In the Black Friday season of 2022, consumers globally increased their online transactions by 4.8% and spent a lot more time online browsing and shopping for the best deals in their quest for the “better price”. With Black Friday/Cyber Monday deals starting earlier and running longer in 2022, how has it impacted ecommerce shopping behaviour in global markets? Bobbie Ttooulis, Group Marketing Director, GFS takes a look back at the lessons retailers can learn.

Global Shopping Behaviour

In the US, ecommerce brands outperformed stores as consumers decided to make their purchases and transactions online. Shockingly, online transactions for US retailers increased over 374% month-over-month, compared to a tiny 64% increase for in-store sales.

And even though not as high, the EMEA region also saw a similar gap in online vs in-store purchases.

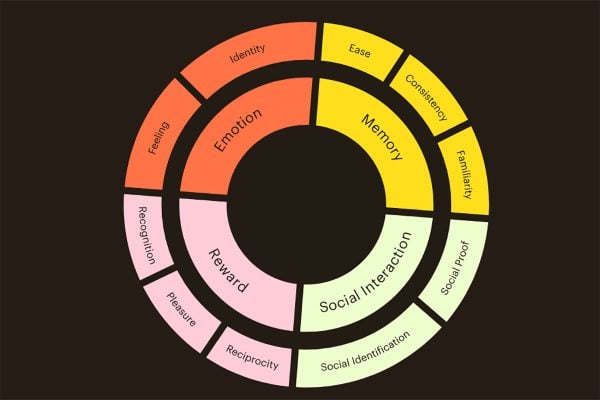

Online Ads and Social media were the top channels for Black Friday ad engagement. 32.9% of respondents in a study said the Black Friday ads they clicked on were from Website and Search Engine ads. Social Media edged at a close second place with 32% saying the ads they engaged with came from social media. Social media platforms now offer user-friendly ecommerce features that retailers must integrate into their sales channels to attract more shoppers.

…But Britons are tired of Black Friday messaging. While the interest in Black Friday is higher than expected this year despite the macroeconomic concerns, data shows UK shoppers are becoming tired of the intense Black Friday messaging.

While almost two-thirds of Black Friday ecommerce sales occurred on mobile devices, desktop shoppers were more likely to convert, at a rate of 4.5% versus 3.6% on mobile.

Compared to previous years, shoppers globally gave their festive shopping a headstart earlier than usual to bag the best deals and promotions offered by retailers.

Globally, health and beauty was the clear winner as the sector saw a 22.6% rise in sales and AOV, up 1.2%, against a backdrop of a 13.5% growth year-on-year in traffic.

As businesses recover from Peak, there is no better time than now to look at the learnings you can carry forward and step stronger into 2023. In their First Cut: eCommerce Review 2022 and 2023 Forecast webinar on the 8th of February,, GFS will cut through the noise and bring you a straightforward, no-nonsense conversation with authoritative speakers from GFS, IMRG and Huda Beauty. Register here to attend.