Currenxie simplifies global payments for businesses. Providing access to the world’s largest network of virtual bank account numbers, the company works with thousands of eCommerce businesses to send, receive, and convert currencies all across the globe – quickly and at a lower cost. Today Currenxie offers tips on how virtual bank accounts can help you take your business to the next level.

Running an ecommerce business is tough, especially in today’s fickle economy. One day consumer demand is on the rise. The next it’s going down. A few days later, forecasts show there’s hope for the holiday season – but that’s only in certain markets – and only a few days later, the situation changes yet again.

While this volatility is (somewhat) normal for ecommerce businesses, COVID and 2022 brought a new set of challenges and questions to the table. Are we headed for a recession? How far will inflation and rising concerns around consumer spending impact the progress the industry has made these last few years?

At present, anything is possible, which makes it ever more important that companies in the ecommerce space stay relevant, continue to adapt, and readily tap into new markets quickly when opportunities arise. Through speed, scalability, and savings, virtual bank accounts can help you and your business weather the economic headwinds, even as they ebb, flow, and change.

What are virtual bank accounts?

Virtual bank accounts are an invaluable tool for merchants looking to expand their business overseas.

The key to defining them isn’t always obvious because many payment solutions are virtual now. It’s important to know that they are not the same as regular bank accounts issued by either traditional brick-and-mortar banks or digital-only banks.

So what are virtual bank accounts? Virtual bank accounts are a way to collect bank transfers without having a regular bank account – and they can be used internationally in every country your company wants to do business in. They are extensions of traditional physical bank accounts, providing a unique account number to your business while the physical account that holds the funds is operated by a payments company such as Currenxie.

In short: they’re a fast-track means of collecting payments in local currencies around the world without having to open bank accounts in each market your business wants to operate.

Why this matters: if you’re selling internationally online, your customers expect a seamless payment experience, no matter where you (or they) are located. Realising this means having the ability to collect payments in their local currency.

While this is par for the course in the world of ecommerce, a notable shift in the number of players has increased the level of competitiveness online. More sellers are now operating in more markets; more consumers are online and ready to buy. While post-COVID forecasts are still in flux, one element holds true: going global is no longer an option. It is essential to the future of your company’s growth.

So, here’s a question to ask yourself: how flexible is your payment infrastructure? Do you have the ability to adapt and move on the fly?

As your business grows, so too will your need for foreign currency payments. If this is supported solely by traditional banking services, it will make it harder and more costly to compete. Virtual bank accounts help simplify this process and deliver speed and scalability at lower cost.

Leveraged together with wholesale foreign exchange rates, they can help you take your ecommerce business to the next level. From security and speed to multi-currency capabilities and cost-savings, they can open the door to new markets and faster growth at lower cost.

Currenxie Global Account

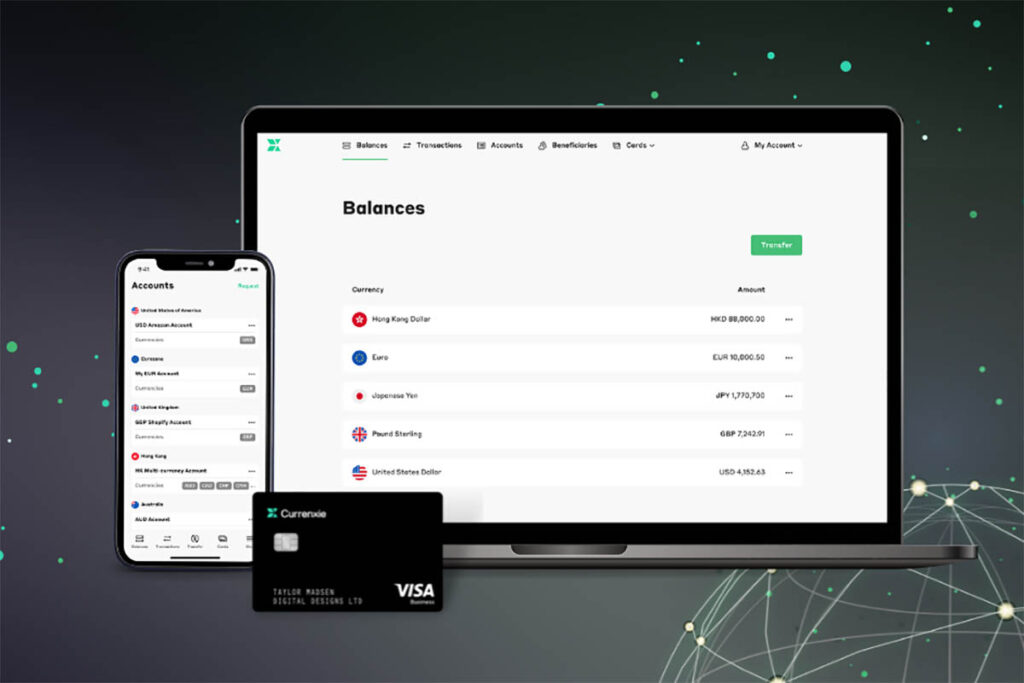

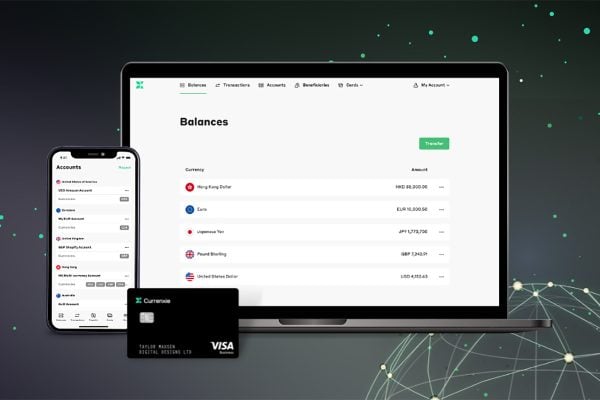

Enter the Currenxie Global Account. Providing access to one of the world’s largest networks of virtual bank accounts, we work with thousands of ecommerce businesses to help them send, receive, and convert different currencies almost instantly with little cost.

Leveraging the power and reach of our network, you can manage payments in over 20 currencies across 100+ countries – all while exchanging currency at the mid-market rate (i.e. the one you see on Google).

You can also instantly connect to all major ecommerce marketplaces and payment gateways, enabling you to withdraw funds straight into your local virtual bank account in the currency of your choice for less. Find out more about what Currenxie can do for your ecommerce business