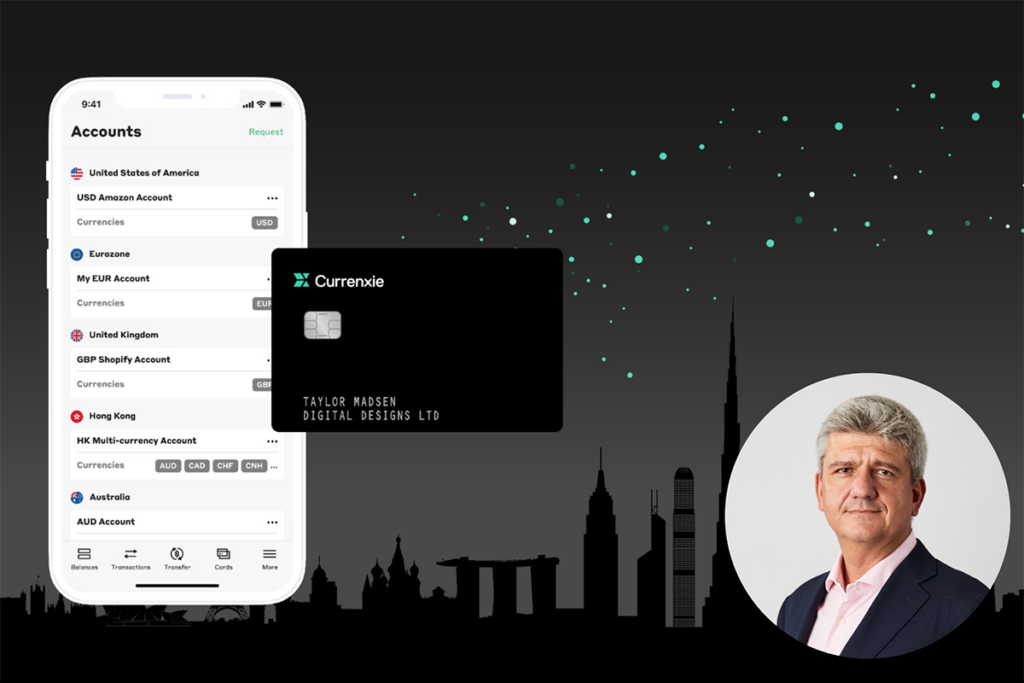

Today we hear the story of Riccardo Capelvenere who, after seeing how his mother’s wine business grappled with the complexities and cost of foreign currency exchanges, drove him to found Currenxie, the company of which today he is the CEO & Co-Founder.

Created with the needs of ecommerce business in mind, the fintech aims to cut overseas transfer costs and maximise profits. Read on to discover how they could help your business:

Who is Currenxie?

Currenxie gives companies access to one of the world’s largest networks of virtual bank accounts, enabling businesses to make borderless payments quickly and affordably. Today we work with thousands of businesses to cut overseas transfer costs and maximise profits on global marketplace sales.

Headquartered in Hong Kong, I founded the company in 2014 alongside my wife, Alison, after I encountered the costly challenge of foreign exchange conversions and cross-border fees for small businesses first-hand.

Observing the exorbitant sums my mother’s wine import business was paying on cross-border transactions and FX, I knew there must be a better way to transfer funds around the world – and at less cost. In time, we built a technology platform and network of licences and partners that could be used to provide businesses of all sizes with access to wholesale foreign exchange rates and efficient global payments.

Today we are on a mission to give our clients the financial tools they need to pay and get paid quickly, effortlessly and affordably. From artisans on Etsy and eSellers on Amazon to giant companies like Tencent, we serve thousands of businesses of all sizes. To date, we’ve transferred billions of dollars for our clients, and we’re just getting started.

What does Currenxie do?

