Today we speak to Scott Peterson, VP of U.S. Tax Policy and Government Relations at Avalara, discusses where he sees government tax policy heading in 2024.

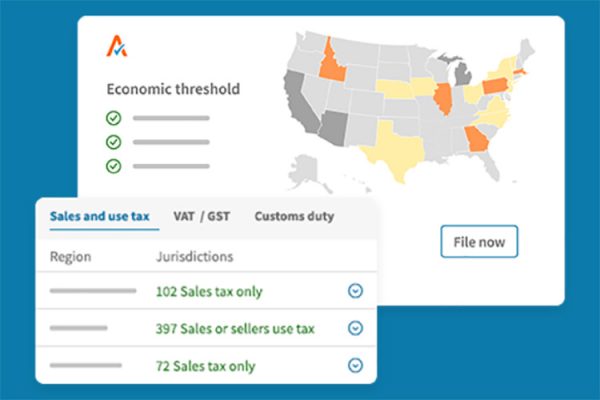

Collecting and remitting sales tax is a reality for businesses. And before you can collect sales tax from your customers, you have to register for sales tax and obtain the necessary sales tax permits and ID numbers. With the myriad of sales tax regimes in the US, automation is almost a prerequisite, but it’s not just sales tax that Scott warns of, you may also be liable for corporation tax.

The final tax policy prediction from Scott is that 2024 may be the year of tax audits, so if you’ve not had an inspection it could be coming next year!

In this video you’ll find:

- 00:00 Introducing Scott Peterson from Avalara

- 02:55 How inflation & interest rates impact tax revenues

- 06:22 Don’t assume what you know is all you need to know!

- 08:19 Why marketplace tax collection doesn’t remove your tax liabilities

- 09:52 What could make a business liable for corporation tax in the US?

- 11:09 Lobbying to remove tax licence requirement when no tax will be paid

- 12:36 How Avalara use AI & ChatGPT

- 15:55 Why automation is key for handling tax liabilities

- 20:00 2024 to be the year of Tax Inspections!