In this guest post today, Avalara discuss US tax obligations, what you need to know and the steps you’ll need to take when selling on Amazon in the USA:

Selling on Amazon USA

Over the course of 2021, an astonishing 60% of all online retail purchases were made via Amazon. As inflation rates in Europe continue to creep up, with the USD holding strong against both GBP and EURO, US buyers are benefiting from cheaper imports. As a result, online cross-border sales continue to grow making these a target for recouping lost revenue.

If you’re selling to customers in the United States, you’re increasingly likely to trigger new sales tax obligations or “nexus” – and you no longer need a physical presence in the US to activate these obligations.

Put simply, when it comes to tax, nexus is a sales tax that requires sellers to collect sales tax in locations where the seller’s sales exceed the state’s monetary or transactional threshold.

If you’ve not come across the term nexus before, in auditing terms there are two forms: Economic nexus and Physical nexus.

- Economic nexus is a connection to a state, based entirely on sales volume made into that location. Businesses can have tax obligations by selling as little as $100,000, or by making 200 individual transactions. Thresholds vary by state and the requirements can be difficult to navigate

- Physical nexus is defined by a seller having a physical presence in a state that creates an obligation to register and remit sales tax to that state. This can include everything from a retail location, to employing remote workers or storing property in a fulfillment center

If you’re an Amazon seller, either of these might apply to your business. With around 210 million people actively making purchases online and a total sales value of US$870 billion, growing your business in the market is an attractive growth prospect.

Do you have, or think you may have physical nexus?

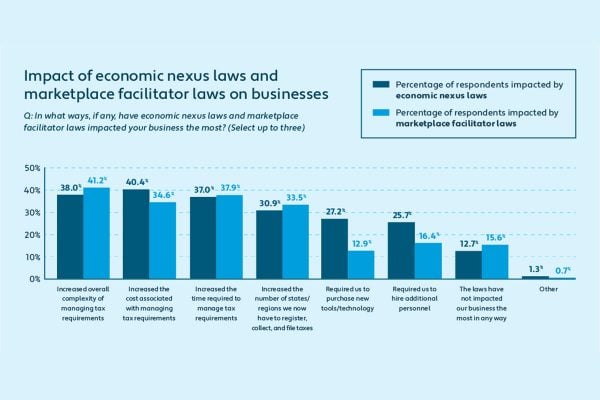

In most states, it is Amazon’s legal responsibility to calculate and apply the relevant sales tax rates for a purchase. However, most US states also require Amazon sellers to register for sales tax and file sales tax returns themselves. According to Avalara’s Benjamin Faust: “Even though marketplace facilitator laws say the marketplace must collect and file taxes for all transactions, it doesn’t mean the tax obligations disappear for the seller.” Complying is important to avoid back taxes, penalties, and seizures of stock.

Given the number and complexity of sales tax jurisdictions in the US, it can be challenging for Amazon sellers to assess their sales tax liability and keep up with US remote seller thresholds.

Check your US tax obligations for free

In a few easy clicks, our free sales tax risk assessment tells you where your business may have an obligation to collect and remit sales tax, or nexus. Make sure your business is staying compliant and take our free US Sales Tax Risk Assessment today or get in touch for free, independent advice.