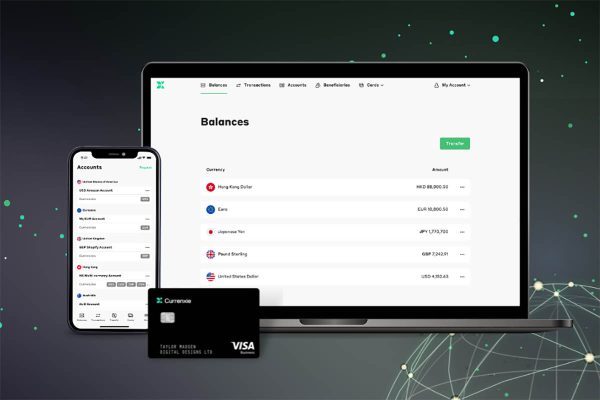

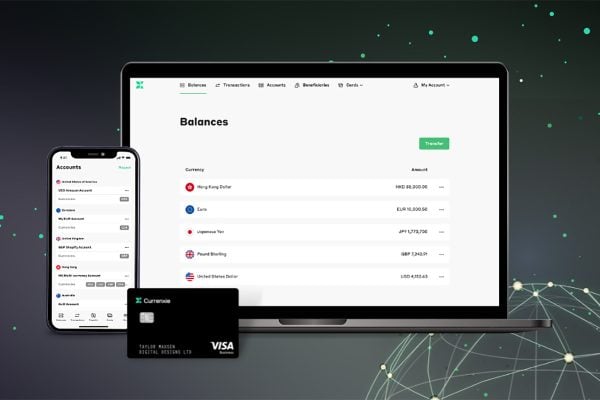

Currenxie aims to open the world of commerce to companies everywhere by giving them a modern and flexible global payment platform. We do this via our Global Account: a one-stop app that’s essentially a modern take on the business current account but designed for today’s increasingly borderless world.

The Currenxie Global Account® gives users their own virtual bank account details in every market they do business. They can receive and send fast, borderless bank payments, have multi-currency digital wallets, and transact at very low costs.

We’ve also got foreign exchange covered. We offer low fees and completely transparent rates. The same mid-market rate you see on Google, XE, or Reuters.

Our Hong Kong clients can also take advantage of instant Visa Business cards, ready to use in seconds – a service offering we’ll be extending to our European and UK-based clients next.

All the above is handled on our cloud-native platform, an in-house core banking system for running our global network of virtual accounts and payment rails. We are fully vertically integrated, and all of our technology has been developed internally.

How can you help online retailers?

For many eCommerce businesses, collecting their foreign currency payouts is a challenge. Finding a banking solution to collect locally in a foreign market is very difficult, and if you receive your payouts cross-border, you encounter really punitive transfer fees and FX rates. Alternatively, a digital business account like the one offered by Currenxie is an ideal eCommerce solution as it’s quick to set up, immediately gives you access to virtual accounts around the world, and fees are low and transparent.

Our Global Account also seamlessly integrates with payment gateways on all major marketplaces, so eCommerce merchants can easily withdraw their funds straight into their local virtual bank account in the domestic currency, whether from Stripe, Checkout.com, PayPal or anyone else.

Currenxie is also an official participant in Amazon’s Payment Services Provider Program (PSPP) which means that Amazon Sellers from around the world can choose us to collect revenue from their sales and make payments to their suppliers anywhere, anytime, without excess time and cost.

Online retailers can also use us for their foreign exchange needs, and to send payments to suppliers, vendors and staff anywhere in the world.

What is your pricing model?

It’s completely free to open and maintain a Currenxie Global Account. We provide the real-time mid-market foreign exchange rate and charge only a transparent commission of 0.4% for exchanges of major currencies. Our payment processing fees are equally simple. US$0.75 to collect local payments, and US$3 to send local payments. Cross-border transfers are charged at US$8 for collecting and sending.

You can see a full breakdown on our website.

Which currencies and geographies do you support?

Our virtual account network covers 40+ countries. Those are the in-network countries we consider local. This includes the USA, Canada, Mexico, Australia, Indonesia, Singapore, Japan, Hong Kong, the UK and the SEPA area of the eurozone.

Our payout network is a little larger, and also includes the Philippines, Thailand, Vietnam, Malaysia, India and South Africa. Cross-border transfers outside our network include an additional 100+ countries.

At present, our clients can collect and hold 16 currencies in their Global Account wallet, and payout in 21 currencies.

What sets you apart from competitors and why should I switch to you?

- The scale of our network and global footprint creates value that is transferable to our clients. Every new market we open benefits thousands of businesses.

- With our simple, online account opening, no monthly fees, and no minimums, we are giving access to global financial tools to small businesses and startups that they would otherwise struggle to get. We also have some of the most affordable rates when it comes to making payments.

- As mentioned above, we’ve built our own infrastructure. Many of our competitors use intermediaries. For us, this means essentially zero downtime, faster payment processing, greater security, and more responsive service. We also pride ourselves on our very simple user experience.

How can I learn more or open an account?

Head to www.currenxie.com to learn more, or click this link to open an account. The application process is conducted entirely online, it’s free to apply and should only take 10-15 minutes to complete.