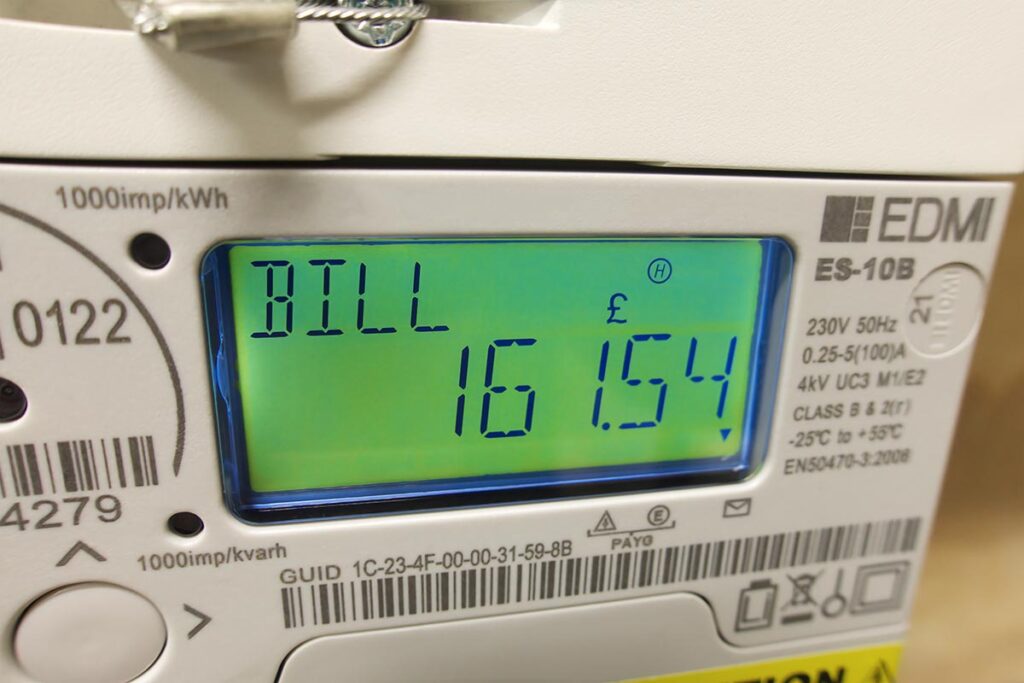

The Energy Price Cap increased by £139 from £1,138 to £1,277 on the 1st of October 2021. Today it rose again by a massive £693 increasing the average household bill by £1,971 from April. It’s even worse if you are on a pre-payment meter as the price cap is higher at £2,017.

The real impact of this is that, since October, millions of households have seen their monthly energy bill go up £70. For those on tight budgets this is more than their incomes can support without cutting their budgets for other spending and for some it’s simply unaffordable. We are waiting for news on any steps the government takes to alleviate the impact but this is rumoured to be about £200 and so way short of the average £832 price increase the two price cap increases represents. It’s worth noting these increases are based on average consumption – some will be facing significantly higher bills and those on lower incomes already spend a greater proportion of their income on heating their homes.

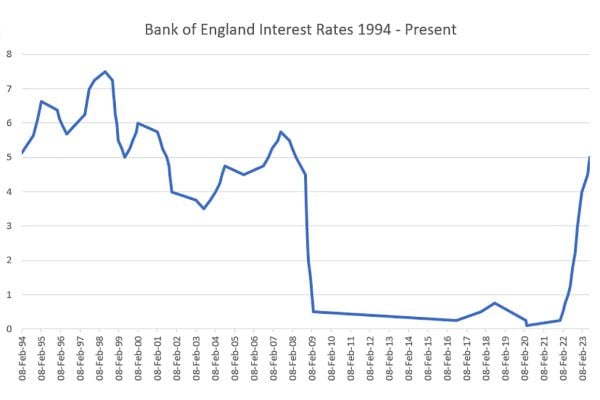

In other news today, the Bank of England are expected to increase Interest Rates around midday today, for the second time in months and this time from 0.25% to 0.5%.

[12:00hrs Edited to add – The Interest Rate rise to 0.5% has now been confirmed]

0.5% is still a historically low rate of Interest (Back in the early 1980s, Interest Rates were running at 14-15%!) but the rise will still add around £15 to £25 a month to average mortgage payments depending whether you are on a standard variable rate or tracker mortgage. Coming on top of the Energy Price Cap increases it’s just more bad news for the third of adults that have a mortgage. It will also eventually impact the third of adults that rent their homes as landlords will take advantage of rent reviews to hike prices.

The Interest Rate increases are part of the Bank of England’s brief to maintain medium term inflation to acceptable levels. The big problem with this is that it will probably have little impact as the main drivers of retail price increases are supply chain costs, energy costs and staff costs. In 2021 we saw the cost of shipping a container from China jump from around $3,000 to over $20,000 and that has to be absorbed as does business energy costs. With unemployment lower than ever, there are also pressures recruiting staff and even if your business isn’t impacted, your carriers will certainly be paying more for HGV drivers who can jump from job to job with pay rises every time they move.

Both the price of energy and Interest Rates will have a direct impact on your business – even if the only energy costs you have are for heating, lighting and running your computers, you are probably seeing an increase in your bills. Plus higher Interest Rates will increase the cost of borrowing for both short term and long term finance.

If your business has been impacted, what steps are you taking? Have you increased prices to cover the additional costs or are you still absorbing price increases from your suppliers to remain competitive?