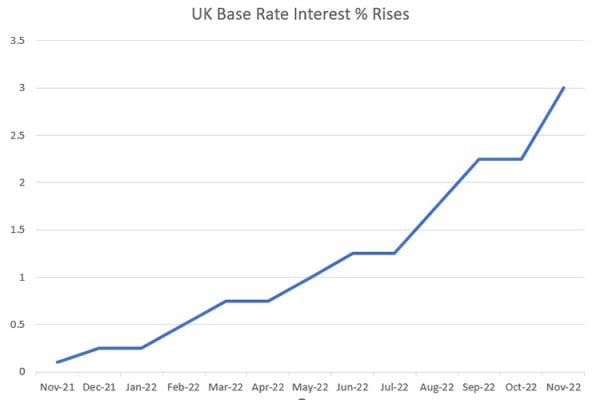

Last week, the Bank of England voted to approve an interest rates rise from 0.5% to 0.75%, the third time an interest rate rise has take place within months.

This is bad news for those with a mortgage but will also impact business borrowing but there are two important things to note.

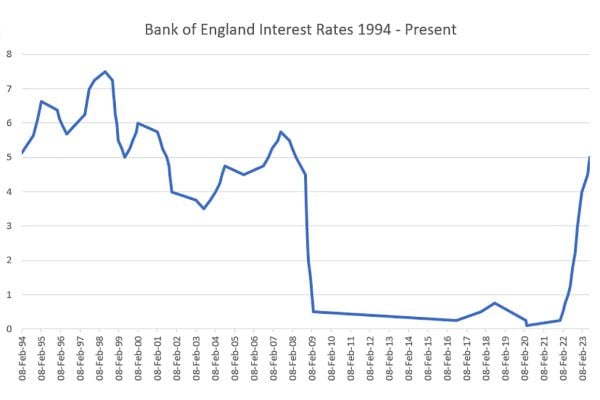

Firstly, 0.75% is still a historic low for interest rates. It was only when the pandemic hit that rates were lowered to 0.1% and for most of the last decade they were at 0.5%, varying up to 0.75% or down to 0.25%. This is after rapid falls in 2008 when rates fell from 5.75 in 2007 to 1.5% and then 1% in early 2009. 0.75% isn’t a punitive interest rate in normal times but these aren’t normal times.

The abnormal times started with spiralling fuel costs, first at the petrol pump and then in gas and electricity prices. Then the invasion of Ukraine by Russia and subsequent sanctions placed on Russia have spiralled costs out of control. This will have a serious impact on households from the 1st of April as their bills skyrocket – the second time for those whose utility companies went bust, and it will get significantly worse come September when the price cap is due to rise by an estimated 50% again. The cost of basic goods like food are already rising and the interest rates rise is just one more expense for consumers adding maybe £25 a month to the average mortgage payment.

Businesses aren’t protected by energy price caps and still have to pay for diesel to move their goods around so there’s no delay to costs for them. It’s likely that almost all will have to edge prices up, even if it’s just because couriers increase their fuel surcharges.

The net result is that we are already in a period where consumers have less money in their pockets and this is on the back of the pandemic which has already devastated lives. We already knew in the back of our minds that the generosity of the government would have to be paid for and the first part of that is coming in April when National Insurance rises by 1.25% health and social care levy.

This is a time where there is bound to be a slow down in the economy and that means less consumer spending. In some ways online selling is protected as consumers will be keen to save money and perhaps shop for different brands, consider refurbished or pre-loved goods and hunt for a bargain. It is however time to examine your business finances and assess where savings can be made and how you can squeeze out profits where pricing pressure may force you to cut margins or increase prices.