iwocaPay is a relatively new B2B solution enabling instant pay and scheduled finance for SME purchasing which looks set to disrupt the way businesses purchase from their suppliers.

When iwoca launched in 2012, few foresaw how they would revolutionise small business funding. By offering instant working capital to SMEs, cutting out months of loan applications to banks, they spearheaded a change in the industry which has seen a ton of competitors spring up.

Now, iwocaPay is reinventing the way that business payments are made and it’s great news for SMEs making business purchases but perhaps even better for those who supply small businesses. They are addressing the two main problems that make it hard to get paid on time – the finance and the payments.

B2B Payment challenges – Finance and Payments

The finance issue is that with B2B payments there are often extended payment terms – 30 days is normal, 60 days is common, but even then not everyone pays on time. This leaves suppliers carrying the credit risk and the cashflow challenges. With many suppliers being themselves small businesses it’s a high stakes game of chasing invoices to keep their operations afloat.

The payments issue is somewhat surprising in that it still exists. When you send an invoice someone somewhere has to enter it into their accounts and authorise a payment and then actually process the payment. It’s a clunky experience – bank transfers are full of friction and accepting cards is expensive and carries chargeback risk for suppliers.

How iwocaPay eliminates Finance and Payments hurdles

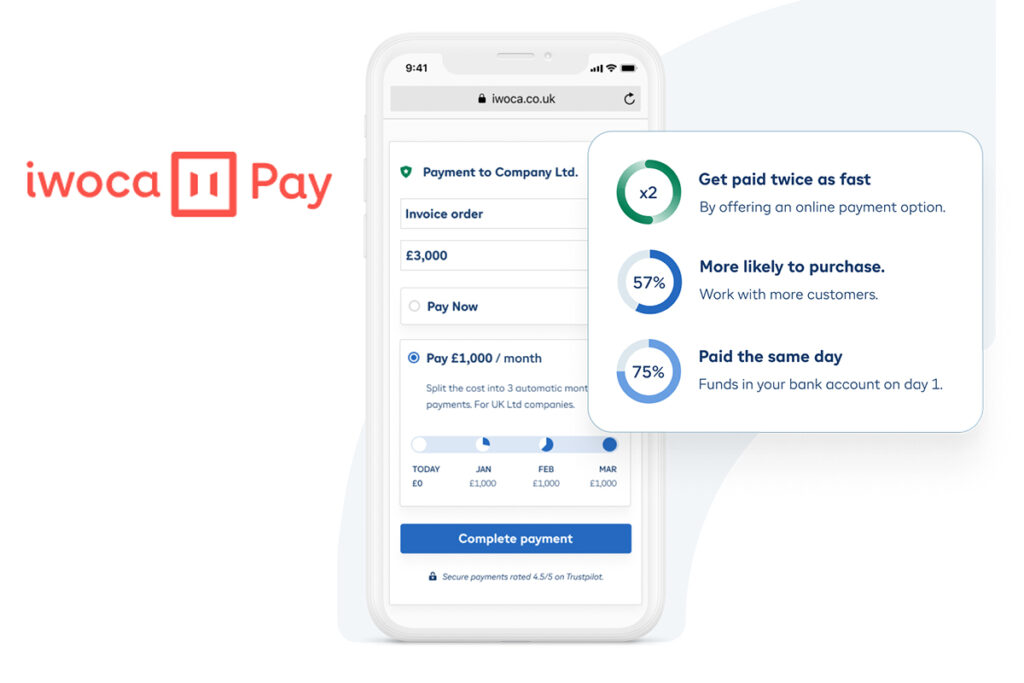

iwocaPay addresses both the payment experience and the payment terms. B2B businesses get a cost-effective, frictionless payment solution with built-in 90-day payment terms. Suppliers can offer their customers the flexibility to choose how and when they pay – either there and then or over three months. And any customer can pay instantly with a two-click solution built on secure and seamless open banking technology.

It has all the cost-effectiveness of a bank transfer, with the bonus of being even easier to use than a card. Business customers can spread the cost over 90 days, while their supplier gets the funds in full as soon as they complete check out.

iwocaPay also syncs up to accounting platforms such as Xero to make reconciliation automatic.

What does iwocaPay mean for you?

B2B Buyers

If you are a B2B buyer and your supplier offers iwocaPay, you have two easy choices. You can pay with a couple of clicks or you can opt to spread payments over a 90 day period with the first payment due 30 days after the transaction. Plus it’s a transaction by transaction option so always available when you need it.

B2B Suppliers

If you are a B2B supplier, iwocaPay will get you paid faster, either by speeding the payment process or if your buyer chooses to spread payments over time you still instantly get paid up front, with iwoca carrying the credit risk for late or non-payment. It’s also a sales tool, you can close deals with customers who don’t have the available upfront and, if you wish, you can even opt to pay the costs making it interest free for customers. Consider iwocaPay as a way to accept orders you may otherwise be forced to decline and increase order size by having instance finance on tap for your business customers.

Start offering iwocaPay

B2B suppliers should visit the iwoca website for more details and to sign up to use the service.

B2B buyers should look out for iwocaPay on supplier websites and if it’s not currently a payment option refer them to iwoca to get them signed up.