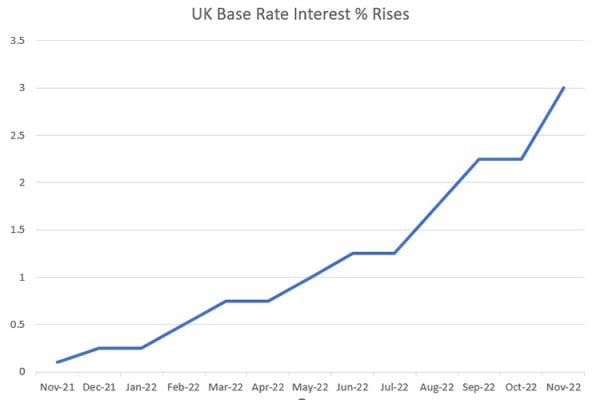

Yesterday, The Bank of England’s Monetary Policy Committee voted by a majority of 7–2 to increase the Bank Rate by 0.5 percentage points, to 4%. While this 10th interest rate rise in a row is bad news for anyone looking to finance their business, there are signs that we are nearing the peak of the interest rate rises.

The latest forecast suggests the implied path for Bank Rate rises to around 4½% in mid-2023 and falls back to just over 3¼% in three years’ time with CPI inflation to decline to below the 2% target in the medium term.

Many of the impacts of previous increases in the Bank Rate are yet to be fully felt by the economy and the overall feeling appears to be that, while inflation is still around 10.5% that the steps taken so far by the Bank will reduce it and downward adjustments in the interest rate will be needed to prevent it swinging the wrong way and going too far below the 2% target.

The other interesting point to note is the change of language used. In previous Minutes of the Monetary Policy Committee, terms such as react ‘forcefully‘ were used. This time the language was gentler saying ‘If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.‘

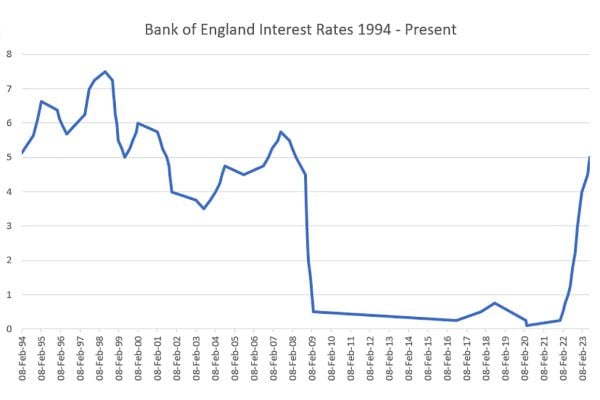

Retailers should be able to take a little confidence that UK interest rates are approaching their peak, if they haven’t already done so. After perhaps rises totally another 0.5%, Rates should then slowly drop over the next few years down to just about 3% where hopefully they will stabilise. It’s almost inconceivable that they will drop much below that level in the near term, as the rates we’ve seen since the 2008 financial crash were historically low.

However on the downside, consumer confidence had remained around historically low levels in January, with customers trading down to lower-priced products and a drop in demand for household goods. This could prove tricky for mid-range brands who see consumer opt for alternatives, but luxury brands may still find plenty of well heeled customers, hardly impacted by energy prices, will still seek out prestigious purchases and have the cash to do so.

2 Responses

We are a consumer economy where everyone’s disposable income is being sucked away.

I have the joys off 2 mortgages on variable right now one a property let and I can’t even put the rent up because Sturgeon is playing popular politics again without looking at the actual ramifications. Political class in this country are truly woeful and they have caused so much damage this last few years especially with Brexit.

Along with nursery for the wee one we are skint at the end of the month right now. I am glad my stock has all been bought and paid for right now and I have been getting a turn on my website ( cause it is cheap and the corporates are not hogging Google right now) and eBay to a lesser extent, but I have nothing left to invest. I have even been searching about for new work the last couple months.

Enjoy it while it lasts sam

If the S N P get their way. inflation ,interest, rates, tax, will make your giblets ache