Profitability challenges, complex logistics, and difficulty forecasting sales are major pain points for consumer brands that sell via Amazon EMEA (Europe and the Middle East) according to new research from Pattern, the category leader for global ecommerce acceleration.

Pattern’s newly published Amazon EMEA Vendor report surveyed nearly 100 brands in EMEA to learn more about their Amazon sales activity, current challenges, and plans for the future on the rapidly expanding marketplace. 98% of vendors in the survey reported experiencing problems trading on Amazon during the past year.

Amazon EMEA Pain Points

Pricing and profitability challenges

Price erosion is the most common pain point experienced by brands in Amazon EMEA during the past year, with 64% of respondents citing them as “extremely” or “quite painful”. Nearly half of vendors reported experiencing unfavourable commercial terms, while only 6% of respondents said discounting on Amazon hasn’t caused issues on other channels.

Complex or expensive logistics

52% of respondents said that complex or expensive logistics are “extremely painful” or “quite painful”. 51% reported experiencing increasing chargebacks, and 52% have faced issues getting products into Amazon’s warehouses; of those 43% cited disruption to their own supply chain as the root cause.

Difficulty forecasting sales

46% of brands surveyed reported having difficulty forecasting sales, 38% say that their forecasting methods are inadequate to keep enough stock in hand, and 37% experience high out-of-stock levels due to Amazon’s algorithm-driven price.

Amazon still a marketplace for growth

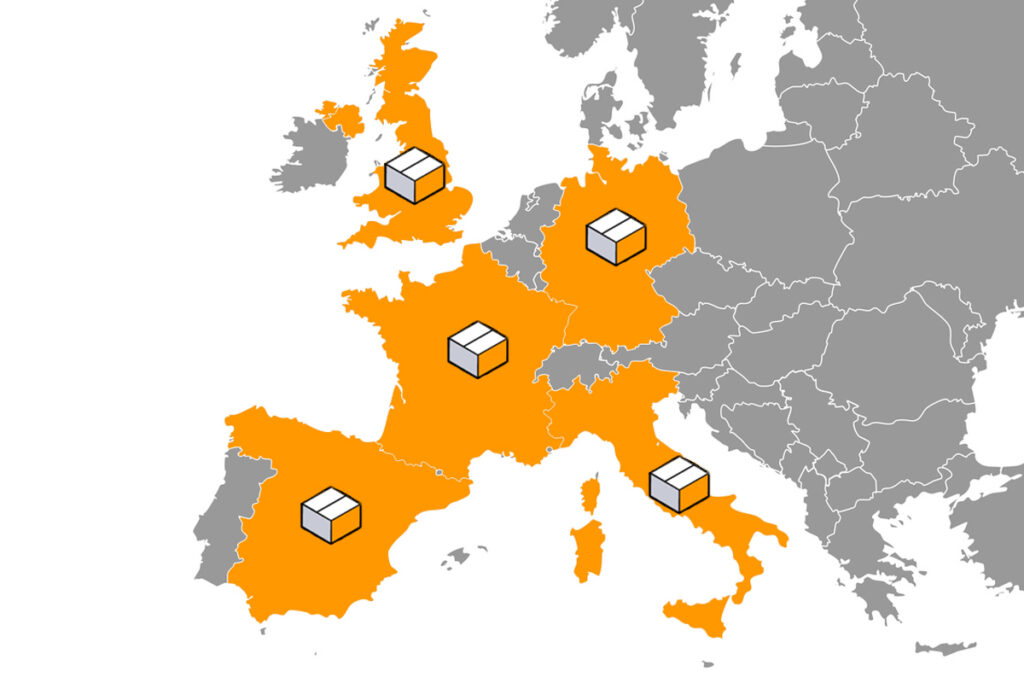

Despite these challenges, brands still perceive Amazon as a marketplace for growth, with more than two-thirds planning to expand internationally through Amazon in the near future. Only 3% reported that they no longer intend to sell on Amazon in the future.

Despite friction, brands still have a largely positive opinion of Amazon. 51% reported feeling “very positive” or “somewhat positive” in a professional capacity, 25% are neutral. More than half the brands surveyed have not yet been able to realise a profit in EMEA. Amazon sales in EMEA have fallen for 29% of respondents, and another 23% said sales are stable.

For the future of their presence on Amazon, 41% of the brands surveyed are considering switching to a hybrid model, and 13% are considering moving from 1P to a 3P model.

This report underscores the challenges brands still face as they attempt to capture their fair share of the $6 trillion global ecommerce market. Profitability, forecasting, and logistical challenges are opportunities for brand partners, like ecommerce and marketplace accelerators, to play a key role in helping brands break through. Many, if not all, of these challenges can be overcome by leveraging the latest data science and global expertise. These findings make us even more bullish about the future of online commerce in EMEA.

– Torsten Schäfer, Germany Country Manager and Director of Business Operations Europe, Pattern